The Euro is consolidating in early Monday after suffering heavy losses last Thu/Fri (down 1.8%) but remains at the back foot and warning of further weakness.

Stronger than expected January US labor data on Friday signal that the Fed may stay in prolonged tightening cycle that inflated dollar and pressure the single currency.

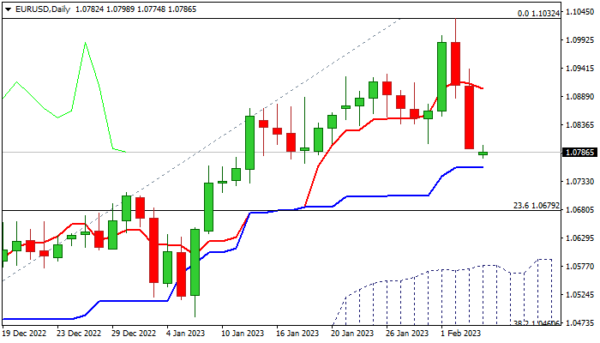

Traders started to collect profits from larger rally after last week’s action failed to sustain break above the top of falling weekly cloud (1.0930) and psychological 1.10 barrier, leaving a bull trap, with additional negative signal seen from bearish weekly candle with long upper shadow, which suggests that bulls are running out of steam.

Although the sentiment has weakened significantly, technical studies on daily chart are still constructive, as momentum is moving at the centreline and stochastic broke into oversold territory.

The price is so far holding above the first trigger at 1.0757 (daily Kijun-sen) that keeps in play the scenario of a healthy correction, though potential bounce to return above daily Tenkan-sen (1.0903) to neutralize immediate downside risk and signal a higher low.

On the other hand, weekly studies are weakening and support scenario of deeper pullback, which sees an initial requirement of close below daily Kijun-sen that would expose open way for test of initial Fibo support at 1.0679 (23.6% of 0.9535/1.1032) and unmask more significant support at 1.0578 (top of thick rising daily cloud).

Res: 1.0844; 1.0903; 1.0930; 1.1000.

Sup: 1.0757; 1.0679; 1.0657; 1.0578.