Two central banks will announce rate decisions today, BoE and then ECB. Currently, the base case is for BoE to hike to bps today to 4.00%, and then another 25bps hike in March, then a pause. Any deviation from that path could trigger much volatility in the Pound. Attention will be on the decision itself, the voting, as well as the new economic projections.

As for ECB, a 50bps hike to 3.00% is widely expect. President Christine Lagarde has been clear that the central bank has to “stay the course”. While some policymakers have already indicated the preference for another 50bps in March, that would very much depend on the new economic projections to be released then. So, no matter how firm Lagarde sounds today, there is room for adjustment before the March meeting.

Here are some suggested readings on ECB and BoE:

- ECB Preview: All About Forward Guidance

- Roaring Euro Turns to ECB Rate Decision

- ECB Preview – Set for Another 50bp Rate Hike

- Voting Rotation, Hawkishness and the Next ECB Meeting in Sight

- UK Will Not Avoid Recession Says IMF; What Does this Mean for the Pound?

- BoE Preview: MPC Might Be Split But 50 bp Hike Likely

- Bank of England: One Final 50bps Rate Hike

- Bank of England Preview – Topside Risk to EUR/GBP

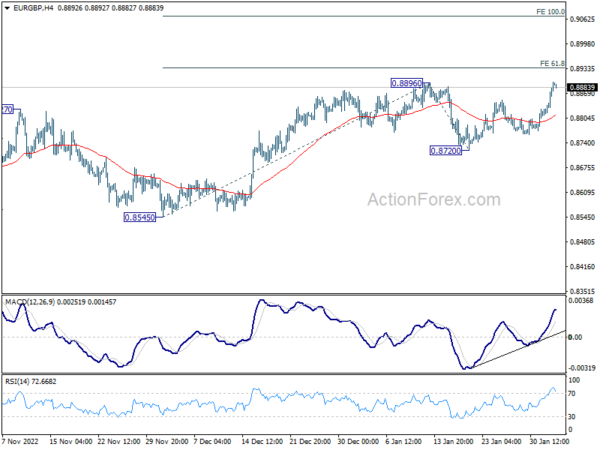

EUR/GBP break through 0.8896 resistance to resume the rise from 0.8545, ahead of the announcements of the two central banks. Further rally is now expected to 61.8% projection of 0.8545 to 0.8896 from 0.8720 at 0.8937. Reaction from there is crucial in determining the underlying momentum. Sustained break should prompt upside acceleration to 100% projection at 0.9071. Rejection by this level will turn near term bias neutral first.