US non-farm payroll employment data is the major focus of the day. Markets are expecting the job market to grow 200k in October. Unemployment rate is expected to tick up from 3.5% to 3.6%.

Looking at related data, ADP report showed solid 239k growth in private employment. ISM manufacturing employment also improved from 48.7 to 50.0. However, ISM services employment dropped notably from 53.0 to contractionary reading of 49.1. Four-week moving average of initial jobless claims rose slightly from 207k to 219k. The set of data overall suggests that job market should remain tight.

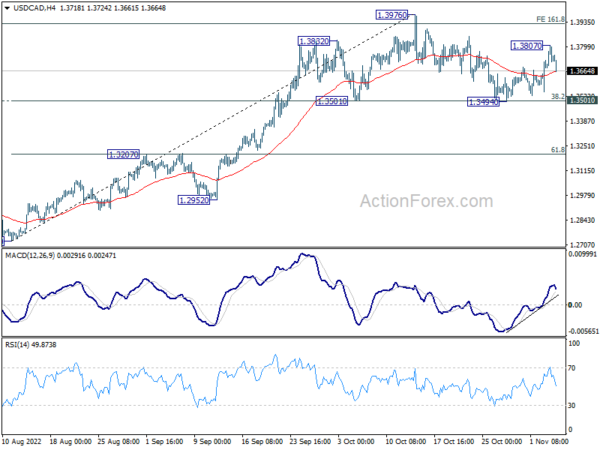

As per market reaction, USD/CAD would be an interesting one to watch considering that Canada will also release job data. For now, near term outlook stays bullish for another rise through 1.3976 to resume larger up trend. However, break of 1.3494/3501 support will complete a head and should top pattern (ls: 1.3832; h:1.3976; rs: 1.3807). In the case, deeper correction would likely be seen back to 1.3207 resistance turned support, before USD/CAD find renewed buying.