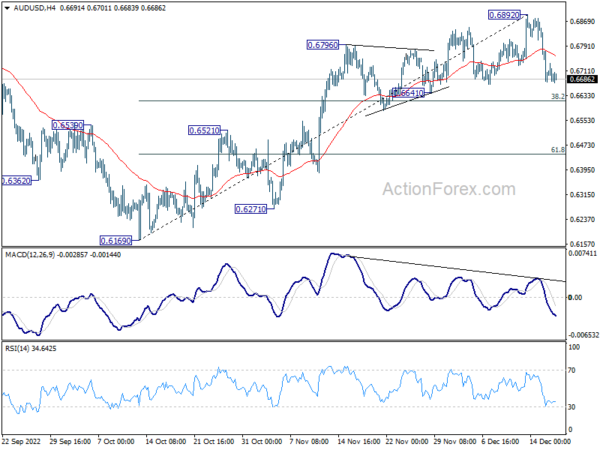

A short term top should be formed at 0.6892 last week after the deep decline from there. Initial bias in AUD/USD remains on the downside this week for 38.2% retracement of 0.6169 to 0.6892 at 0.6616. Sustained break there will suggest rejection by 0.66871 fibonacci level. Deeper fall should then be seen to 61.8% retracement at 0.6445. For now, risk will stay mildly on the downside as long as 0.6892 resistance holds, in case of recovery.

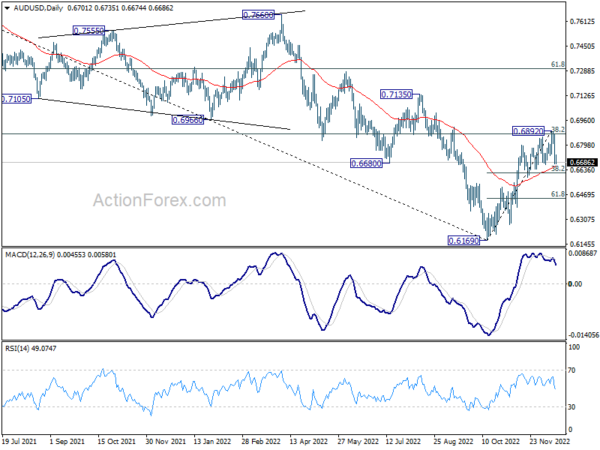

In the bigger picture, it’s still unsure if price actions from 0.6169 medium term bottom are developing into a corrective pattern or trend rejection. Rejection by 38.2% retracement of 0.8006 to 0.6169 at 0.6871 will maintain medium term bearishness for another fall through 0.6169 at a later stage. However, firm break of 0.6871, and sustained trading above 55 week EMA (now at 0.6909) will raise the chance of the start of a bullish up trend.

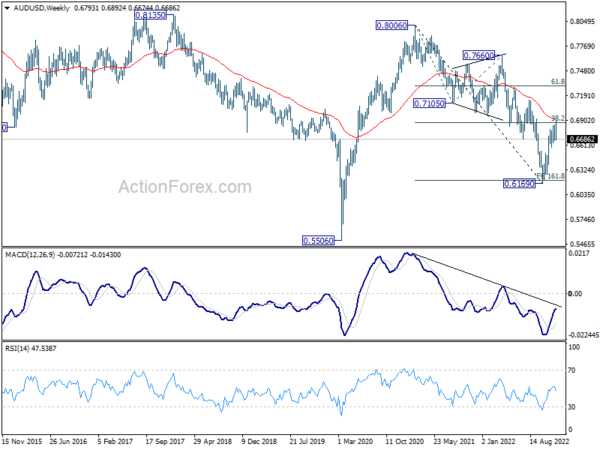

In the long term picture, the down trend from 0.8006 could still be seen as a corrective move, considering that it failed to break through 161.8% projection of 0.8006 to 0.7105 from 0.7660 at 0.6202 decisively. Strong rebound from current level will keep long term outlook neutral first. However, sustained break of 0.6202 will open up deep fall to retest 0.5506.