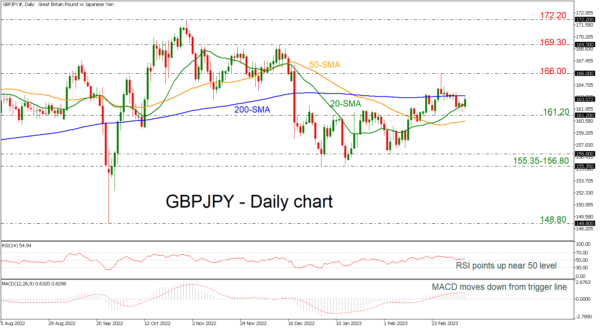

GBPJPY is advancing above the 163.00 round number and is approaching the flat 200-day simple moving average (SMA) at 163.50. A closing day above the latter level could endorse a bullish bias in the near-term timeframe. The RSI indicator is pointing slightly up, while the MACD is holding beneath its trigger line in the positive region.

Hence, the short-run risk is looking neutral-to-positive at the moment and another retest of the 166.00 barrier is likely. Particularly, a decisive close above 166.00 might be what the bulls are eagerly waiting for to rally towards the 169.30 resistance.

To the downside, the 20-day SMA at the162.50 nearby support area may add some footing to the market, but a violation at this point may not attract much attention unless the price slumps below the 161.20 line and the 50-day SMA at 160.50. Negative momentum could further strengthen if the aforementioned level is breached as well, with the 155.35-156.80 restrictive zone likely appearing next on the radar.

In brief, GBPJPY could trade neutral-to-positive in the short-term. A closure above the 200-day SMA could bring fresh buying pressure into the market.