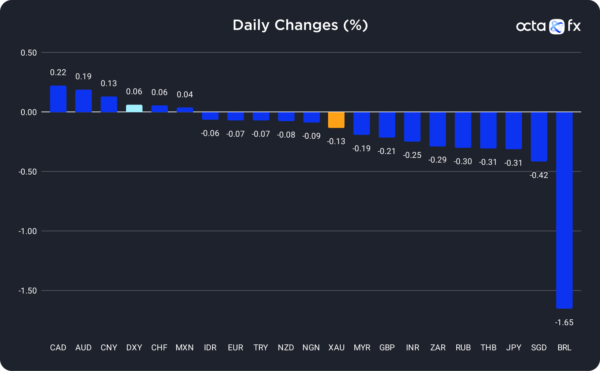

On Friday, the Canadian dollar was the best-performing currency among the 20 global currencies we track, while the Brazilian real showed the weakest results. The Chinese yuan was the leader among emerging markets, while the Japanese yen underperformed among majors.

In focus today

U.S. Dollar Index

The U.S. Dollar Index (DXY) slightly strengthened on Friday’s low liquidity trading.

Possible effects for traders

The Friday session was calm following the U.S. Thanksgiving. This morning DXY reached 106.500 as investors turned to the safe-haven instrument on the back of anti-lockdown protests in China. Now, the market will focus on the Federal Reserve (Fed) Chairman Jerome Powell’s speech on Wednesday that may support the greenback. It will come out a week after the FOMC Minutes showed the regulator’s willingness to adopt a more dovish policy. Simon Harvey, a senior FX analyst at Monex Europe, commented that ‘Powell’s first comments since the 2 November meeting will be crucial. If he doesn’t push back on the recent loosening in financial conditions, the dollar’s near-term support may slip.’

XAUUSD

XAUUSD traded flat and closed at 1,756.06.

Possible effects for traders

The gold price slightly changed following the U.S. dollar movements on Friday. This morning, XAUUSD decreased to 1,746 as the firm greenback pushed the pair lower. Jerome Powell’s speech on Wednesday and the anticipated NFP data on Friday will influence gold’s price this week. XAUUSD will likely continue trading within the bearish sentiment. If it drops below 1,745, the pair can target the support at 1,736.

EURUSD

EURUSD fluctuated during the day but closed almost unchanged.

Possible effects for traders

The pair was turbulent as the European Central Bank (ECB) officials disagreed on the monetary policy outlook. Chief economist Philip Lane and board member Isabel Schnabel gave controversial opinions on whether the ECB should slow down its rate increases. The regulator will hold the next meeting in mid-December, and traders are discussing what are the ECB’s next steps will be. EURUSD fluctuated from 1.03550 to 1.04300, and the pair will likely continue its sideways trading today.

Other events

XTIUSD

U.S. crude oil declined for the third consecutive week, closing below 77.00 on Friday.

Possible effects for traders

XTIUSD was primarily bullish, reaching the resistance at 80.00. However, news about record-high COVID-19 cases in China sent the market into a huge downwards move, and the pair broke below 77.35. Moreover, crude oil consumption reached a seven-month low in China, signalling the country’s demand will not recover soon. At the same time, G7 countries cancelled the scheduled meeting on the Russian oil price cap, and XTIUSD found support at 76.70 by Friday night. The pair dropped slightly during the Asian session today and consolidated at 74.20 due to the weekend’s huge anti-lockdown protests in China. Then the price rebounded but remained heavily oversold. Overall, traders will stay cautious ahead of the G7 meeting this week, which can resolve political tensions.