Dollar weakened broadly overnight, more on risk-on sentiment than FOMC rate decision. Yet, selloff was not particularly fierce except versus Euro and Swiss Franc. In particular, Sterling is clearly lagging behind. Judging from the upside breakout in EUR/GBP, traders are probably guarding against the possibility of a dovish twist in BoE today. As for the greenback and overall risk sentiment, there is another mega event of non-farm payrolls ahead. So, fasten your seat-belt.

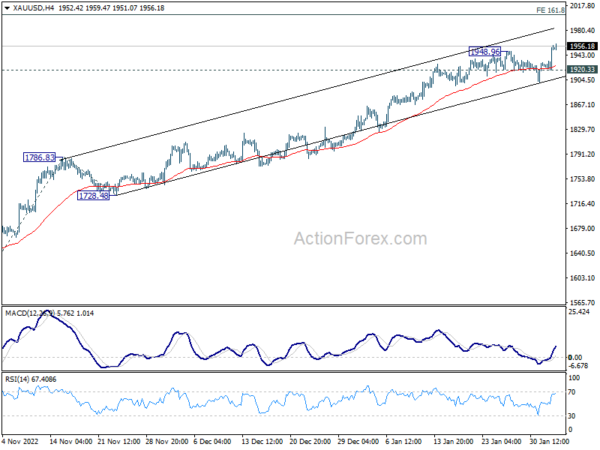

Technically, Gold resumed recent rally by breaking through 1948.96. Outlook will stay bullish as long as 1920.33 support holds. Next target is 161.8% projection of 1616.51 to 1786.83 from 1728.48 at 2004.05, which is also close to 2000 psychological level. Strong resistance might bee seen there to bring a correction. Let’s see.

In Asia, Nikkei rose 0.20%. Hong Kong HSI is down -0.12%. China Shanghai SSE is up 0.02%. Singapore Strait Times dropped -0.62%. Japan 10-year JGB yield rose 0.0094 to 0.492. Overnight, DOW rose 0.02%. S&P 500 rose 1.05%. NASDAQ rose 2.00%. 10-year yield rose dropped -0.132 to 3.397.

NASDAQ completed double bottom, investors responded well to Fed

NASDAQ closed strongly up by 2.00% overnight to close at 11816.31. Fed’s 25bps rate hike was well received by investors, with Chair Jerome Powell admitting that “we can now say for the first time that the disinflationary process has started.”

Suggested readings on FOMC:

- An End to the Tightening Cycle is on the FOMC’s Horizon

- FOMC Hikes Rates and Signals Yet More to Come

- FOMC Meeting Recap: Powell Not Hawkish Enough, Traders Price in 50bps of Cuts by EOY

- EUR/USD upside breakout as Fed Powell said disinflationary process has started

- FOMC Hikes Policy Rate by 25 Basis Points, Signals More to Come

NASDAQ’s break of 11571.64 resistance completes a double bottom pattern (10088.82, 10207.47). Near term outlook will stay bullish as long as 55 day EMA (now at 11043.84) holds. Next target is 38.2% retracement of 16212.22 to 10088.82 at 12427.95.

It’s still a bit early to tell if NASDAQ is in correction to the down trend from 16212.22, or in bullish reversal. Key level lies in 13181.08 cluster resistance, 50% retracement at 13150.52. Reactions from there will reveal which case it is.

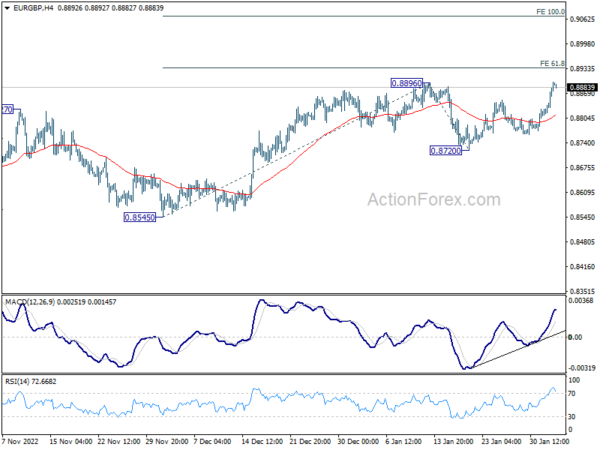

EUR/GBP upside breakout ahead of BoE and ECB, some previews

Two central banks will announce rate decisions today, BoE and then ECB. Currently, the base case is for BoE to hike to bps today to 4.00%, and then another 25bps hike in March, then a pause. Any deviation from that path could trigger much volatility in the Pound. Attention will be on the decision itself, the voting, as well as the new economic projections.

As for ECB, a 50bps hike to 3.00% is widely expect. President Christine Lagarde has been clear that the central bank has to “stay the course”. While some policymakers have already indicated the preference for another 50bps in March, that would very much depend on the new economic projections to be released then. So, no matter how firm Lagarde sounds today, there is room for adjustment before the March meeting.

Here are some suggested readings on ECB and BoE:

- ECB Preview: All About Forward Guidance

- Roaring Euro Turns to ECB Rate Decision

- ECB Preview – Set for Another 50bp Rate Hike

- Voting Rotation, Hawkishness and the Next ECB Meeting in Sight

- UK Will Not Avoid Recession Says IMF; What Does this Mean for the Pound?

