The WTI oil remains at the front foot and extends strong rise from $72.24 (Feb 6 low) for the fourth straight day, underpinned by growing optimism over Chinese demand recovery.

Analysts remain cautiously optimistic as signs that inflation in the US is getting entrenched that would result in further increase in interest rates, may partially offset positive impact and limit gains.

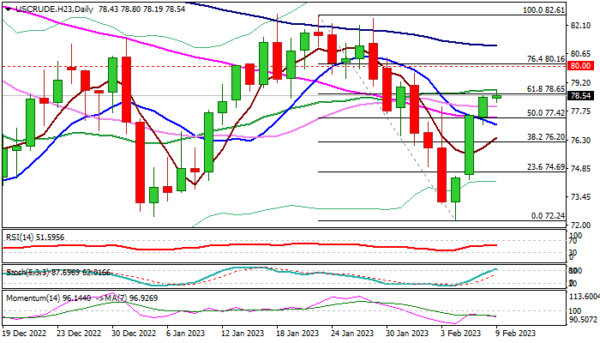

The latest bullish acceleration hit target at $78.65 (Fibo 61.8% of $82.61/$72.24) reinforced by 20DMA, where bulls may face stronger headwinds as daily stochastic entered overbought zone and momentum moves deeper into negative territory.

Failure to break above $78.65 pivot would signal consolidation, with bullish near-term bias to remain intact while dips stay above daily cloud base ($76.83) for attempt at psychological $80.00 barrier.

Conversely, return below the base of thickening daily cloud and extension through daily Tenkan-sen ($76.34) would weaken near-term structure and signal an end of recovery from $72.24.

Res: 78.82; 79.69; 80.00; 81.04

Sup: 77.96; 77.44; 76.83; 76.34