U.S. Highlights

- The week’s data reminded markets that inflation is far away from the Fed’s target. Both headline and core CPI came in on par with expectations, but details suggest that disinflationary forces are softening.

- Retail sales rebounded from the year-end weakness. The biggest gains were picked up by auto dealers, but other categories were strong beyond expectations.

- More evidence of economic resilience means the Fed may need to fight harder to keep inflation under control. The probability of a 50-basis point hike in March rose from 9% to 21% on the week.

Canadian Highlights

- This week’s housing data showed more weakness than expected as housing starts plunged 13% month-on-month (m/m) to 215.4k units in January.

- While the housing market is feeling the hurt of higher borrowing costs, a strong labour market has kept people spending.

- All eyes will be on next week’s inflation report to get a sense of whether more moves from the Bank of Canada will be necessary.

U.S. – Higher for Longer

“Resilient” is the epithet that describes this week’s economic data the best. Retail sales came in a full percentage point stronger than expected, while inflation figures point to a slower descent than expected. The reaction of the equity market was mixed: stock prices dipped after the initial releases but then bounced back, losing less than 1% on the week. Bond markets, on the other hand, continued to price in higher rates, with 2-year and 10-year yields rising by 18 and 22 basis points on the week (at the time of writing).

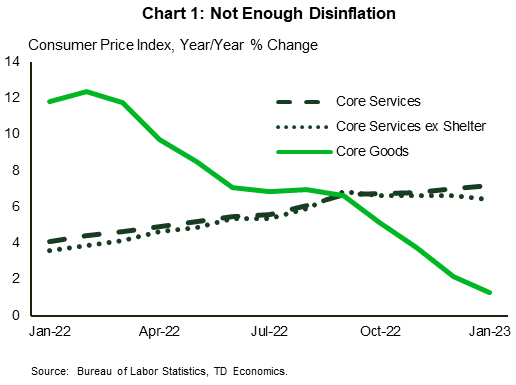

The source of this divergence is interpretation. The Consumer Prices Index (CPI) came in on par with expectations for both the headline and core (ex. food & energy) measures, which gained 0.4% and 0.5% on the month, respectively. Relative to last year, the pace of growth slowed to 6.4% for headline CPI and to 5.6% for core CPI. However, there were few convincing signs of weakness in core services inflation, even when excluding the shelter component – the most important metric for the monetary policy outlook, according to Chair Powell (Chart 1). This is at the time when the disinflationary contribution from core goods inflation appears to have taken a break, especially if the car prices turn higher next month (as signaled by the Manheim price index for used vehicles).

More inflationary pressure was also reported in the Producer Price Index (PPI), which surprised to the upside in January. The headline measure rose 0.7% month-on-month (m/m), while core inflation gained 0.5% m/m. A change in the PPI doesn’t always result in parallel changes in the CPI, but its volatile dynamic proves that the path to disinflation is not a straight line.

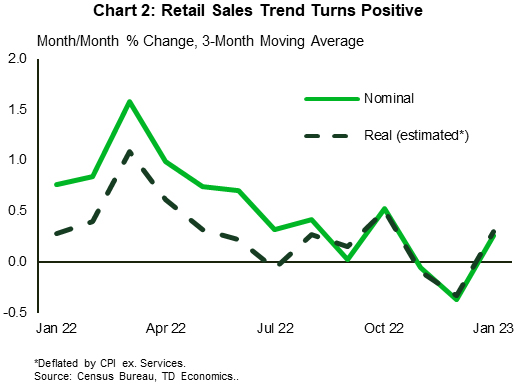

In the context this week’s retail sales report, however, persistent inflation seems less surprising. A warmer January helped heat up consumers’ aptitude to spend. The biggest gains were picked up by auto dealers, primed by the remaining pent-up demand and improved supply as production continues to recover. Predictably, nicer weather made dining out more pleasant, making restaurants the second largest contributor to growth last month. But other categories (department stores, e-commerce, and furniture & electronics stores to name a few) were also robust beyond expectations. This suggests that demand remains resilient: our estimate of real sales was up 2.8% on the month, turning the three-months trend positive (Chart 2).

