Yen tumbles broadly today after Nikkei newspaper reported, quoting unnamed source that current BoJ Deputy Governor Masayoshi Amamiya was approached by the government to take over Governor Haruhiko’s job. The news was seen as bearish for the currency, as Amamiya would likely stick with the current ultra-loose monetary policy, comparing to a hawkish alternative.

Nevertheless, Finance Minister Shunichi Suzuki told reports that he had not heard that the government offered Amamiya the job. The prime minister’s office and the BOJ were also not immediately available to comment. Amamiya did not comment to reporters himself neither.

Kuroda’s term will end on April 8 while his deputies Masayoshi Amamiya and Masazumi Wakatabe will have their terms expire on March 19. The final monetary policy policy meeting the three would hold together would be on March 9-10. The more concrete details of the appointments would probably come in early March by latest.

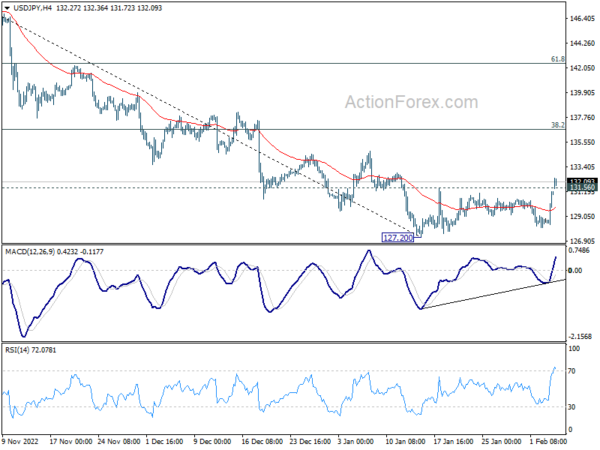

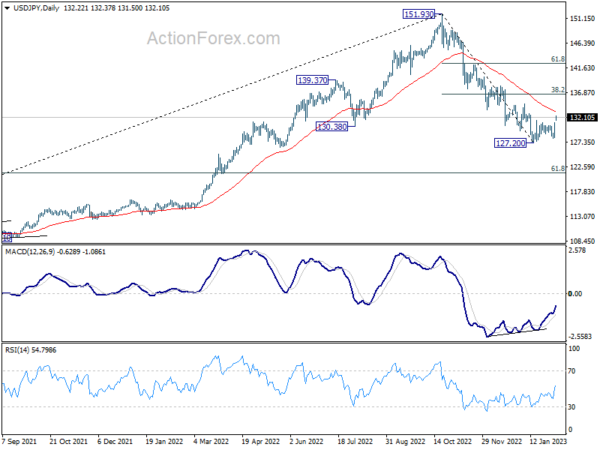

USD/JPY’s break of 131.56 resistance should confirm short term bottoming at 127.20, on bullish convergence condition in daily MACD. Further rally should be seen to 55 day EMA (now at 133.28) first. Firm break there will target 38.2% retracement of 151.93 to 127.20 at 136.64, even just as a correction to the decline from 151.93.