The markets appear to be back in risk-on mode as seen in major European indexes and US futures. Aussie is recovering notably, followed by Swiss Franc. But New Zealand Dollar is the weakest for the day, followed by Sterling and then Yen. Dollar and Euro are mixed. As for the week, Kiwi is the worst performer for now, followed by Dollar, and the Sterling. yen is still the best performer, followed by Swiss Franc, and then Canadian.

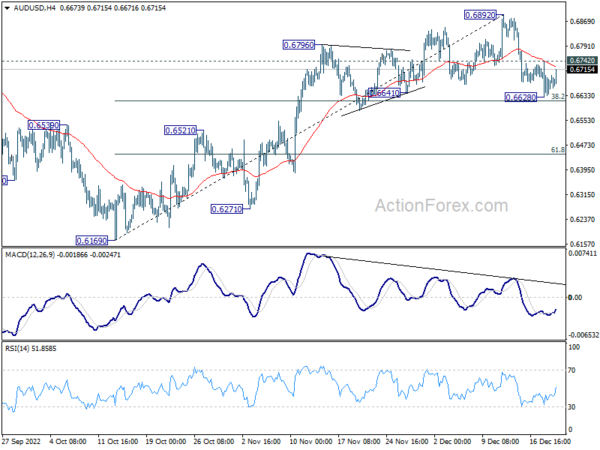

Technically, AUD/USD recovers notably today and focus is back on 0.6742 resistance. Break there will suggest that pull back from 0.6892 has completed at 0.6628, ahead of 38.2% retracement of 0.6169 to 0.6892 at 0.6616. Stronger rise would then be seen back to retest 0.6892 high.

In Europe, at the time of writing, FTSE is up 0.94%. DAX is up 0.96%. CAC is up 1.23%. Germany 10-year yield is down -0.0250 at 2.280. Earlier in Asia, Nikkei dropped -0.68%. Hong Kong HSI rose 0.34%. China Shanghai SSE dropped -0.17%. Japan 10-year JGB yield rose 0.0619 to 0.479.

Canada CPI slowed to 6.8% yoy, but accelerated excluding food and energy

Canada CPI slowed from 6.9% yoy to 6.8% yoy in November. Excluding food and energy, CPI accelerated from 5.3% yoy to 5.4% yoy. On a monthly basis, CPI rose 0.1% mom, much slower than October’s 0.7% mom.

CPI median accelerated from 4.9% yoy to 5.0% yoy. CPI trimmed was unchanged at 5.3% yoy. CPI common, accelerated sharply from 6.3% yoy to 6.7% yoy.

Germany Gfk consumer sentiment rose to -37.8, slowly working its way out of depression

Germany Gfk Consumer Sentiment for January improved from -40.1 to -37.8. In December, economic expectations rose from 17.9 to -10.3. Income expectations rose from -54.3 to -43.4. Propensity to buy rose form -18.6 to -16.3.

“The third increase in a row indicates that consumer sentiment is slowly working its way out of the depression. The light at the end of the tunnel is getting a little brighter”, explains GfK consumer expert Rolf Bürkl.

“The measures taken by the federal government to mitigate skyrocketing energy costs are apparently having an effect. However, it is still too soon to give the all-clear. The recovery of the consumer sentiment, as we are currently experiencing, is still on shaky ground. For example, if the geopolitical situation were to worsen again, leading to significantly higher energy prices, the light at the end of the tunnel would very quickly become dimmer again or even go out altogether.”

Australia leading index consistent with below trend growth well into 2023

Australia Westpac-MI leading index dropped from -0.84% to -0.92% in November. Growth rate was, thus, in negative territory for the fourth consecutive month. The data is consistent with below trend growth well into 2023. Drivers of weakness are the RBA interest rate and commodity prices.

Westpac expects another 25bps rate hike by RBA in February, “give the outlook for wages; inflation and economic growth”. It expects wages and inflation challenges to persist through early months of 2023, requiring “further increase of 25bps in both March and May.

IMF: BoJ YCC adjustment a sensible step

Ranil Salgado, the IMF’s mission chief to Japan, said that “with uncertainty around the inflation outlook, the Bank of Japan’s adjustment of yield curve control settings is a sensible step including given concerns about bond market functioning.”

“Providing clearer communications on the conditions for adjusting the monetary policy framework would help anchor market expectations and strengthen the credibility of the Bank of Japan’s commitment to achieve its inflation target,” he said.

