After days of market turbulence, Asian session has been relatively calm today. US stocks recovered overnight with a strong rebound in treasury yields, helping to calm market sentiments. Mixed economic data from China did not seem to have any significant impact on the markets.

With the banking crisis slowly fading into the background, focus is expected to shift back to economic data and central bank policies. The Euro is showing signs of firming up ahead of the ECB rate decision on Thursday, but there seems to be a lack of follow-through momentum. While there is some uncertainty, ECB is still expected to hike rates by 50bps. The key will be on the new economic projections and any guidance on the rate path forward.

Dollar, Yen, and Swiss Franc are currently the weakest currencies for the week, while the Australian dollar, New Zealand dollar, and Sterling are the strongest. However, the recovery in commodity currencies remains weak, so it’s hardly a return to a risk-on environment yet.

Technically, AUD/JPY recovered ahead of 87.00 support. But outlook is unchanged that corrective rise from 87.00 has completed at 93.02. Another decline to retest 87.00 is expected sooner rather than later. Decisive break there will resume larger decline from 99.32. However, sustained trading above 4 hour 55 EMA will argue that corrective pattern from 87.00 is extending with another rising leg, and stronger rebound could be seen back to 93.02.

In Asia, at the time of writing, Nikkei is down -0.30%. Hong Kong HSI is up 1.26%. China Shanghai SSE is up 0.60%. Singapore Strait Times is up 1.24%. Japan 10-yaer JGB yield is up 0.0466 at 0.330. Overnight, DOW rose 1.06%. S&P 500 rose 1.65%. NASDAQ rose 2.14%. 10-year yield rose 0.123 to 3.638.

China posts mixed economic data in Jan-Feb period

China’s economic data for the first two months of 2023 showed mixed results, with industrial production growth falling short of expectations but retail sales and fixed asset investment exceeding them.

According to China’s National Bureau of Statistics, industrial production grew by 2.4% yoy, below the forecasted 2.6% yoy. Retail sales, on the other hand, rose by 3.5% yoy, slightly above expectations of 3.4% yoy.

Fixed asset investment also exceeded expectations, growing by 5.5% yoy, compared to the forecasted 4.5% yoy. Infrastructure investment saw a rise of 9.0% yoy. However, property investment showed a decline of -5.7% yoy, indicating a slowdown in the real estate sector.

The NBS released a statement that highlighted the challenges facing China’s economy. “The external environment is even more complex, inadequate demand remains prominent and the foundation for economic recovery is not solid yet,” the statement said.

The economic data for January and February is combined to smooth out the impact of the Lunar New Year holiday, which falls at different times during the two months in different years.

BoJ minutes: Basic stance to continue with current monetary easing

BoJ has reaffirmed its commitment to continuing with its current monetary easing policy, including yield curve control, to achieve the price stability target, according to the minutes of its meeting in January 17-18.

One member noted that there is “still a long way to go to achieve the price stability target”, and thus the Bank should continue with the current monetary easing to firmly support the economy.

To encourage firms’ efforts with regard to business transformation until sustained wage increases can be expected, the Bank needs to “curb interest rate rises across the entire yield curve” while paying attention to the functioning of bond markets, according to another member.

Another member added that it was “inappropriate to rush to an exit” from the current monetary policy, as overseas economies were currently heading toward slowdowns.

However, one member recognized that “at some point in the future”, it will be necessary to examine and assess the balance between the positive effects and side effects of the current monetary easing policy.

The Bank’s “basic stance on its future conduct of monetary policy” is to “continue with the current monetary easing — including the conduct of yield curve control — and thereby achieve the price stability target in a sustainable and stable manner accompanied by wage increases,” the minutes read.

Looking ahead

Eurozone will release industrial production in European session. Main focuses, however, are on US retail sales and PPI to be released later in the day. US business inventories, Empire State manufacturing index, NAHB housing index, and Canada housing starts will also be released.