- BoE Preview: MPC Might Be Split But 50 bp Hike Likely

- Bank of England: One Final 50bps Rate Hike

- Bank of England Preview – Topside Risk to EUR/GBP

EUR/GBP break through 0.8896 resistance to resume the rise from 0.8545, ahead of the announcements of the two central banks. Further rally is now expected to 61.8% projection of 0.8545 to 0.8896 from 0.8720 at 0.8937. Reaction from there is crucial in determining the underlying momentum. Sustained break should prompt upside acceleration to 100% projection at 0.9071. Rejection by this level will turn near term bias neutral first.

Elsewhere

New Zealand building permits dropped -7.2% mom in December. Australia building permits rose 18.5% mom in December, well above expectation of 1.1% mom. Japan monetary base dropped -3.8% yoy in January, versus expectation of -3.2% yoy. Germany trade surplus narrowed slightly to EUR 10.0B in December.

Looking ahead, Swiss SEO consumer climate will be a feature in the European session. US will release jobless claims, non-farm productivity, and factory orders. Canada will release building permits. But main focuses are of course on BoE and ECB rate decisions.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0894; (P) 1.0948; (R1) 1.1043; More…

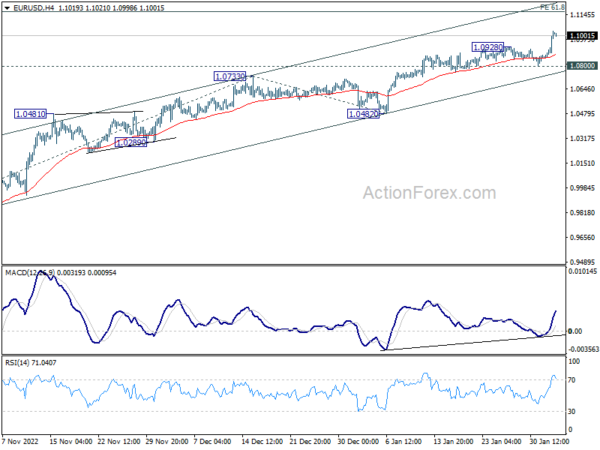

EUR/USD’s up trend resumed by breaking through 1.0928 resistance and intraday bias is back on the upside. Current rally from 0.9534 should target 61.8% projection of 0.9630 to 1.0733 from 1.0482 at 1.1164 next. On the downside, break of 1.0800 support is needed to confirm short term topping. Otherwise, outlook will remain bullish in case of retreat.

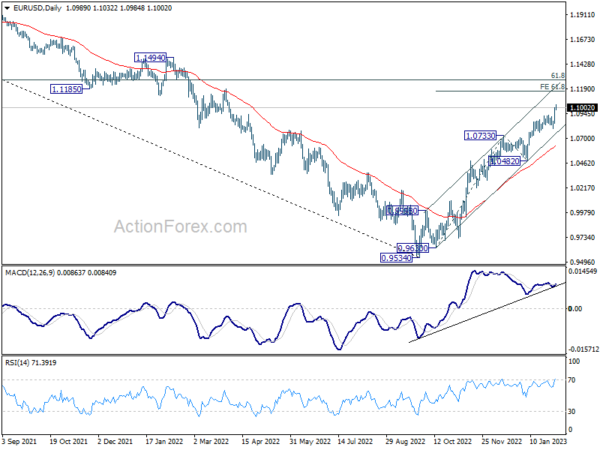

In the bigger picture, current development suggests that the rally from 0.9534 low (2022 low) is a medium term up trend rather than a correction. Further rise is in favor to 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 next. This will remain the favored case as long as 1.0482 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Dec | -7.20% | 7.00% | 6.70% | |

| 23:50 | JPY | Monetary Base Y/Y Jan | -3.80% | -3.20% | -6.10% | |

| 00:30 | AUD | Building Permits M/M Dec | 18.50% | 1.10% | -9.00% | |

| 07:00 | EUR | Germany Trade Balance (EUR) Dec | 10.0B | 8.8B | 10.8B | 10.9B |

| 08:00 | CHF | SECO Consumer Climate Q1 | -38 | -47 | ||

| 12:00 | GBP | BoE Rate Decision | 4.00% | 3.50% | ||

| 12:00 | GBP | MPC Official Bank Rate Votes | 7–0–2 | 7–0–2 | ||

| 12:30 | USD | Challenger Job Cuts Y/Y Jan | 129.10% | |||

| 13:15 | EUR | ECB Main Refinancing Rate | 3.00% | 2.50% | ||

| 13:30 | USD | Initial Jobless Claims (Jan 27) | 186K | |||

| 13:30 | USD | Nonfarm Productivity Q4 P | 2.50% | 0.80% | ||

| 13:30 | USD | Unit Labor Costs Q4 P | 1.60% | 2.40% | ||

| 13:30 | CAD | Building Permits M/M Dec | 1.50% | 14.10% | ||

| 13:45 | EUR | ECB Press Conference | ||||

| 15:00 | USD | Factory Orders M/M Dec | 2.30% | -1.80% | ||

| 15:30 | USD | Natural Gas Storage | -146B | -91B |