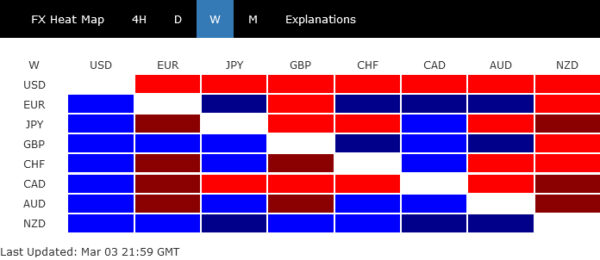

The likelihood of higher and sustained interest rates in the US and Europe is increasing as time goes on. This expectation has led to some volatility in risk markets, but the late rally in stocks indicates that sentiment remains resilient. Despite a rally in treasury yields, Dollar ended the week as the worst performer, with risk-on sentiment out-weighing. The near term corrective rebound in the greenback might still extend, but upside is potential is looking limited.

New Zealand dollar came out on top, followed by Sterling and Euro. Canadian dollar was the second-worst performer, followed by Yen and Swiss Franc. Australian dollar had a mixed performance, despite optimism surrounding China’s economic recovery providing some support.

Stock markets showed resilience despite expectations of higher interest rates

While there was some volatility in recent weeks, investor sentiment showed much resilience. There was optimism that both the US and Europe would avoid a recession with much help from the service sectors. Inflation is still expected to ease, albeit slowly. That somewhat overshadowed the path to higher interest rate peaks, and the longer to stay there.

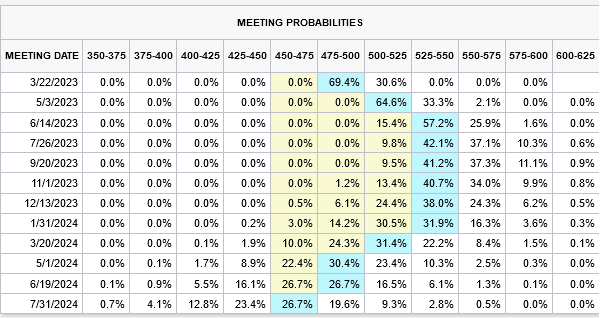

As with Fed, markets are now pricing in 84.6% chance of peaking at 5.25-5.50% in June, and just slightly lower than 50% chance of hitting 5.50-5.75% in either July or September. A rate cut will probably not happen at least March 2024.

DOW ended the week higher with strong rebound on both Thursday and Friday. The development suggests that 38.2% retracement of 28660.94 to 37412.28 at 32400.66 was defended. Price actions from 34712.28 are just a sideway consolidation pattern. Immediate focus is now on 55 day EMA (now at 33400.21). Sustained break there will bring further rally towards 34712.28 high, and raise the chance of resuming whole rally from 28660.94 in Q2.

NASDAQ might have defended 55 day EMA (now at 11394.22) too, keeping the rise from 10207.47 intact. There is prospect of further rally through 12269.55 in the near term.

In Eurozone, after stronger than expected CPI, most analysts raised their expectation on the terminal rate for ECB to 4%. A rate cut this year is also basically ruled out. Yet, investors reacted more to positive data like PMIs, which painted an upbeat picture as lead by expansion in services.

