ECB Review – Markets Conclude ECB is Close to Being Done

- The ECB hiked policy rates by 50bp, as expected, and said it ‘intends’ to hike another 50bp at the March meeting, after at which point it will ‘evaluate’ the subsequent path of its monetary policy rate.

- Markets took the ECB’s communication as a sign that the ECB is close to ending its hiking cycle, as bond yields rallied strongly. We judge that today’s communication reflects a very split governing council. We still expect the ECB to hike its policy rates by 50bp in March and 25bp in May.

- QT details were uneventful, as expected.

Resilient economy is a double-edged sword for the ECB

President Lagarde acknowledged that the economy proved more resilient than expected and the ECB expects the recovery to continue in the coming quarters. Although recession risks have abated, the economy has also yet to feel the full impact of the ECB’s monetary tightening (see also Euro macro notes – From recession to stagnation, 2 February 2023).

For the ECB, the brighter near-term economic outlook remains a double-edged sword, as it risks prolonging inflationary pressures. Energy inflation has slowed faster than expected, but underlying inflation remains high. Lagarde pointed to delayed supply effects and pent-up demand in some sectors are still pushing up prices, while upside risks remain from catch-up effects in wage growth. With a resilient labour market and still elevated selling price expectations, high core inflation could remain a worry for the ECB for some time. Yet, the ECB now sees a more balanced risk picture, also with respect to the inflation outlook.

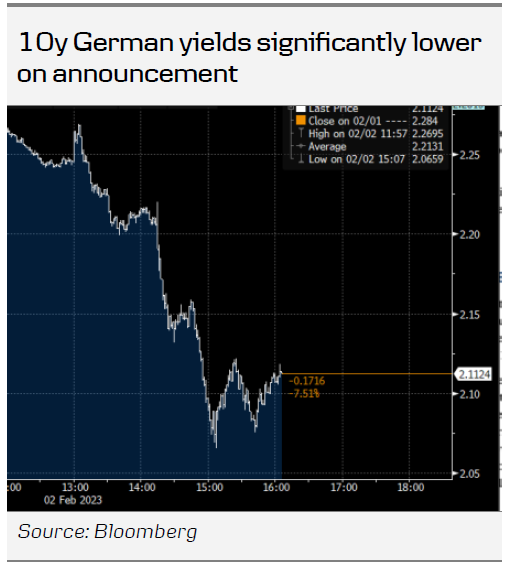

Hawkish on decision – but soft on guidance reflects a split GC

On the face of it, the ECB took a hawkish decision to hike 50bp today and signal another 50bp hike is coming in March, but the subtle changes left markets to conclude that it will soon soften its monetary policy stance and that the ECB is coming close to the end of its hiking cycle. In particular, the reference to a ‘more balanced’ inflation outlook, especially in the near term, was noted by markets. During the press conference, President Lagarde also opened the door for a potential hike of a size other than 50bp, and emphasised that it would be taken only at the March meeting, where the ECB also has new staff projections on which to base its monetary policy decisions. Despite this data dependency, she believes that when assessed on various underlying inflation measures, 50bp was warranted. Unsurprisingly, the ECB confirmed the data-dependent and meeting-by-meeting decision approach. This means that with markets trading on a narrative other than that which the ECB wants to convey on a more holistic plan (e.g. one of underlying inflation lingering, despite lower headline), we saw significantly lower yields to today’s meeting.

We interpret Lagarde’s communication during the press conference as reflecting a very split governing council, where she also said that any decision is the fruit of compromise. In the end, the ECB’s intention to hike 50bp at the March meeting is not a 100% commitment. As late as in June, the ECB also ‘intended’ to hike the rates by 25bp at the coming July meeting, but in the end decided to hike 50bp at that meeting.

