Sentiment in Asia was mixed today. Most markets have turned cautious ahead of the central bank bonanza this week. At the same time Hong Kong stocks tumble deeply, as led by Chinese tech giants. In the currency markets, Australia Dollar is currently leading commodity currencies lower. Yen is the slightly stronger one while European majors are mixed. Much volatility is anticipated ahead considering the number of heavy weight events.

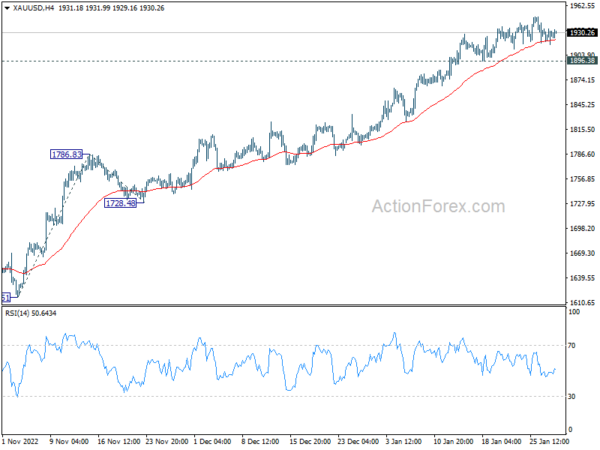

Technically, there is prospect of at least short term rebound in Dollar, considering oversold condition and loss of downside momentum. But some levels will need to be taken out firmly to confirm short term bottoming first, including 1.0765 support in EUR/USD, 1.2252 support in GBP/USD, as well as 131.56 resistance in USD/JPY. At the same time, Gold should also take out 1896.38 support decisively, if the greenback set to rebound with some conviction.

In Asia, Nikkei rose 0.19%. Hong Kong HSI is down -2.39%. China Shanghai SSE is up 0.20%. Singapore Strait Times is down -0.44%. Japan 10-year JGB yield is down -0.0068 at 0.478.

NZ goods exports rose 11% yoy in Dec, imports rose 1.8% yoy

New Zealand goods exports rose 11% yoy or NZD 640m to NZD 6.7B in December. Goods imports rose 1.8% yoy or NZD 125m to NZD 7.2B. Monthly trade deficit narrowed to NZD -475m, comparing to November’s NZD -2180m and expectation of NZD -1750m.

The US leads monthly expect rise, up 40% yoy, while exports to all trade partners were up, including China (up NZD 4.2m), Australia (up 17% yoy), EU up (9.8% yoy), and Japan (up 14% yoy).

The US also leads monthly import rise up 80% yoy. Others were mixed with China down -11% yoy, EU up 3.8% yoy, Australia up 7.0% yoy and Japan up 3.4% yoy.

BoJ Kuroda: Inflation trend likely to gradually accelerate, but takes some more time

BoJ Governor Haruhiko Kuroda told the parliament today, “Japan’s trend inflation is likely to gradually accelerate … but that will take some more time.”

“Uncertainty regarding Japan’s economy is extremely high. It’s therefore important now to support the economy, and create an environment where companies can raise wages,” he said.

Separately, a panel of academics and business executives urged BoJ to make the 2% inflation target a long-term goal, to make monetary policy more flexible.

“The way the BOJ conducts monetary policy must be revamped,” Yuri Okina, a candidate for the next BOJ deputy governor.”By making 2% inflation a long-term goal, the BOJ can make its monetary policy more flexible.”

Fed, BoE and ECB to continue tightening

The main events of the week are rate decisions of Fed, BoE and ECB. Fed is widely expected to slow down tightening to 25bps hike to 4.25-4.50%. At this point, Fed fund futures are pricing in another 25bps hike in March to 4.50-4.75%. Markets will looking affirmation from the statement for such expectations. Beyond that, the path will depend on upcoming data for sure, and then the new economic projections to be delivered in March. But in any case, Fed Chair Jerome Powell should reiterate that interest rate will stay high for as long as necessary to bring inflation back to target, and talk down any case of a rate cut this year.

BoE is expected to raise the Bank Rate by 50bps to 4.00%. Voting will be a main focus as usual as the hawk/dove split was very clear. At the December meeting where a 50bps rate hike was delivered, two members, (Swati Dhingra and Silvana Tenreyro voted for no change) and one (Catherine Mann) voted for 75bps hike. Additionally, BoE will also publish new economic projections. Currently there are expectations that another 25bps rate hike will be delivered in March, and then a pause. Any deviation from such expectation could trigger much volatility in the Pound.

ECB is widely expected to hike the main refinancing rate by 50bps to 3.00%. There were talks that ECB might start slowing down in March, but many officials have come out dismissing that. President Christine Lagarde should reiterate the stance to “stay the course”. But beyond February, all would depend on the new economic projections to be delivered in March.