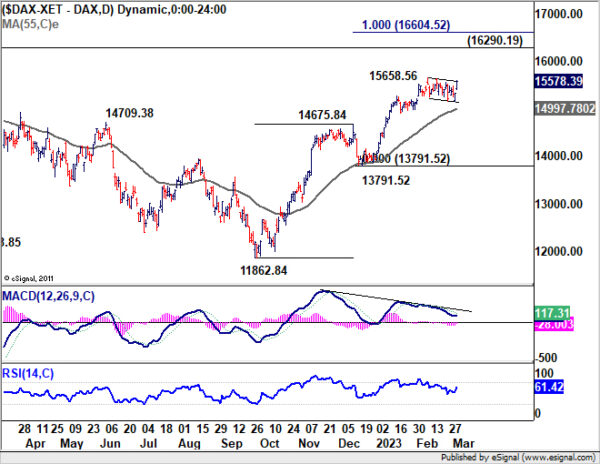

DAX’s price actions from 15658.56 has been corrective look, and the retreat is held well above 55 day EMA (now at 14997.78), keeping near term outlook bullish. Indeed, Friday’s gap up and rally suggests that an upside breakout is due. Break of 15658.56 will resume whole rise from 11862.84 to 16290.19 record high, or even further to 100% projection of 11862.84 to 14675.83 from 13791.52 at 16604.52.

US 10-year yield breached 4%, staying near term bullish

Major benchmark treasury yields also jumped on expectations of higher interest rate. In the US, 2-year yield hit the highest level since 2007, reaching 4.966, before closing at 4.871. US 10-year yield also breached 4.000 handle to 4.091 before closing at 3.964. In Germany, 10-year yield rose to 2.774, hitting the highest level since 2011, before closing at 2.719.

Outlook in US 10-year yield is unchanged that rise from 3.334 is in progress, and should extend higher as long as 3.863 support holds. Further rally should be seen to retest 4.333 high. A break there is not envisaged for now, but even in that case, strong resistance should be seen from 61.8% projection of 2.525 to 4.333 from 3.334 at 4.451 to limit upside. Meanwhile, break of 3.863 will bring some consolidations first before staging another rise.

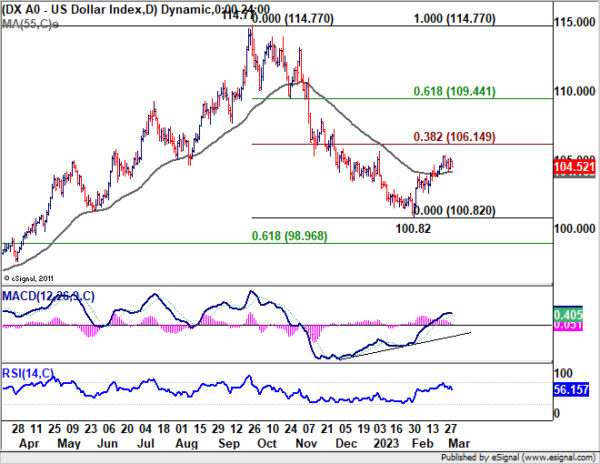

Dollar index’s corrective rise might still have another leg

Dollar index struggled to extend the rebound from 100.82 last week but there was no apparent selloff yet. Such rebound remains seen as a corrective move. Thus, even in case of another rise, strong resistance should be seen from 38.2% retracement of 114.77 to 100.82 at 106.14 to limit upside. Firm break of 55 day EMA (now at 104.16) will bring deeper fall back towards 100.82 low.

This view is in-line with the outlook in other markets as mentioned above. Extended rally in US treasury yield could keep Dollar afloat, but not much against Euro as German yield is strong too. Additionally, underlying bullish sentiment in stocks would cap the greenback’s upside. Near term fortune of Dollar could turn if yields turn into a retreat, which also drag USD/JPY down.