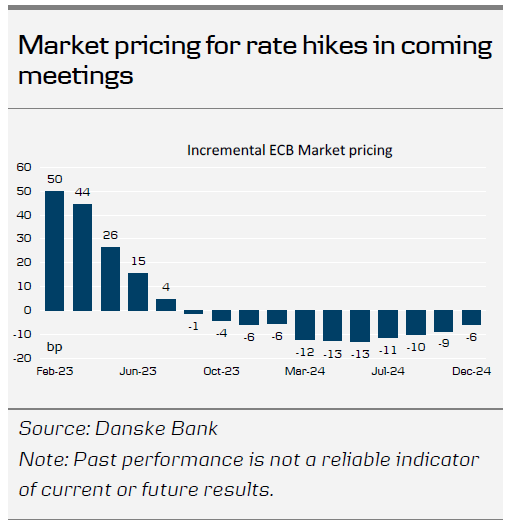

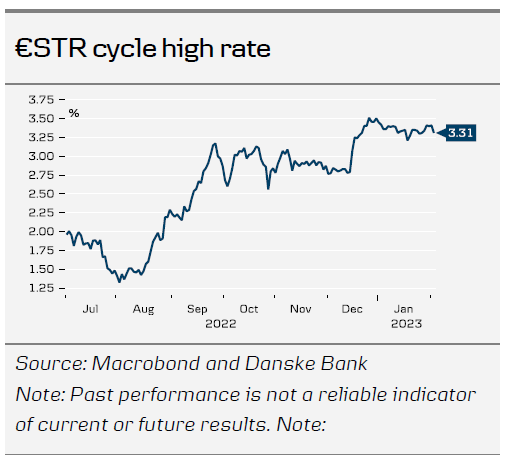

44bp priced in March – cuts early 2024

Markets repriced the peak policy rate lower by 5bp compared with pre-press release level,

at which point it had already repriced slightly on spillover from the BoE’s policy meeting

earlier in the day. At the time of writing, markets see a peak policy rate of 3.40%, which is

10bp lower than yesterday. Markets price in 44bp for March and 25bp in May.

The ECB repeated its judgement of rates will have to rise significantly and stay sufficiently

restrictive to get inflation to the 2% target, but markets downplayed the importance of that

guidance and focused on the data-dependent and meeting-by-meeting approach to policy

decisions.

QT details were relatively uneventful

The announcement of the reinvestment policies was relatively uneventful, as expected. The

ECB confirmed its decision to allow EUR15bn/month to mature on average from March to

June. As regards the reinvestments that will be done, it said that this will be done

proportionally to the redemptions in the jurisdiction and asset class, thereby not actively

pursuing another portfolio composition. This conclusion does not include the private sector

purchases, which were seen as reinvestments under the CSPP, tilted more to the better

climate performance issuers.

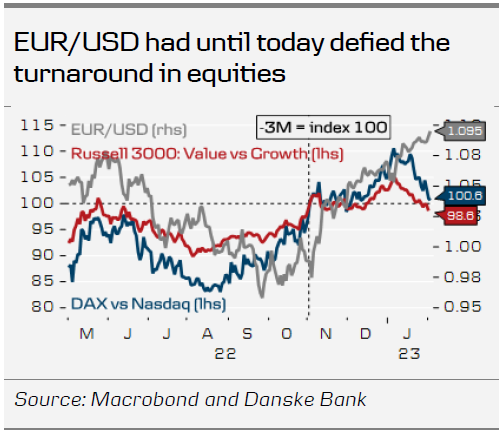

EUR-crosses decline on Lagarde communication

While the initial market reaction in FX markets was fairly limited, the EUR initiated a

broader-based decline during the press conference. EUR/USD is now firmly below the 1.10

mark and EUR/Scandies are also trading considerably lower.

In recent weeks, EUR/USD has defied the shift and sudden underperformance of Eurozone

equities, which we otherwise deem to have been an important driver behind the EUR/USD

rally since September (Eurozone equities overperforming during this period). Our tactical

conviction on EUR/USD is not high, but we maintain a clear sell-on-rallies bias for the

cross as we still think medium-term drivers indicate that EUR/USD is overvalued (and not

undervalued).