The economic calendar is also jam-packed with heavy weight data, including US non-farm payrolls, ISM indexes and consumer confidence; Eurozone GDP and CPI; Canada GDP; Swiss KOF and retail sales, Japan industrial production in retail sales; New Zealand employment; China PMIs. Here are some highlights for the week:

- Monday: New Zealand trade balance; Swiss KOF economic barometer; Germany GDP.

- Tuesday: Japan unemployment rate, industrial production, retail sales, consumer confidence, housing starts; Australia retail sales, private sector credit; China official PMIs; France consumer spending, GDP; Germany CPI flash, unemployment; Swiss retail sales; UK M4 money supply, mortgage approvals; Eurozone GDP; Canada GDP; US employment cost, house price index, Chicago PMI, consumer confidence.

- Wednesday: Australia AiG manufacturing; New Zealand employment; Japan PMI manufacturing final; China Caixin PMI manufacturing; Eurozone PMI manufacturing final, CPI flash, unemployment rate; UK PMI manufacturing final; US ADP employment, ISM manufacturing, construction spending, FOMC rate decision.

- Thursday: New Zealand building permits; Australia building approvals; Japan monetary base; Germany trade balance; Swiss SECO consumer climate; BoE rate decision; ECB rate decision; Canada building permits; US jobless claims, non-farm productivity, factory orders.

- Friday: Australia AiG construction; China Caixin PMI services; France industrial production; Eurozone PMI services final; UK PMI services final; US non-farm payroll employment, ISM services.

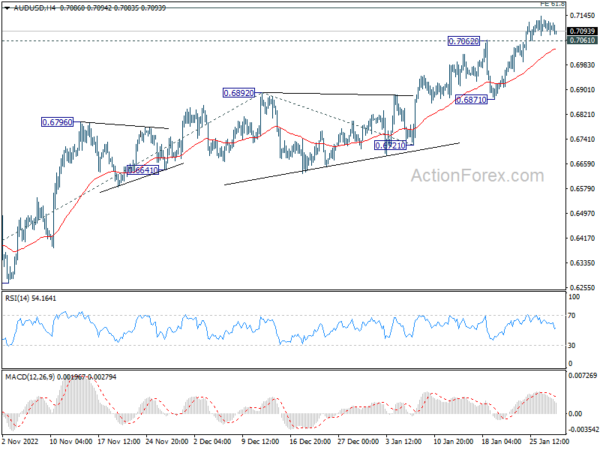

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7085; (P) 0.7107; (R1) 0.7132; More…

Intraday bias in AUD/USD is turned neutral first, as it lost momentum ahead of 61.8% projection of 0.6169 to 0.6892 from 0.6721 at 0.7168. On the downside, break of 0.7061 minor support will indicate short term topping, and turn bias to the downside, for pull back to 0.6871 support. Nevertheless, sustained break of 0.7168 will resume the rise from 0.6169 to 0.7304 fibonacci level.

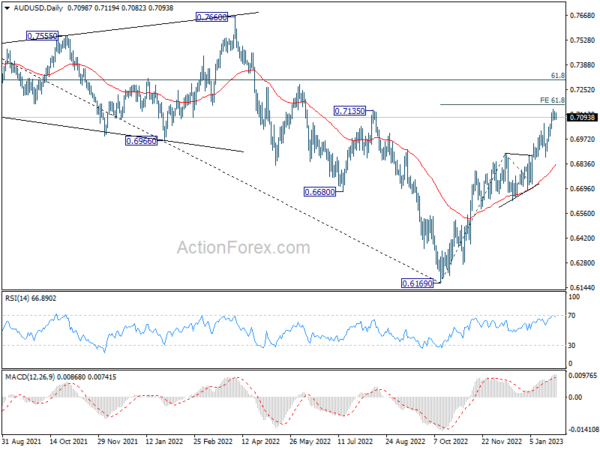

In the bigger picture, corrective decline from 0.8006 (2021 high) should have completed with three waves down to 0.6169 (2022 low). Further rally should be seen to 61.8% retracement of 0.8006 to 0.6169 at 0.7304. Sustained break there will pave the way to retest 0.8006. This will now remain the favored case as long as 0.6721 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Dec | -475M | -1750M | -1863M | -2180M |

| 08:00 | CHF | KOF Leading Indicator Jan | 89.1 | 92.2 | ||

| 09:00 | EUR | Germany GDP Q/Q Q4 P | 0.00% | 0.40% | ||

| 10:00 | EUR | Eurozone Economic Sentiment Jan | 94.6 | 95.8 | ||

| 10:00 | EUR | Eurozone Industrial Confidence Jan | -1.7 | -1.5 | ||

| 10:00 | EUR | Eurozone Services Sentiment Jan | 4.3 | 6.3 | ||

| 10:00 | EUR | Eurozone Consumer Confidence Jan F | -20.9 |