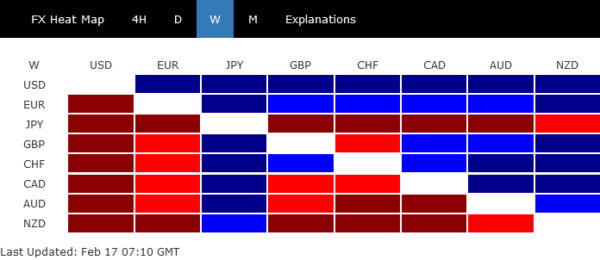

Dollar ended as the best performer last week, after data argued that the slow disinflation process could prompt Fed to tightening further to a higher terminal rate. Yet, buying remained rather uncommitted, as show in Friday’s late pull back. Resilient risk sentiment continued to cap the greenback’s upside, and could continue to do so.

Elsewhere in the forex markets, Euro ended as second strongest as ECB officials reiterated that they staying the course, and tightening could extend well into summer. Swiss Franc and Sterling were the next strongest ones. Yen was the worst performer on widening yield gap with Europeans and Americans. Also, the nomination of the new BoJ governor provided little hope of a U-turn in monetary policy. Commodity currencies were the worst performers.

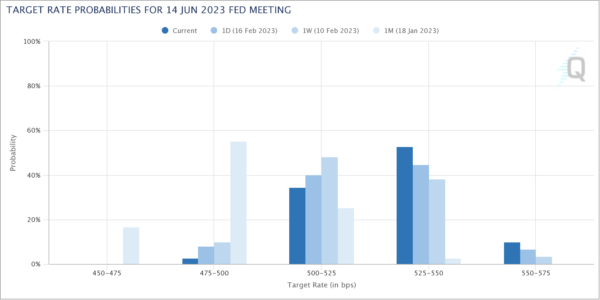

Over 60% chance of three more Fed hikes

January inflation data from the US released last week showed that while disinflation process is continuing, it’s disappointingly slow. Together with hawkish comments from Fed officials, markets have been raising their bets on a higher terminal rate.

As indicated by Fed fund futures, there is now 62.9% chance of interest rate reaching 5.25-5.50% after June meeting. That’s notably higher than 41.8% a week ago, and that mere 2.7% a month ago. That target range is even higher that Fed’s down median estimate of 5.1%, and equivalent to three more 25 bps hike from the current 4.50-4.75%.

US stocks resilient, S&P 500 and NASDAQ staying on higher track

US stocks have been rather resilient. While there was some selloff after the inflation data, late buying on Friday indicated that investors had not given up. DOW and S&P 500 just closed the weekly slightly lower while NASDAQ ended up with gain.

S&P 500 is holding well inside the channel support that started last year at 3491.58. Further rise is expected as long as 55 day EMA (now at 4004.88) holds. Even as a corrective move, rise from 3491.58 would target 4325.28 resistance, or even further to 100% projection of 3491.58 to 4100.51 from 3764.49 at 4373.42.

There is also no sign of reversal in NASDAQ despite loss of upside moment. Further rally is expected as long as 55 day EMA (now at 11355.36) holds. Firm break of 38.2% retracement of 16212.22 to 10088.82 at 12415.87 will pave the way to 13181.08 resistance.

10-year yield pressing 3.905 resistance as rally extended

10-year yield extended the rebound from 3.373 and hit as high as 3.900 but failed to break through 3.905 resistance. Outlook is nonetheless unchanged that corrective pattern from 4.333 has completed with three waves down to 3.373. Further rise is expected as long as 55 day EMA (now at 3.638 holds). Decisive break of 3.905 could set the stage for a retest on 4.333 high.

Dollar index extended corrective rebound, with disappointing momentum

Rising treasury yields and expectations of higher Fed terminal rate should be supportive to Dollar. Yet, the positive force has been offset by resilient risk-on sentiment. Overall movements in the greenback remained rather indecisive, except versus Yen for now. That’s reflected clearly in Friday’s disappointing upside breakout.

