Economic output stats for January will kick off this month’s data releases for the UK on Friday (07:00 GMT), providing investors fresh clues on whether the British economy is still teetering on the edge of a recession. Recent indicators suggest that the outlook has brightened slightly, but the Bank of England nevertheless is undecided about how much further it will have to tighten policy. Subsequently, the pound has been somewhat adrift lately. Can the data provide traders with some direction?

Recession risks are subsiding

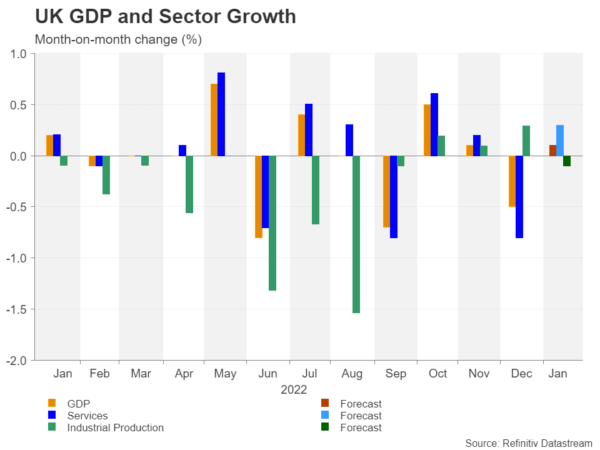

The UK economy narrowly avoided recession last year and likely eked out growth of 0.1% month-on-month in January, having shrunk by 0.5% in December. The meagre rebound is expected to have been driven by a 0.3% expansion in the services sector, as industrial production is forecast to have declined by 0.1% over the period. The manufacturing sub-sector is also expected to have contracted by the same amount.

If these estimates turn out to be correct, or even bettered, the timing of any recession would likely get pushed back to late 2023 or early 2024, which is what has been the case for the predictions about the United States and Eurozone economies. This is assuming of course that the growth numbers for 2022 do not get trimmed down at a future point to show two consecutive quarters of contraction, as UK GDP data is notoriously prone to multiple revisions.

BoE still gloomy

For the moment, policymakers at the Bank of England seem to be taking note of the slightly better-than-expected performance of the economy but they are still anticipating a recession in 2023, albeit a shallower one based on their February projections. Hence, should Friday’s GDP readings underscore the improving picture, the January numbers alone probably won’t sway many minds within the Monetary Policy Committee.

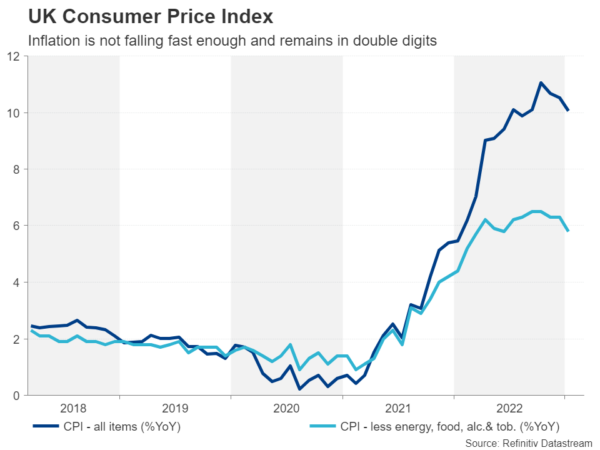

However, what could be more of a game changer is strong GDP data combined with hot inflation figures. The February CPI report is due on March 22 and there is great anxiety about how fast inflation is falling in the UK. Having been in double digits for much of the second half of 2022, inflation could finally dip below 10% in February.

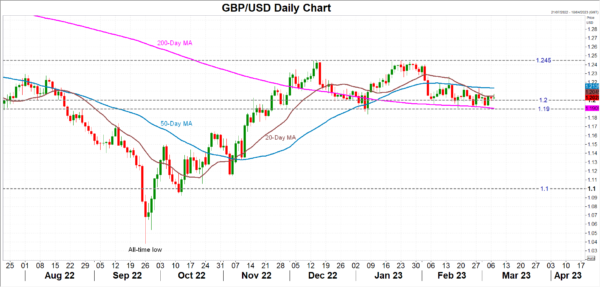

The CPI update will come just in time for the BoE’s policy decision the following day and so it could be a waiting game for sterling until then. The pound has been hovering around the $1.20 mark for the last couple of weeks, confined within its moving averages.

Pound lacking momentum in both directions

There seems to be strong support in the $1.19 region, which came into formation as investors priced out the risk of a steep recession. However, there is a similarly strong barrier to the upside just beneath the $1.2450 level.

Cable’s trading range is perhaps an accurate illustration of the predicament the UK economy is in right now: the worst case scenario appears to have been averted but it is not completely out of the danger zone. Specifically, the economic outlook being upgraded from recession to stagnation is hardly grounds for a rally in the pound. Unless the US dollar were to fall victim to a Fed-sparked selloff, cable will struggle to resume its stalled uptrend as things stand.

The lack of any precise forward guidance by the Bank of England isn’t helping pound bulls either. At its last meeting, the Bank opened the door to a rate hike pause as early as March. But rather than this being an intentional bias towards a neutral stance, policymakers were merely acknowledging that the data and therefore the policy response could go either way. The BoE is probably right to resist the urge to make promises it can’t keep as other central banks have run into trouble doing this.

Politics matters

But for pound traders, they may have to rely on political headlines to guide them until the economic fog clears up a bit more. There was some boost recently with the announcement of the long-awaited deal between the UK and the EU on fixing the Northern Ireland protocol, the row over which had led to stalemate between Unionists and Republicans in the province’s power-sharing assembly.

The deal is not only positive for the pound because it strengthens ‘the Union’, but it also increases the prospect of deeper post-Brexit ties with the EU. In the more near-term horizon, Chancellor Jeremy Hunt will present his Spring Budget on March 15 and the big question is whether he will extend the energy price guarantee beyond April. UK consumers could be forced to tighten their purse strings again if the government stops subsidizing energy bills.