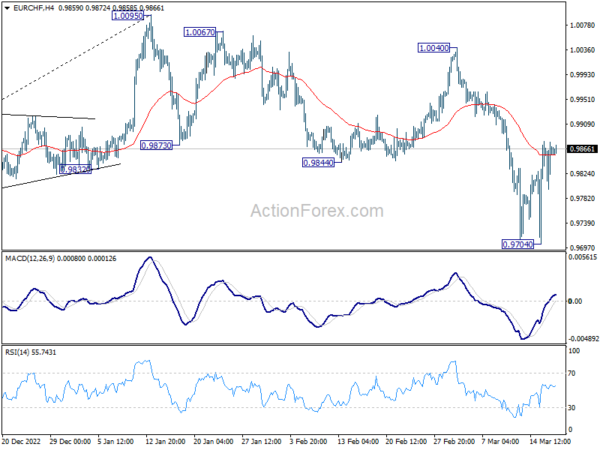

Daily Pivots: (S1) 0.9815; (P) 0.9849; (R1) 0.9898; More…

Intraday bias in EUR/CHF remains neutral first and risks stays on the downside with 55 day EMA (now at 0.9899) intact. Rebound 0.9407 could have completed at 1.0095 already. Below 0.9711 will target 61.8% retracement of 0.9407 to 1.0095 at 0.9670. Firm break there will bring deeper fall to retest 0.9407 low. However, sustained trading above 55 day EMA will bring stronger rise back to retest 1.0095 instead.

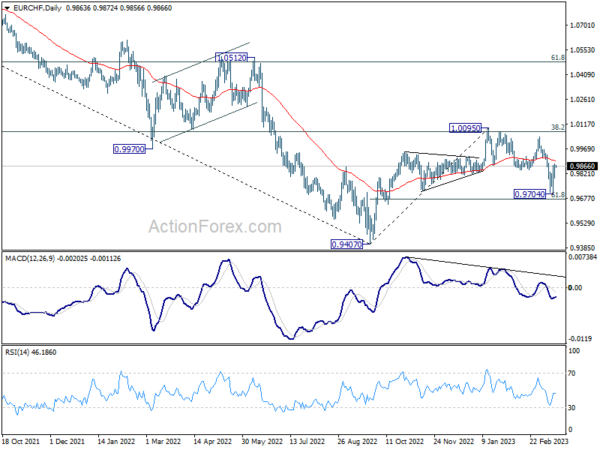

In the bigger picture, rejection by 55 week EMA (now at 1.0011) and 38.2% retracement of 1.1149 to 0.9407 at 1.0072 suggests that medium term outlook is staying bearish. That is, down trend from 1.2004 is not completed yet and is in favor to resume through 0.9407 at a later stage. For now, this will be the favored case as long as 1.0095 resistance holds.