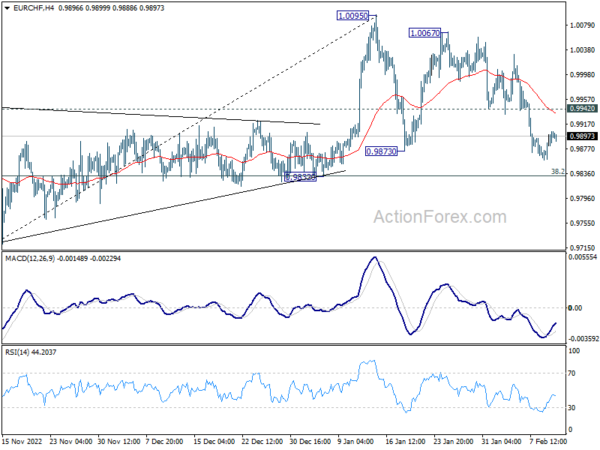

Daily Pivots: (S1) 0.9875; (P) 0.9891; (R1) 0.9920; More….

No change in EUR/CHF’s outlook as consolidation from 1.0095 is still in progress. Deeper fall cannot be ruled out but downside should be contained by 38.2% retracement of 0.9407 to 1.0095 at 0.9832 to bring rebound. On the upside, break of 0.9942 minor resistance will turn bias back to the upside for retesting 1.0067.95 resistance zone.

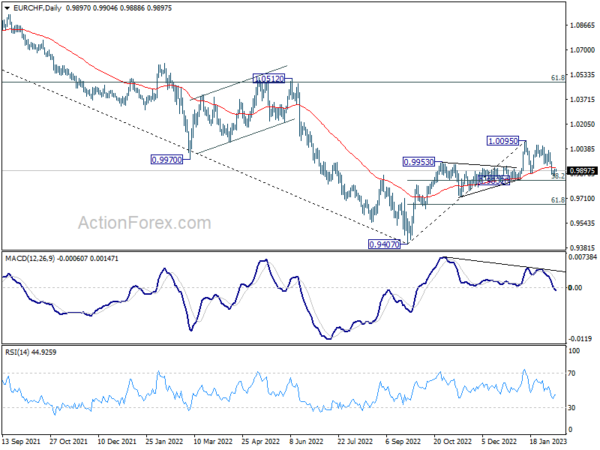

In the bigger picture, the initial rejection by 55 week EMA (now at 1.0039) mixed up the outlook. On the upside, sustained trading above 55 week EMA will raise the chance of bullish trend reversal. Rise from 0.9407 should then target 1.0505 cluster resistance (2020 low at 1.0505, 61.8% retracement of 1.1149 to 0.9407 at 1.1484). However, firm break of 0.9832 support will revive medium term bearishness and bring retest of 0.9407 low instead.