Fed Review: FOMC Signals Fed Funds above 5% in 2023

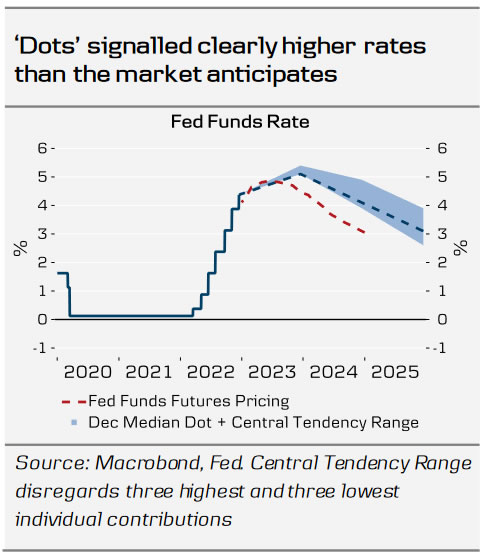

- The US Federal Reserve hiked the Fed Funds Rate by 50bp as widely anticipated. The updated ‘dots’ signal policy rates above 5% in 2023.

- EUR/USD recovered near pre-meeting levels despite the hawkish rate projections, as Powell left the door open for less hikes if warranted by data.

- Resilient consumption, tight labour markets and still high underlying price pressures support the case for further hikes in Q1. We maintain our forecast of 50bp in February and 25bp in March unchanged.

Although 17 out the 19 individual estimates saw Fed Funds Rate above 5% in 2023, the initial hawkish market reaction faded over the press conference, as Powell left the door open for more modest hikes, if warranted by the weaker incoming data. While we did see decent curve flattening and a set-back to equities, the USD gain was still fairly modest.

That said, Powell emphasized that labour market conditions still remain ‘extremely’ tight, and that Fed would be closely following core services ex. shelter inflation for gauging the underlying price pressures. As we highlighted in Global Inflation Watch – Mixed inflation signals in November, 14 December, the most wage-sensitive sectors continued to signal even accelerating inflation pressures in November, despite the overall soft CPI print.

Communicating inflation developments will become increasingly challenging next year, as the negative base effects from energy, used cars and health insurance combined with the delayed development in shelter prices will mask the broader underlying inflation.

Powell highlighted, that the current wage data showed few signs progress towards returning to levels better consistent with Fed’s 2% target. We agree, and while markets tend to focus more on the short-term inflation developments, the key risk for Fed is that even if inflation comes down sharply next year, it will not come down for good. As of now, average hourly earnings, JOLTs job openings and employment cost index all point towards inflation remaining closer to 4% than 2%. Powell also once again emphasized the asymmetric balance of risks favouring hiking rates more, rather than less: recession can be dealt with by easing financial conditions, but CBs have few good tools against stagflation.

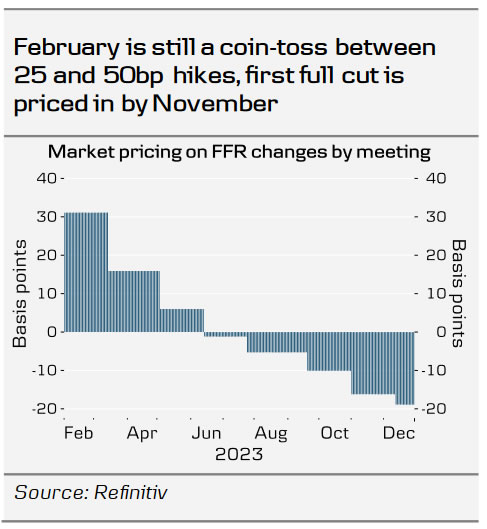

For now, Fed’s focus has shifted from the near-term hiking pace to determining how long policy needs to be maintained restrictive. The entire real interest rate curve is now clearly on positive levels, which suggests that as long as inflation expectations remain stable, Fed does not need to hike rates much higher than what has now been communicated. The lower CPI prints give a sense that Fed is moving to the right direction. We maintain our call for terminal rate at 5.00-5.25%, well in line with the new projections.

While Powell noted that Fed looks through short-term volatility in financial conditions, we think the recent easing supports the case for inflation risks still being tilted to the upside. We continue to see modest near-term upside risks to USD rates, and forecast EUR/USD moving lower in 2023, as broad USD strength plays a key role in maintaining financial conditions restrictive.