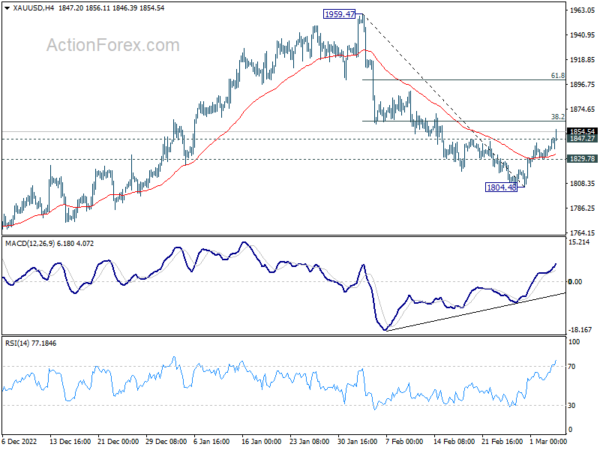

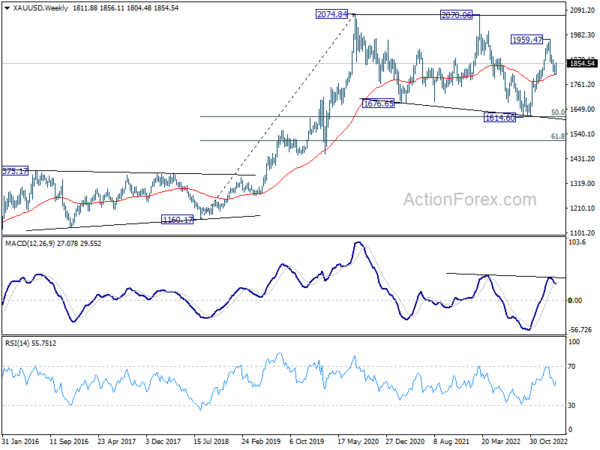

Gold’s rebound could hint on more Dollar weakness

Gold’s extended rebound last week could be seen as an early sign of Dollar weakness. The break of 1847.27 resistance indicates short term bottoming at 1804.48, on bullish convergence condition in 4 hour MACD. That also came after drawing support from 55 week EMA (now at 1804.37). Further rise is expected as long as 1829.78 support holds. Decisive break of 38.2% retracement of 1959.47 to 1804.48 at 1863.68 could prompt upside acceleration to 61.8% retracement at 1900.26 Also, break of 1863.68 could come with near term reference in Dollar Index.

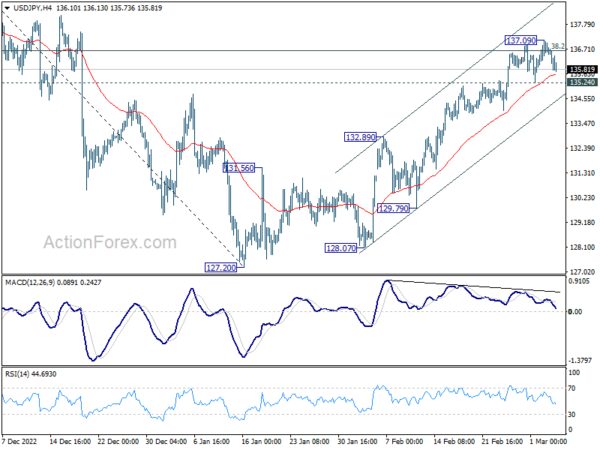

USD/JPY Weekly Outlook

USD/JPY edged higher to 137.09 last week but struggled to sustain above 38.2% retracement of 151.93 to 127.20 at 136.64. Initial bias remains neutral this week first. On the downside, break of 135.24 support will indicate rejection by 136.64, and turn bias back to the downside for 55 day EMA (now at 133.92) first. Sustained break of 55 day EMA will indicate that whole rebound from 127.20 has completed. On the upside, however, sustained break of 136.64 will indicate that fall from 151.93 has completed, and bring further rally to 61.8% retracement at 142.48.

In the bigger picture, focus remains on 38.2% retracement of 151.93 to 127.20 at 136.64. Sustained break there will indicate that price actions from 151.93 medium term are merely a corrective pattern. Such development will maintain long term bullishness. Rejection by 136.64 will, on the other hand, extend the fall from 151.93 to 61.8% retracement of 102.58 to 151.93 at 121.43 at a later stage.

In the long term picture, 151.93 looks increasingly likely a major top. But it’s too early to call for long term bearish reversal at this point. Rebound from around 38.2% retracement of 75.56 to 151.93 at 122.75 will keep the case open for price action from 151.93 to be just a corrective pattern.