Market pricing about the Fed’s future course of action has dramatically changed lately, following a streak of upbeat US economic data and hotter-than-expected inflation numbers for January. Several Fed officials have become more vocal about the need for more aggressive action hereafter, but a big question is whether Fed Chair Powell has ditched his disinflationary view following the data. With that in mind, investors will closely watch his testimony before Congress on Tuesday and Wednesday.

Streak of January data boosts Fed hike bets

At the press conference following the last FOMC gathering, Fed Chair Powell appeared less hawkish than expected, saying that the disinflationary process has started and although he noted that it will not be appropriate to cut rates this year, he added that if inflation comes down faster, that will be incorporated into their policy.

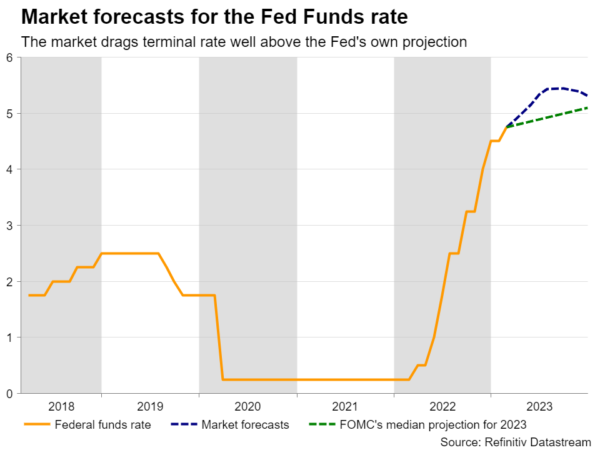

Back then, his remarks added credence to investors’ view that the terminal rate could not reach the Fed’s median projection of 5.1%, and that a couple of rate cuts could be warranted by the end of the year. Nonetheless, a run of upside surprises in economic and inflation data made investors radically change their mind. They raised the level of where they expect interest rates to reach at 5.4%, while scaling back their bets for rate cuts.

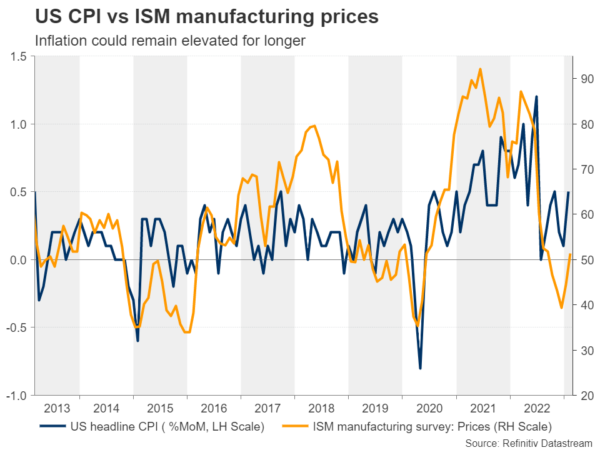

The stellar gains in nonfarm payrolls for January marked the beginning of the shift, with the acceleration in the monthly CPI rate for the month cementing this change of heart. Although those releases were the game changers, early February numbers also corroborated the new narrative. The preliminary S&P Global PMIs surprised to the upside, and although the ISM manufacturing PMI stayed in contractionary territory, its prices subindex jumped above 50, heightening fears that inflation may remain elevated for longer.

Will Powell abandon his disinflationary view?

With all that in mind, investors may be sitting on the edge of their seats in anticipation of what Fed Chair Powell has to say in his semi-annual testimony before Congress. Will he reiterate his disinflationary remarks, or will he appear in a hawkish suit and fuel expectations that interest rate projections will be revised higher at the upcoming meeting?

Several of his colleagues seem to have adopted the latter stance. Minneapolis Fed President Neel Kashkari, who has long been an advocate of a terminal rate above 5.4%, said that he is “open minded” on either a 25 or 50bps hike at the upcoming meeting, while Cleveland Fed President Mester and Atlanta Fed President Bostic argued that rates should exceed 5% and stay there for a prolonged period, with Bostic specifically saying that they should keep them at the peak well into 2024.

How can the dollar respond?

Therefore, a hawkish message by Fed Chair Powell could further endorse investors’ view and thereby push Treasury yields and the dollar higher. At the same time, stock indices could extend their slide as higher interest rates mean higher borrowing costs and lower present values for firms. However, calling for a long-lasting recovery in the US dollar seems premature and impulsive. Ahead of the upcoming FOMC meeting, investors will have to take in the employment report for February, coming out on Friday, and the CPI numbers for the month, due to be released on March 14, both of which have the capacity to give market pricing a 180-degree spin again.

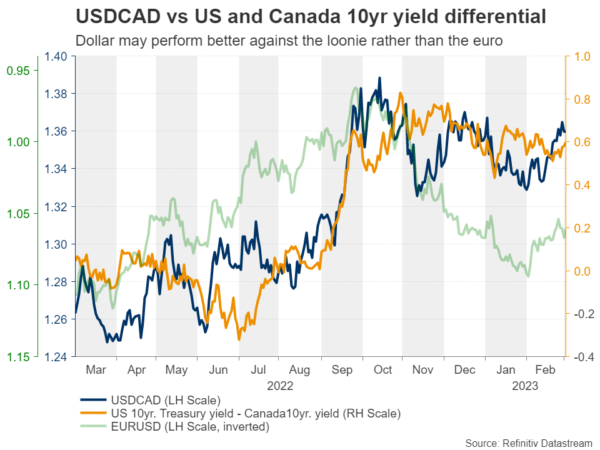

Considering that investors have drastically increased their ECB hike bets as well, euro/dollar may not be the best pair for exploiting any further dollar gains. With the slowdown in Canada’s inflation for January and the nation’s disappointing GDP data for Q4 congealing expectations that the BoC may refrain from hiking at Wednesday’s meeting, the loonie may be a better choice.

Will dollar/loonie break above 1.3700 soon?

Dollar/loonie seems to be in a recovery mode since February 14, while in the bigger picture, it is trading well above the key support zone of 1.3230 and well above the uptrend line drawn from the low of June 2021. So, should the bulls recharge soon, they could challenge the 1.3700 territory, which acted as a ceiling between December 7 and January 3. If there are no sellers to be found there, they may climb towards the 13810 zone, where another breach could set the stage for extensions towards the peak of October 13 at 1.3980.

Now, if Powell reiterates his disinflationary view, which seems an unlikely scenario following the latest bunch of US data, traders may abandon the US dollar and allow dollar/loonie to fall below 1.3470, a move that might trigger declines towards the key support territory of 1.3230. That said, the pair would still be trading above the aforementioned uptrend line and thus, the slide will be far from signaling a full-scale bearish reversal.