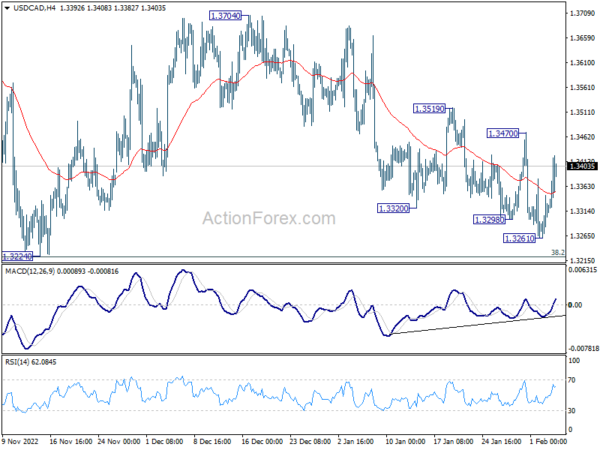

USD/CAD gyrated lower to 1.3261 last week but recovered strongly since then. Initial bias stays neutral this week and outlook is unchanged. While the choppy fall from 1.3704 might still extend lower, strong support is expected to 1.3224 key support to bring rebound. On the upside, above 1.3470 minor resistance will indicate short term bottoming on bullish convergence condition in 4 hour MACD, and turn intraday bias back to the upside for 1.3519 resistance and above. However, decisive break of 1.3224 would carry larger bearish implication.

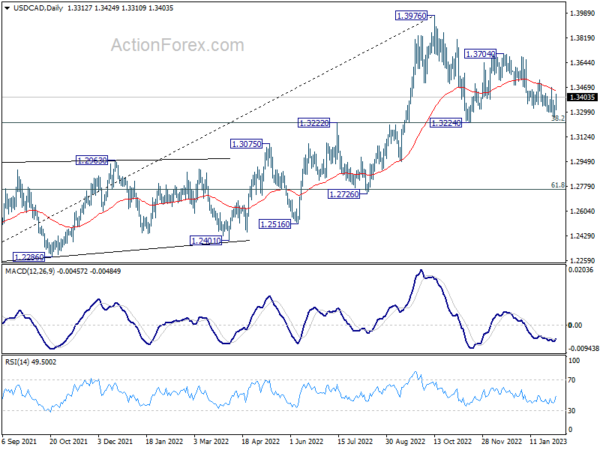

In the bigger picture, as long as 1.3222 cluster support (38.2% retracement of 1.2005 to 1.3976 at 1.3223) holds, larger up trend from 1.2005 (2021 low) is still expected to resume through 1.3976 high at a later stage. However, firm break of 1.3222/3 will indicate that the trend might have reversed. Deeper fall would be seen to next cluster support at 1.2726 (61.8% retracement at 1.2758).

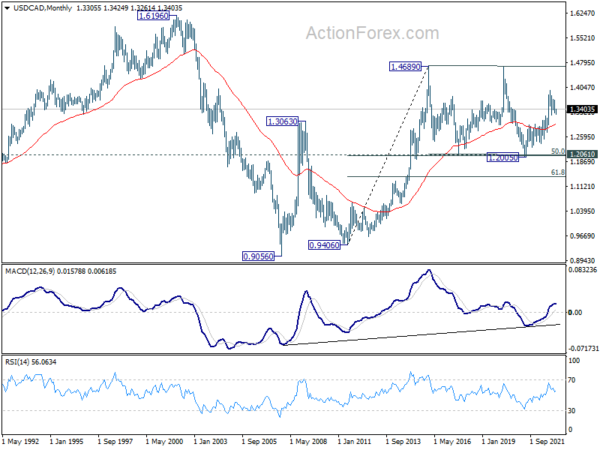

In the longer term picture, price actions from 1.4689 (2016 high) are seen as a consolidation pattern only, which might have completed at 1.2005. That is, up trend from 0.9506 (2007 low) is expected to resume at a later stage. This will remain the favored case as 55 month EMA (now at 1.2953) holds.