USDCAD skyrocketed in the wake of Powell’s hawkish rate hike comments, with the Bank of Canada adding more fuel to the rally on Thursday after saying that inflation may decelerate significantly in the middle of the year.

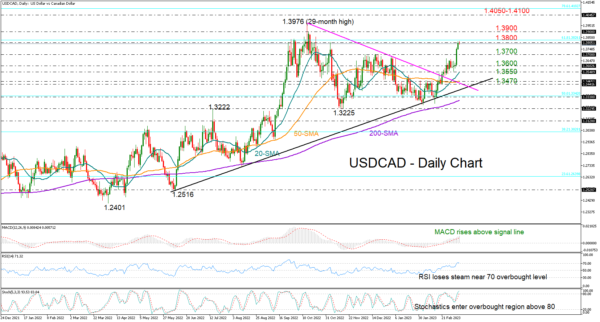

The pair rallied by 1.4% over the past two days to pause at a three-month high of 1.3816. This is where the uptrend from 2021 stalled last fall and a similar episode could play again as the RSI and the Stochastic oscillator flag overbought conditions. Yet, the indicators have not found a peak yet, while the MACD keeps trending upwards in the positive area, suggesting that there might be some extra bullish power in the market.

Strikingly, the 61.8% Fibonacci retracement of the 2020-2021 downtrend is also acting as resistance around 1.3800. Therefore, traders may wait for a clear close above that bar before they target the 1.3900 psychological level. If the uptrend resumes above October’s 1.3976 top, resistance could next pop up somewhere between 1.4050 and the 78.6% Fibonacci of 1.4100.

In the bearish scenario, where the price gets rejected at 1.3800, the former resistance zone of 1.3700 may switch to a support area ahead of the 1.3600 number. The 20- and 50-day simple moving averages (SMAs) could next come into view at 1.3550 and 1.3470 respectively.

Summing up, USDCAD seems to be trading at a make-or-break point around 1.3800. A successful penetration higher would raise hopes for an uptrend resumption. Otherwise, the five-month-old consolidation phase could continue for longer.