The countering forces argue that Dollar index is merely in a corrective rebound, moving two steps forward one step back. For now, further rise is expected in DXY as long as 102.58 support holds. Next target is 38.2% retracement of 114.77 to 100.82 at 106.14. Strong resistance could be seen there to limit upside.

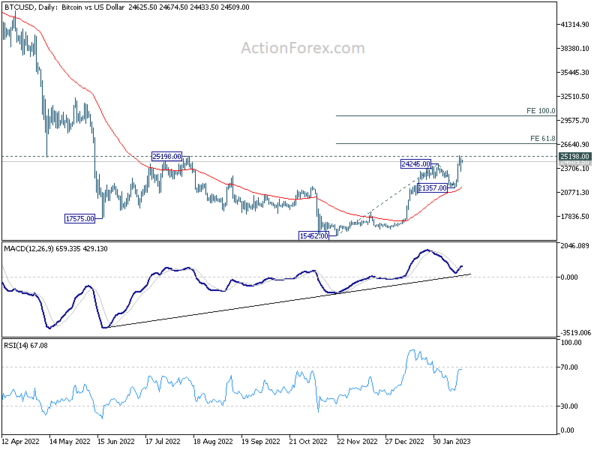

Bitcoin pressing 25198 resistance as risk sentiment improved

Bitcoin is seen as a proxy to overall risk appetite, the development is inline with the bullish outlook in NASDAQ. Rise from 15452 resumed last week and breached 25000 handle. Initial rejection was seen from 25198 structural resistance. But the retreat was so far rather shallow. Further rise is in favor as long as 21357 support holds. Firm break of 25198 will target 61.8% projection of 15452 to 24245 from 21357 at 26791.

For now, it’s still early to see if Bitcoin will break through 26791 decisively. But if it does, next target will be 100% projection at 30150. That could also mean that NASDAQ is breaking through 13181.08 resistance as mentioned, which would be another medium term bullish signal for stocks, but bearish signal for Dollar.

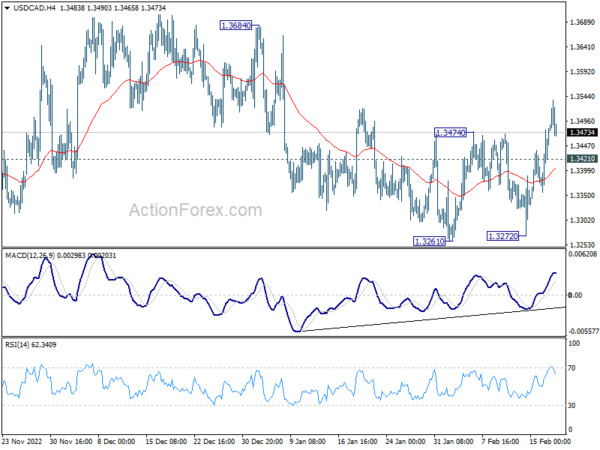

USD/CAD Weekly Outlook

USD/CAD’s break of 1.3474 resistance last week confirmed short term bottoming at 1.3261. More importantly, the corrective pattern from 1.3976 should have completed too. Initial bias stays on the upside this week for 1.3684 resistance. Firm break there will bring retest 1.3976 high. Nevertheless, break of 1.3421 minor support will dampen this bullish case and turn intraday bias neutral again.

In the bigger picture, as long as 1.3222 cluster support (38.2% retracement of 1.2005 to 1.3976 at 1.3223) holds, larger up trend from 1.2005 (2021 low) is still expected to resume through 1.3976 high at a later stage. However, firm break of 1.3222/3 will indicate that the trend might have reversed. Deeper fall would be seen to next cluster support at 1.2726 (61.8% retracement at 1.2758).

In the longer term picture, price actions from 1.4689 (2016 high) are seen as a consolidation pattern only, which might have completed at 1.2005. That is, up trend from 0.9506 (2007 low) is expected to resume at a later stage. This will remain the favored case as 55 month EMA (now at 1.2967) holds.