BoJ announced to raise the cap on 10-year JGB yield from 0.25% to 0.50% yesterday, to ” correct distortions in the yield curve”.

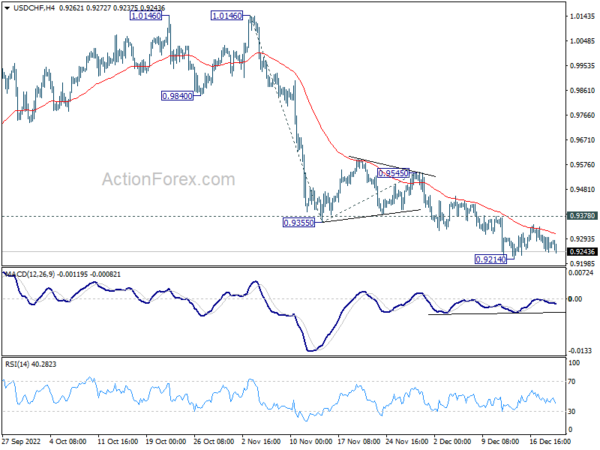

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9233; (P) 0.9271; (R1) 0.9299; More…

USD/CHF dips mildly today but stays in range above 0.9214. Intraday bias stays neutral for the moment. Further decline is in favor with 0.9378 resistance intact. On the downside, break of 0.9214 will resume the fall and target 61.8% projection of 1.0146 to 0.9355 from 0.9545 at 0.9056. However, break of 0.9378 resistance will indicate short term bottoming and turn bias back to the upside for 0.9545 resistance instead.

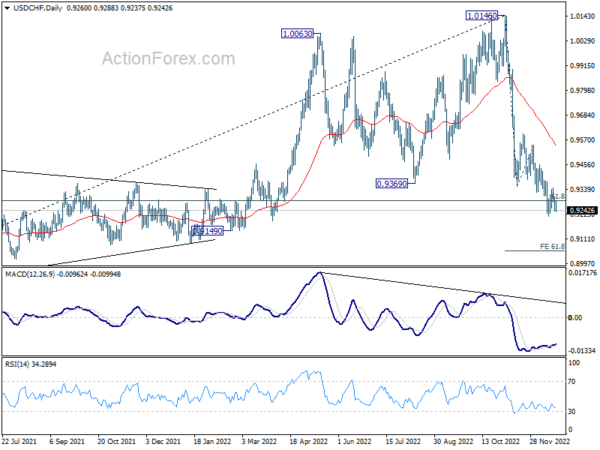

In the bigger picture, rise from 0.8756 (2021 low) has completed at 1.0146, well ahead of 1.0342 long term resistance (2016 high). Based on current downside momentum, fall from 1.0146 might be a medium term down trend itself. Sustained break of 61.8% retracement of 0.8756 to 1.0146 at 0.9287 will pave the way to 0.8756. In any case, risk will stay on the downside as long as 0.9545 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Nov | -1863M | -2062M | -2129M | -2298M |

| 23:30 | AUD | Westpac Leading Index Nov | -0.10% | -0.10% | 0.00% | |

| 07:00 | EUR | Germany Gfk Consumer Confidence Jan | -37.8 | -38 | -40.2 | -40.1 |

| 07:00 | GBP | Public Sector Net Borrowing (GBP) Nov | 21.2B | 10.3B | 12.7B | 13.4B |

| 13:30 | CAD | CPI M/M Nov | 0.10% | 0.00% | 0.70% | |

| 13:30 | CAD | CPI Y/Y Nov | 6.80% | 6.70% | 6.90% | |

| 13:30 | CAD | CPI Median Y/Y Nov | 5.00% | 4.90% | 4.80% | 4.90% |

| 13:30 | CAD | CPI Trimmed Y/Y Nov | 5.30% | 5.30% | 5.30% | |

| 13:30 | CAD | CPI Common Y/Y Nov | 6.70% | 6.10% | 6.20% | 6.30% |

| 13:30 | USD | Current Account (USD) Q3 | -217B | -222B | -251B | |

| 15:00 | USD | Existing Home Sales Nov | 4.20M | 4.43M | ||

| 15:00 | USD | Consumer Confidence Dec | 101 | 100.2 | ||

| 15:30 | USD | Crude Oil Inventories | 2.5M | 10.2M |