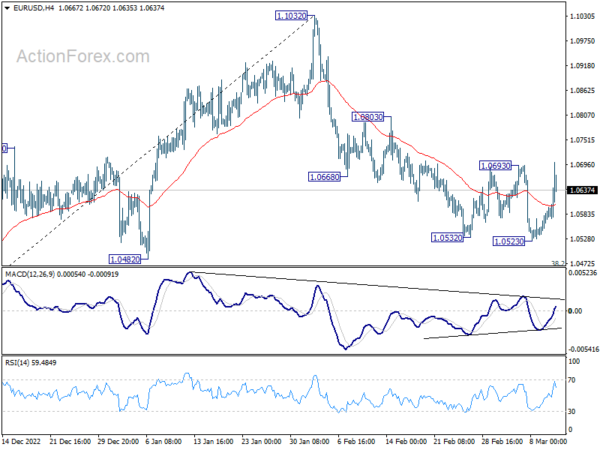

EUR/USD edged lower to 1.0523 but rebounded strongly since then. Yet, it couldn’t take out 1.0693 resistance decisively. Initial bias remains neutral this week first. Fall from 1.1032 is seen as a corrective move only. Then, in case of another decline, downside should be contained by 38.2% retracement of 0.9534 to 1.1032 at 1.0463 to bring rebound. Firm break of 1.0693 will confirm short term bottoming, and turn bias back to the upside for 1.0803 resistance and above.

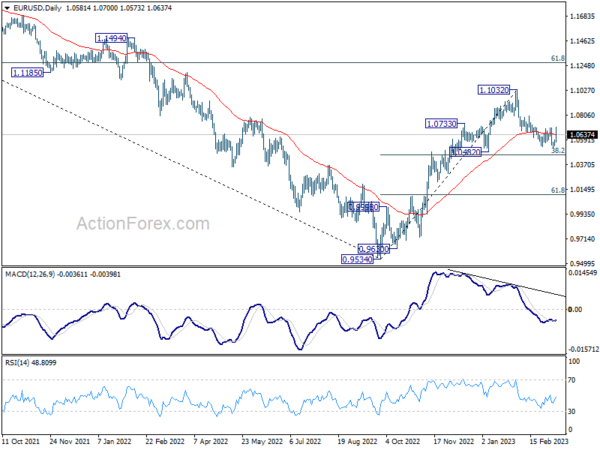

In the bigger picture, as long as 1.0482 support holds, rise from 0.9534 (2022 low) should continue to 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273. However, sustained break of 1.0482 will bring deeper fall to 61.8% retracement of 0.9534 to 1.1032 at 1.0106, even as a corrective pull back.

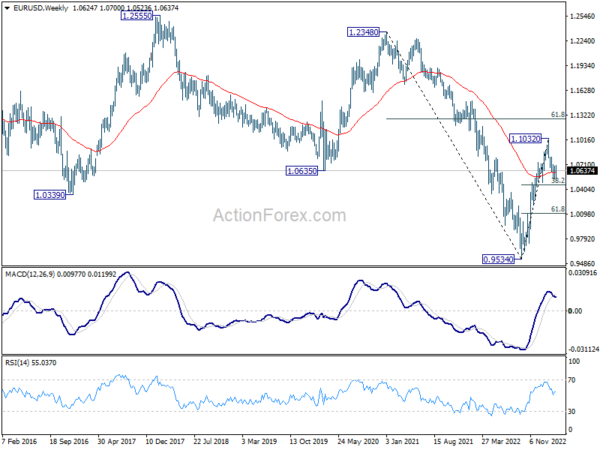

In the long term picture, while it’s too early to call for long term trend reversal at this point, the strong break of 1.0635 support turned resistance (2020 low) should at least turn outlook neutral. Focus will turn to 55 month EMA (now at 1.1165). Rejection by this EMA will revive long term bearishness.