Yen and Dollar are both in recovery mode in Asian session, as investor continued to turn cautious ahead of the three central bank meetings of Fed, BoE and ECB later in the week. Asian markets shrugged of better than expected PMI data from China, which indicated a return to expansion in both manufacturing and non-manufacturing activities. Aussie was weighed down further by surprisingly deep contraction in retail sales. For now, commodity currencies are the worst performers while European majors are mixed.

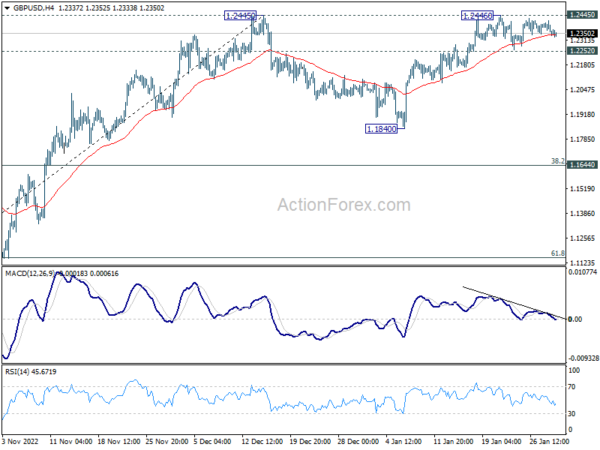

Technically, as the greenback is trying to recovery, focuses will be on some resistance levels for indication of short term bottoming, and a more sustainable rebound. The levels include 1.0765 minor support in EUR/USD, 1.2252 support in GBP/USD, and 131.56 resistance in USD/JPY. These levels need to be taken out in tandem to confirm the underlying buying momentum of Dollar.

In Asia, Nikkei closed down -0.39%. Hong Kong HSI is down -1.63%. China Shanghai SSE is down -0.42%. Singapore Strait Times is down -0.62%. Japan 10-year JGB yield is up 0.013 at 0.494, marching back to BoJ’s 0.5% cap. Overnight, DOW dropped -0.77%. S&P 500 dropped -1.30%. NASDAQ dropped -1.96%. 10-year yield 0.033 to 3.551.

France GDP grew 0.1% qoq in Q4, up 2.6% in 2022

France GDP grew 0.1% qoq in Q4, better than expectation of 0.0% qoq. On average over the year 2022, GDP increased by 2.6% (after +6.8% in 2021 and -7.9% in 2020).

This annual growth figure was essentially the result of the rebound in activity in the second and third quarters of 2021, as the health crisis receded. Quarter-on-quarter growth was significantly less dynamic over the year 2022. The growth overhang for 2023 stands at +0.3% at the end of the fourth quarter of 2022.

China official PMI manufacturing rose to 50.1, non-manufacturing up to 54.4

China official PMI Manufacturing rose from 47.0 to 50.1 in December, slightly below expectation of 50.2. PMI Non-Manufacturing jumped from 41.6 to 54.4, above expectation of 51.0. Both indexes were also back in expansion region.

Senior NBS statistician Zhao Qinghe noted that economic activity returned to expansion amid an improvement in the business operation climate and the situation.

“Meanwhile, many companies in the manufacturing and services sectors still reported a lack of market demand is the major concern for their businesses. The foundation of economic recovery still needs to be further consolidated,” he added.

Japan industrial production declined -0.1% mom in Dec, but expected to rebound

Japan industrial production declined -0.1% mom in December, much better than expectation of -0.8% mom. The Ministry of Economy, Trade and Industry retained the assessment from the previous month that industrial production is “weakening.” 10 of the 15 industries surveyed, reported decline in output, four reported increase, and one remained unchanged.

Based on a poll of manufacturers, the ministry expects output to remain flat in January, and then grow 4.1% in February. A ministry official said, “we still need to keep a close eye on the influence of a potential spread in coronavirus infections, material shortages and high prices.”

Also released, retail sales rose 3.8% yoy in December, above expectation of 3.1% yoy. Unemployment rate was unchanged at 2.5%. housing starts dropped -1.7% yoy. Consumer confidence rose from 30.3 to 31.0 in January.

Australia retail sales turnover down sharply by -3.9% mom in Dec

Australia retail sales turnover dropped sharply by -3.9% mom to AUD 34.47m in December, much worse than expectation of -0.3% mom. That’s the first contraction after 11 straight months of growth. Still, sales turnover remained elevated at its sixth highest level on record, and was up 7.5% yoy for the year.

Ben Dorber, ABS head of retail statistics, said: “The large fall in December suggests that retail spending is slowing due to high cost-of-living pressures… The latest Consumer Price Index showed that prices continued to rise strongly in the December quarter. To see the effect of consumer prices on recent turnover growth, it will be important to look at quarterly retail sales volumes which we will release next week.”

Looking ahead

Eurozone GDP and Germany CPI flash are the main features in European session. Later in the day, Canada GDP will be released. US will also publish employment cost index, house price indexes, Chicago PMI and consumer confidence.

