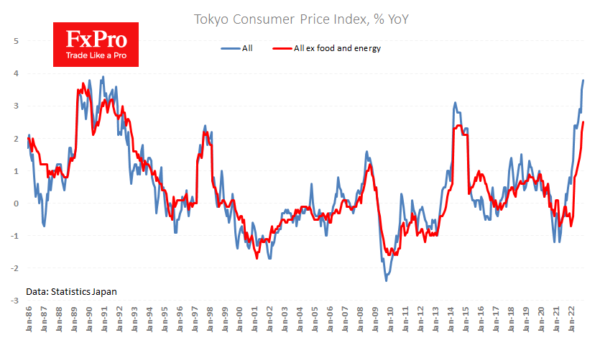

Tokyo’s headline inflation estimates put the annual price growth rate at 3.8% in November against 3.5% a month earlier and the 3.6% expected. The core index, which excludes food and energy prices, accelerated from 2.2% to 2.5% (the highest since 1992), suggesting that nationwide inflation continues to accelerate beyond the 2% target.

Nevertheless, a country accustomed to deflation is in no hurry to let go of its habits. Rising prices only lead to a temporary activity drop rather than causing consumers to run to the shops for fear that tomorrow will be even more expensive. Household spending rose 2.3% YoY in September, and wages rose by 2.1%.

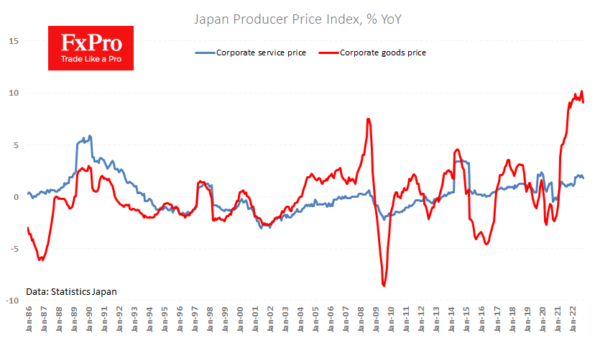

And while Domestic Corporate Product prices rose 0.6% m/m and 9.1% y/y in October, the Bank of Japan reported today that the Corporate Services Price Index rose only 1.8% y/y vs 2.1% a month earlier. Annual rate increases in both indices have stalled, showing the first signs of a reversal to a slowdown.

It may take 2 to 4 months before the stabilisation of producer prices spreads to consumer price inflation. Nevertheless, we are already getting the first early signs, with Japan not having implemented any policy tightening but benefiting from globally lower commodity prices and a slowdown in economic activity.

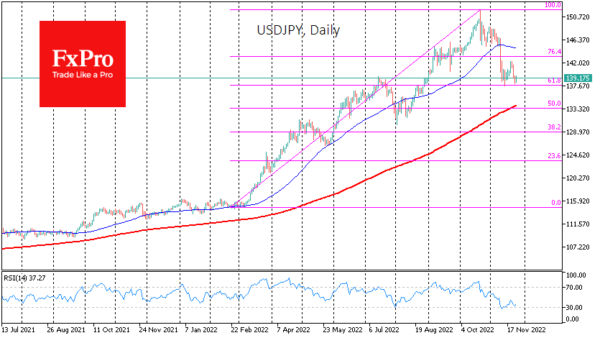

Also, in November, the Japanese finance ministry intervened, reinforcing the effect of the weaker dollar against other main competitors (euro, pound, franc). The appreciation of the domestic currency should further reduce domestic inflationary pressures. However, the increasing interest rate differential between the yen and other reserve currencies raises doubts about whether the yen will continue to rise.

The critical question is whether global financial markets have entered the path of normalisation. If so, the primary trend in the months or years to come could be the carry trade strategy forgotten in 2008, where a low-interest rate currency funds purchases of a high-interest rate currency. Traders capitalise on the difference in overnight rates and the general upward trend of the high-yielding currencies.

In such a scenario, the pullback of the USDJPY from the peak of 152 in October to the current 139 should be seen as a correction before a new growth impulse. Suppose the world growth will lose momentum sharply and markets regain appetite for defensive assets. In that case, a rapid unwinding of carrying trade positions could deepen the USDJPY correction to 125 by the end of March next year.