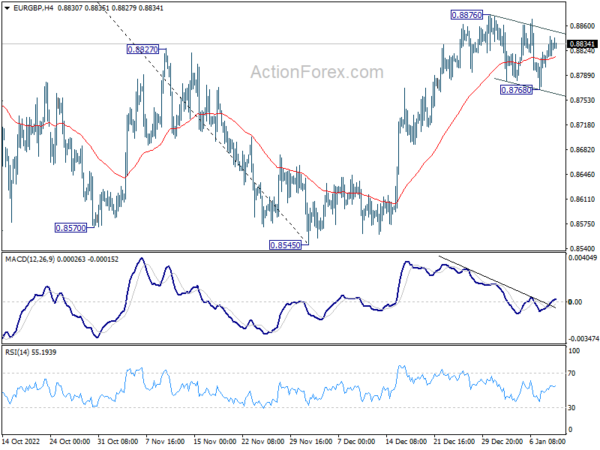

Daily Pivots: (S1) 0.8809; (P) 0.8828; (R1) 0.8854; More…

Intraday bias in EUR/GBP remains neutral for the moment. Corrective pattern from 0.8876 could still extend with another dip. But, further rally is expected as long as 55 day EMA (now at 0.8732) holds. Break of 0.8876 will resume the rise from 0.8545 to 61.8% retracement of 0.9276 to 0.8545 at 0.8997 and possibly above. However, sustained trading below 55 day EMA will bring retest of 0.8545 low instead.

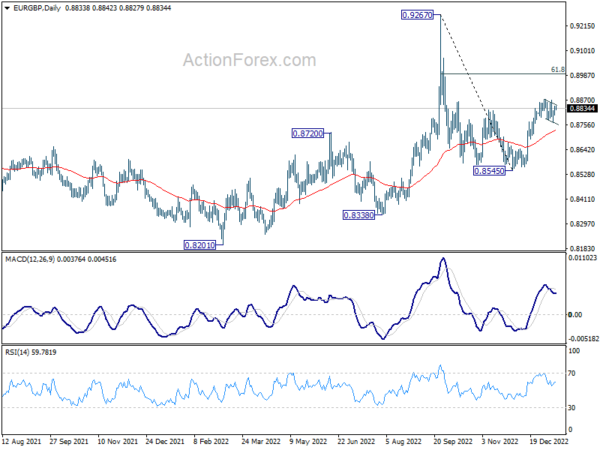

In the bigger picture, outlook is mixed for now as rise from 0.8545 would either be part of the up trend from 0.8201 (2022 low), or just a correction to 0.9267 (2022 high). As long as 55 week EMA (now at 0.8616) holds, the former case is in favor, and break of 0.9267 should be seen next as up trend resumes at a later stage. However, sustained break of 55 week EMA will shift favor to the latter case, for another decline back towards 0.8201.