US 10-year yield rose notably overnight, ending up 0.109 at 3.860. The rally was believed to be triggered by news that China is further exiting pandemic restrictions and travel controls. The move was seen, on the one hand, as a boost to the global economy. On the other hand, Japan, India, Italy and South Korea all said they would be imposing tighter COVID-testing requirements on tourists from China, with concerns on the lack of transparency on infections and variants in the country.

Anyways, 10-year yield’s break of 3.798 resistance argues that the slightly deeper than expected corrective fall from 4.333 has completed at 3.402. The range of the corrective pattern should be set between 3.4/4.3. Further rally is now in favor for the near term. But break of 4.333 is not envisaged until further developments.

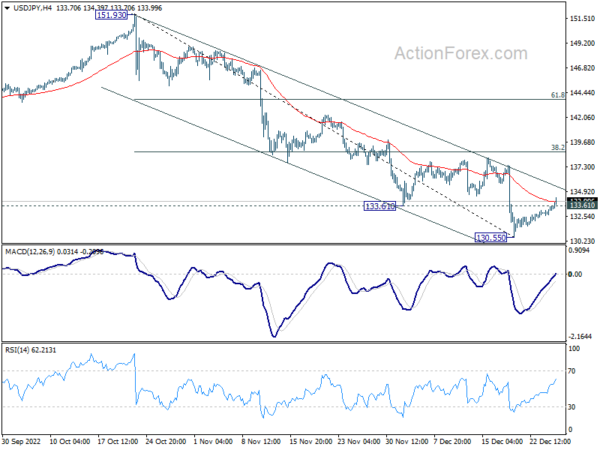

USD/JPY’s break of 133.61 support should confirm short term bottoming at 130.55, on bullish convergence condition in 4 hour MACD. With a little help from the rebound in yields, USD/JPY would rise further towards 38.2% retracement of 151.93 to 130.55 at 138.71.