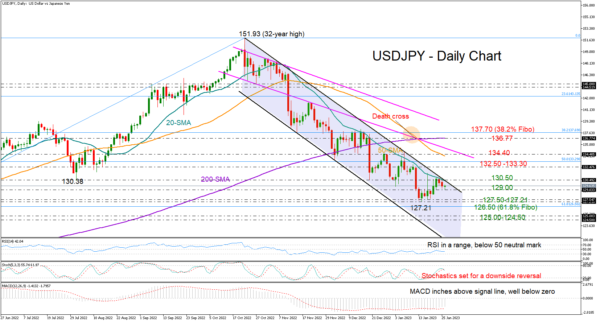

USDJPY faced another rejection at the topline of the four-month-old downward-sloping channel near 131.11, increasing speculation that a new selling wave could start in the short term. The 20-day simple moving average (SMA) was another hurdle.

Monday’s low of 129.00 is currently buffering downside pressures, though the technical signals remain confusing, providing little hope for a bullish breakout. Despite its latest rebound, the RSI keeps hovering within a range below its 50 neutral mark. The stochastic oscillator looks set for a negative reversal, whereas the MACD, although pushing for some recovery, is still well dipped in the negative area.

Meanwhile, the clear bearish SMA crosses keep promoting the negative trajectory in the market.

If the 129.00 base gives way, the bears may push for a downtrend resumption below the previous support area of 127.50-127.21. In this case, the 61.8% Fibonacci retracement of the 114.64 – 151.93 uptrend may attempt to pause the decline near 126.50. If it proves weak, selling pressures may intensify towards the March-April constraining zone of 125.00-124.50, while lower, the price may plummet to meet the channel’s lower boundary seen near 121.50.

In the event the pair exits the channel on the upside at 130.50, closing above the 20-day SMA too, the focus will turn to the 132.50-133.30 bar. There might be another trap nearby, set between the 50-day SMA and the descending line at 135.10. Hence, a sustainable extension above that wall will probably be the key for an advance towards the 200-day SMA and the 38.2% Fibonacci of 137.70.

Summarizing, USDJPY continues to trade within a caution area, facing a bleak short-term outlook. A decisive close above 130.50 is required to reduce negative risks, though only a rally above 134.40 would violate the downward pattern.