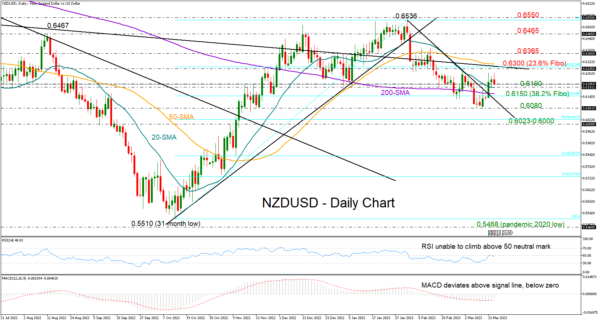

NZDUSD stalled immediately around 0.6230 following the clear break above the descending trendline that kept the bulls in control over the past month.

The pair has crawled above its 20- and 200-day simple moving averages (SMAs) too, raising optimism for a bullish trend reversal. That said, the negative trajectory from February’s eight-month high of 0.6536 is still in place as the price has yet to print a new higher high above the 0.6300 barrier. The 50-day SMA and the falling constraining line drawn from December 2020 reside in the same area, cementing that ceiling.

The technical signals are reflecting some caution as well. The RSI continues to hover below its 50 neutral mark, while the MACD remains within the negative zone despite both pivoting higher.

Hence, traders may wait for an extension above 0.6300, which overlaps with the 23.6% Fibonacci retracement of the 0.5510-0.6536 uptrend, before they target the next resistance area of 0.6365. A successful move higher could add more fuel to the rally, lifting the price towards the 0.6465 barricade and then up to the 0.6536-0.6550 bar.

If downside pressures persevere below 0.6190 and under the 20-day SMA, the door will open for the 200-day SMA and the 38.2% Fibonacci of 0.6150. Another failure here would shift the spotlight to the previous low of 0.6083, a break of which could initiate a quick drop to the 50% Fibonacci of 0.6023 and the 0.6000 round-level.

In brief, NZDUSD has not achieved a bullish bias yet, although it has almost recouped last week’s losses. A decisive close above 0.6300 could be a prerequisite to boosting buying sentiment.