January surprised to the downside with some sign the inflationary pulse may be starting to ease.

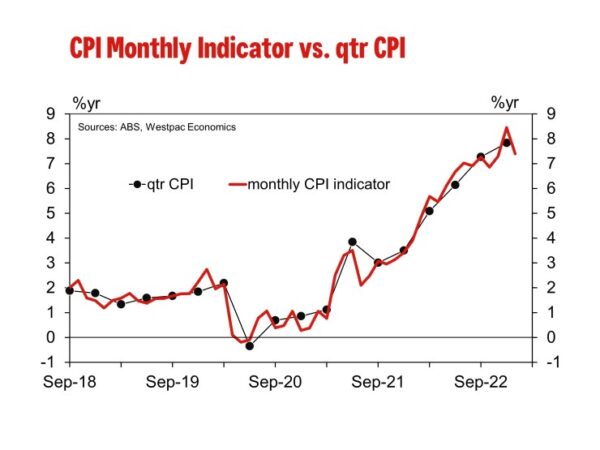

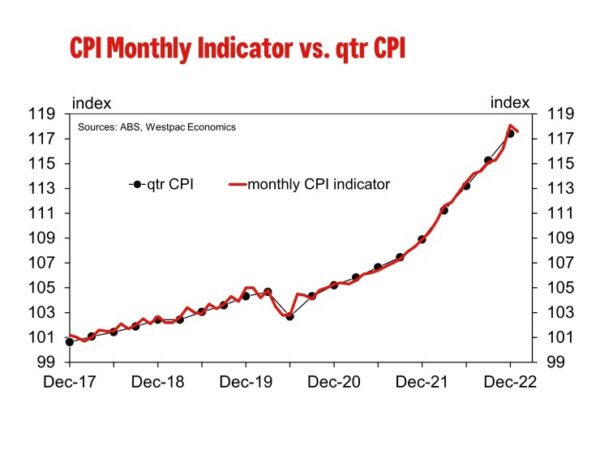

The Monthly CPI Indicator rose 7.4% in the year to January compared to Westpac’s 7.9%yr forecast and the market’s 8.0%yr.

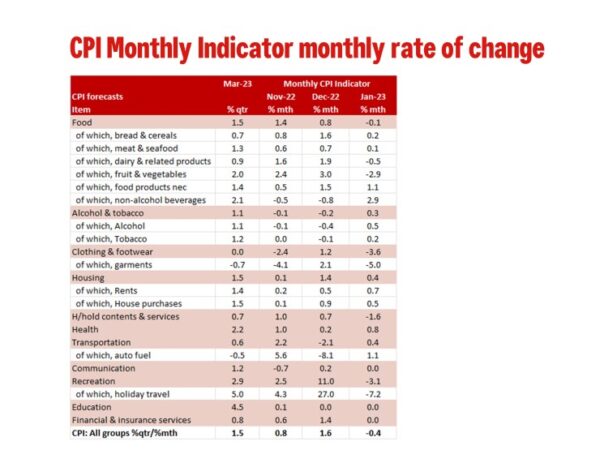

Diving into the detail this was the index fell 0.4% in January compared to 0.1% rise forecast by Westpac; we assume the market median would have been around 0.2% given the 8.0%yr forecast. This is a moderation from the 3.0% rise in December, 2.4% increase in November and a 6.3% decline in October. The Monthly CPI Indicator can be very volatile month to month as it is not a true monthly price index but rather the released of data for the quarterly CPI as it becomes available hence it can be very volatile month to month depending on the timing of the price surveys. This may be way the ABS only reference the annual pace of growth.

The most significant contributions to the annual rise in January were: housing (+9.8%yr), food & non-alcoholic beverages (+8.2%yr) and recreation a& culture (+10.2%yr).

The ABS noted that the annual increase for the housing group in January was lower than December (+10.1%yr) due to a moderation in new dwellings and rents. In monthly terms, both dwelling (+0.5%) and rents (+0.7%) rose in January. However, rents are now growing more strongly than they were a year ago while the increases in dwelling prices are moderating.

Food & non-alcoholic beverages rose 8.2%yr in January, a moderation from the 9.5%yr increase in December. The ABE noted that in the month most food & non-alcoholic beverages prices rose. The main exception was fruit & vegetables which fell 2.3%.

As we expected there was a moderation in price inflation for recreation & cultural with holiday travel & accommodation rising 17.8%yr to January, a moderation from the 29.3%yr pace to December. In January holiday travel & accommodation prices fell 7.2% following a 29.3% increase in December.

Outside of the above contributions to the monthly increase in January worth noting is the 3.6% fall in clothing & footwear on the back of a 5% fall in garments; a 1.1% rise in auto fuel prices and a very modest 0.2% rise in tobacco. Please refer to the included table for a further breakdown on the Monthly CPI indicator and its comparison to our current CPI forecast for Q1.

The ABE no longer publishes an estimation of a Trimmed Mean CPI Indicator as the variation in the timing of price surveys resulted in a meaningful different result from Monthly Trimmed Mean compared to the quarterly Trimmed Mean.

We are processing the Monthly CPI Indicator data to incorporate it into a complete Q1 CPI preview. Our current published inflation forecast for Q1 are 1.5%qtr/7.2%yr for the CPI and 1.3%qtr/6.6%yr for the Trimmed Mean.