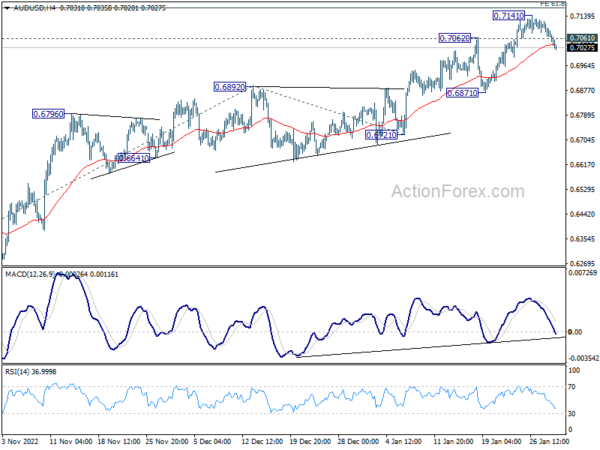

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7034; (P) 0.7077; (R1) 0.7103; More…

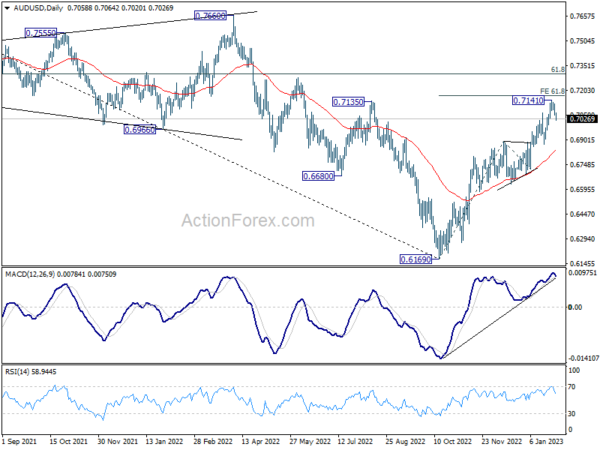

AUD/USD’s break of 0.7061 minor support suggests short term topping at 0.7141, ahead of 61.8% projection of 0.6169 to 0.6892 from 0.6721 at 0.7168. Intraday bias is back on the downside for 0.6871 support, for further to 55 day EMA (now at 0.6832). On the upside, firm break of 0.7141 will resume the rally from 0.6169 to 0.7304 fibonacci level.

In the bigger picture, corrective decline from 0.8006 (2021 high) should have completed with three waves down to 0.6169 (2022 low). Further rally should be seen to 61.8% retracement of 0.8006 to 0.6169 at 0.7304. Sustained break there will pave the way to retest 0.8006. This will now remain the favored case as long as 0.6721 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Unemployment Rate Dec | 2.50% | 2.50% | 2.50% | |

| 23:50 | JPY | Industrial Production M/M Dec P | -0.10% | -0.80% | 0.20% | |

| 23:50 | JPY | Retail Trade Y/Y Dec | 3.80% | 3.10% | 2.50% | |

| 00:30 | AUD | Private Sector Credit M/M Dec | 0.30% | 0.50% | 0.50% | |

| 00:30 | AUD | Retail Sales M/M Dec | -3.90% | -0.30% | 1.40% | 1.70% |

| 01:00 | CNY | Manufacturing PMI Dec | 50.1 | 50.2 | 47 | |

| 01:00 | CNY | Non-Manufacturing PMI Dec | 54.4 | 51 | 41.6 | |

| 05:00 | JPY | Consumer Confidence Jan | 31 | 30.5 | 30.3 | |

| 05:00 | JPY | Housing Starts Y/Y Dec | -1.70% | 0.50% | -1.40% | |

| 06:30 | EUR | France Consumer Spending M/M Dec | -1.30% | 0.20% | 0.50% | |

| 06:30 | EUR | France GDP Q/Q Q4 P | 0.10% | 0.00% | 0.20% | |

| 07:30 | CHF | Real Retail Sales Y/Y Dec | 2.60% | -1.30% | ||

| 08:55 | EUR | Germany Unemployment Change Dec | 5K | -13K | ||

| 08:55 | EUR | Germany Unemployment Rate Dec | 5.50% | 5.50% | ||

| 09:30 | GBP | Mortgage Approvals Dec | 44K | 46K | ||

| 09:30 | GBP | M4 Money Supply M/M Dec | -0.30% | -1.60% | ||

| 10:00 | EUR | Italy GDP Q/Q Q4 P | -0.20% | 0.50% | ||

| 10:00 | EUR | Eurozone GDP Q/Q Q4 P | -0.10% | 0.30% | ||

| 13:00 | EUR | Germany CPI M/M Jan P | -0.30% | -0.80% | ||

| 13:00 | EUR | Germany CPI Y/Y Jan P | 8.80% | 8.60% | ||

| 13:30 | CAD | GDP M/M Nov | 0.20% | 0.10% | ||

| 13:30 | USD | Employment Cost Index Q4 | 1.20% | 1.20% | ||

| 14:00 | USD | S&P/CS Composite-20 HPI Y/Y Nov | 6.80% | 8.60% | ||

| 14:00 | USD | Housing Price Index M/M Nov | -0.40% | 0.00% | ||

| 14:45 | USD | Chicago PMI Jan | 45.4 | 44.9 | ||

| 15:00 | USD | Consumer Confidence Jan | 109.2 | 108.3 |