EUR/USD Daily Outlook

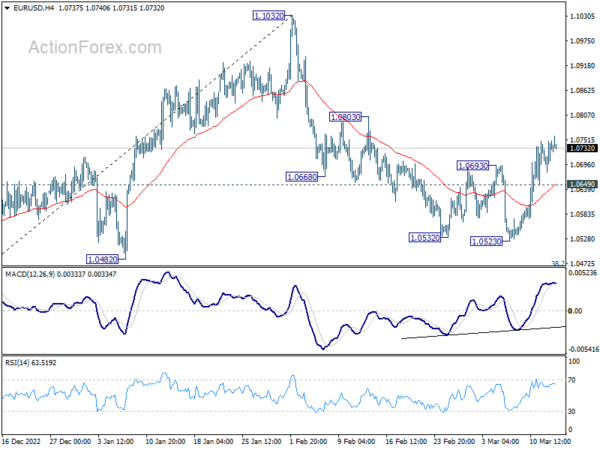

Daily Pivots: (S1) 1.0691; (P) 1.0721; (R1) 1.0762; More…

Intraday bias in EUR/USD stays on the upside and outlook is unchanged. Corrective decline from 1.1032 should have completed at 1.5023, ahead of 1.0482 key support. Break of 1.0803 resistance will bring retest of 1.1032 high next. On the downside, below 1.0649 minor support will turn bias back to the downside. In this case, decline from 1.1032 could resume through 1.0523 to keys structural support at 1.0482.

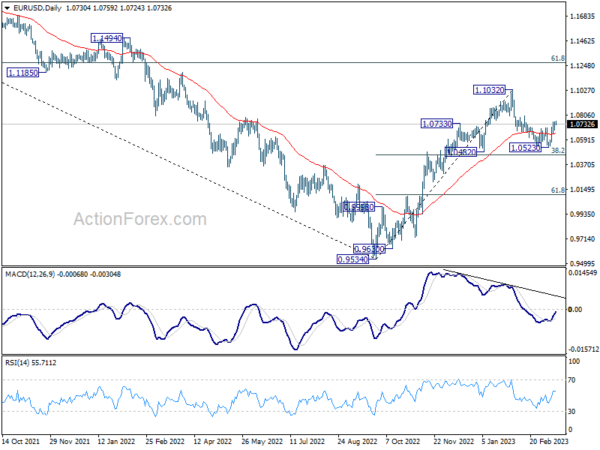

In the bigger picture, as long as 1.0482 support holds, rise from 0.9534 (2022 low) should continue to 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273. However, sustained break of 1.0482 will bring deeper fall to 61.8% retracement of 0.9534 to 1.1032 at 1.0106, even as a corrective pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Current Account (NZD) Q4 | -9.46B | -7.65B | -10.21B | -11.40B |

| 23:50 | JPY | BoJ Minutes | ||||

| 02:00 | CNY | Retail Sales Y/Y Feb | 3.50% | 3.40% | -1.80% | |

| 02:00 | CNY | Industrial Production Y/Y Feb | 2.40% | 2.60% | 1.30% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Feb | 5.50% | 4.50% | 5.10% | |

| 10:00 | EUR | Eurozone Industrial Production M/M Jan | 0.50% | -1.10% | ||

| 12:15 | CAD | Housing Starts Feb | 225K | 215K | ||

| 12:30 | USD | Empire State Manufacturing Index Mar | -7.5 | -5.8 | ||

| 12:30 | USD | Retail Sales M/M Feb | 0.20% | 3.00% | ||

| 12:30 | USD | Retail Sales ex Autos M/M Feb | -0.10% | 2.30% | ||

| 12:30 | USD | PPI M/M Feb | 0.30% | 0.70% | ||

| 12:30 | USD | PPI Y/Y Feb | 5.10% | 6.00% | ||

| 12:30 | USD | PPI Core M/M Feb | 0.40% | 0.50% | ||

| 12:30 | USD | PPI Core Y/Y Feb | 5.00% | 5.40% | ||

| 14:00 | USD | Business Inventories Jan | 0.00% | 0.30% | ||

| 14:00 | USD | NAHB Housing Market Index Mar | 42 | 42 | ||

| 14:30 | USD | Crude Oil Inventories | -0.2M | -1.7M |