What didn’t respond to warm weather is housing starts, which fell by 4.5% m/m in January, coming in below the consensus forecast. Both single- and multi-family segments were softer, but while the former remains below its pre-pandemic average, the latter remains 27% stronger relative to 2018-19. Still, housing construction is the only measure that held a course towards disinflation this week. The rest of the economic data makes a “compelling economic case” to bring rates higher and keep them there for longer. As a result, the probability of a 50-basis point hike in March rose from 9% to 21% on the week, while bets on fewer rate cuts by the end of the year jumped higher. We now expect the Fed will raise the policy rate to 5.25% and keep it there until the fourth quarter of 2023.

Canada – Rate Jitters Ahead of Inflation Release

In this week’s edition of, “The economy is more resilient than we thought,” a heatlhy U.S. consumer price index (CPI) inflation print was behind a sharp rise in North American bond yields. Markets are repricing how far they think the Fed needs to go to tame inflation, and have pushed the U.S. 10-year yield up 22 basis points since Tuesday. Canadain bond yields, never immune to financial market ructions south of the border, followed sharply higher with the 10-year yield rising 21 basis points over the same time period. Yet, for policymakers things are not so clear cut north of the 49th parallel due to the outsized role of Canada’s housing market.

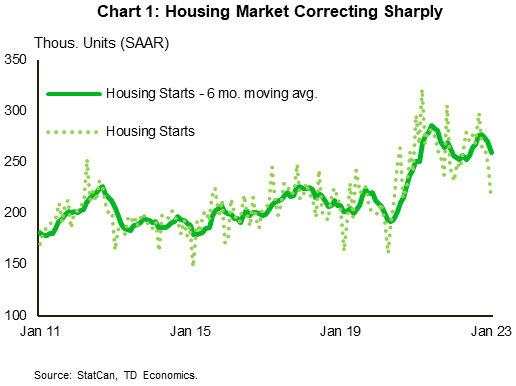

This week’s housing data showed more weakness than expected. Housing starts plunged 13% month-on-month (m/m) to 215.4k units in January. While the trailing six-month moving average shows a still healthy 259.4k units (Chart 1), January’s drop comes after a year where prices and sales cratered. In fact, sales data released Wednesday showed the slowdown in activity extended into January as existing home sales fell another 3.0% m/m for the month. With new listings ticking up (+3.3% m/m), average home prices continued their slide – falling another 1.8% in the month. Prices are now 21% below their peak last February, with Ontario (-21%) and B.C. (-18%) feeling the brunt of the fall.

The housing market is clearly showing the strain of a year’s worth of super-sized rate hikes from the Bank of Canada (BoC). While forced selling is not yet increasing housing supply, policymakers are going to be wary of pushing too far with rate hikes and doing undue damage to the economy in order to tame inflation.

While the housing market is feeling the hurt of higher borrowing costs, a strong labour market has kept people spending. As we recently wrote about, credit and debit card transaction data showed a bounce-back in outlays to close out 2022. December’s official retail sales data are due next Tuesday, but things are building towards a healthy print.

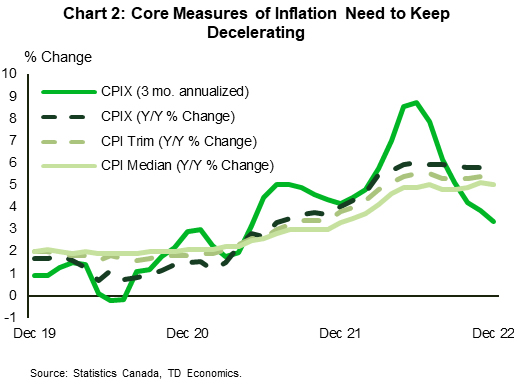

Given the backdrop, next week’s inflation report is a big deal. Policymakers will have a tough time ignoring any more evidence that the cumulative rate hikes have not slowed down demand enough to take some heat off prices. With improving supply conditions and slowing goods demand, the key item to look for will be further moderation in services prices. Also of interest will be the CPIX measure, as officials will be looking through the recent large swings in energy prices (like gasoline) and rising mortgage interest costs that are the result of loans resetting at higher interest rates (Chart 2).

The Bank stated that they would pause rate hikes to evaluate the cumulative effects of 425 basis points of tightening over the last year, but as the upside surprises keep coming all eyes will be on next week’s inflation report to get a sense of whether more moves will be necessary. Should inflation prove to be more sticky than expected the BoC’s planned pause may be shorter than they would have liked.