Quick update: Little reactions to better than expected ISM manufacturing, which rose to 60.8 in September. ISM price paid also rose to 71.5.

Sterling weakens sharply today as pressured by weaker than expected manufacturing data. Indeed, the Pound performs even worse than Euro, which is troubled by the political tensions in Spain. And, in spite of the early selloff, EUR/USD is holding above last week’s low at 1.1716 and no follow through selling is seen yet. Meanwhile, commodity currencies are trading broadly higher, recovering part of last week’s loss. In other markets, gold extends recent fall and dips to as low as 1273.7 so far. WTI crude oil also declines sharply and breaches 50.5, comparing to last week’s high at 52.86.

Spanish markets rocked by Catalonia referendum

Despite government’s violent intervention, Catalonia’s referendum took place and resulted in an overwhelmingly "yes" to seceding the region from the rest of Spain. Peripheral European markets’ reactions are rather negative to the outcome. Spanish equities fell with the benchmark IBEX index losing over -1% in the morning session. Treasuries fell, sending yields higher. The 10-year Spanish government bond yields soared to a 2.5-month high of 1.68%. Spread between Spanish-German 10 yields rose to the highest in 3 weeks. Last Friday, S&P affirmed Spain’s sovereign credit rating at BBB+/A-2 with a positive outlook. Despite optimism over the economic outlook, the rating agency warned of the current tensions between the central government and the regional government of Catalonia. It suggested that rating outlook would be revised to "stable from "positive" if the tensions "escalated and started weighing on business confidence and investment, leading to less predictable future policy responses". More in Government Misstep Exacerbates Political Instability in Spain.

UK PMI manufacturing missed expectations

UK PMI manufacturing dropped to 55.9 in September, down from 56.7, missed expectation of 56.2. Markit noted that "the growth slowdown in September is a further sign that momentum is being lost across the broader UK economy." And, "on balance, the continued solid progress of manufacturing and export growth is unlikely to offset concerns about a wider economic slowdown, but the upward march of price pressures will add to expectations that the Bank of England may soon decide that the inflation outlook warrants a rate hike."

Also released from Europe, Swiss retail sales dropped -0.2% yoy in August, SVME PMI rose to 61.7 in September Italy PMI manufacturing was unchanged 56.3 in September. Eurozone PMI manufacturing was revised down by 0.1 to 58.1 in September. Eurozone unemployment rate was unchanged at 9.1% in August.

Tankan large manufacturers index hit decade high

In Japan, the quarterly Tankan survey painted a positive picture for the economy. The large manufacturers index jumped to 22 in Q3, up from 17 and beat expectation of 18. That’s also the highest reading in a decade since 2007. Large manufacturers outlook rose to 19, up from 15 and beat expectation of 16. That is seen as a result from a weaker Yen, that helped exports. However, non-manufacturing index was unchanged at 23, missing expectation of 24. Non-manufacturing outlook improved to 19, missing expectation of 21. All industrial capex rose 7.7%, slowed from 8.0% and missed expectation of 8.4%. The overall upbeat data could provide Prime Minister Shinzo Abe a mild lift going into the snap election on October 22.

China PBoC cut RRR, PMI upbeat

In China, PBoC announced targeted cuts to the reserve requirement ratio (RRR) ranging from 0.5% to 1.5%. The moves should apply to the majority of banks (90% of city commercial banks, and 95% of rural commercial lenders) in order to spur lending to small firms. This is the first reduction in RRR since February 2016. An RRR cut is regarded as an accommodative monetary policy in nature and the PBoC’s move is estimated to release around RMB300-400B to the market. But the central bank claimed that it has not derailed from the prudent and neutral policy stance.

The official manufacturing PMI added 0.7 points to 52.4 in September, highest since April 2012. Looking into the details, the new orders index gained 1.7 points to 54.8 while the new export orders index added 0.9 point to 51.3. The input prices index jumped 3.1 points to 68.4, highest since December 2016. The Caixin manufacturing PMI, however, slipped -0.6 points to 51 for the month. On the non-manufacturing sector, official PMI added 2 points to 55.4, highest since May 2014.

GBP/USD Mid-Day Outlook

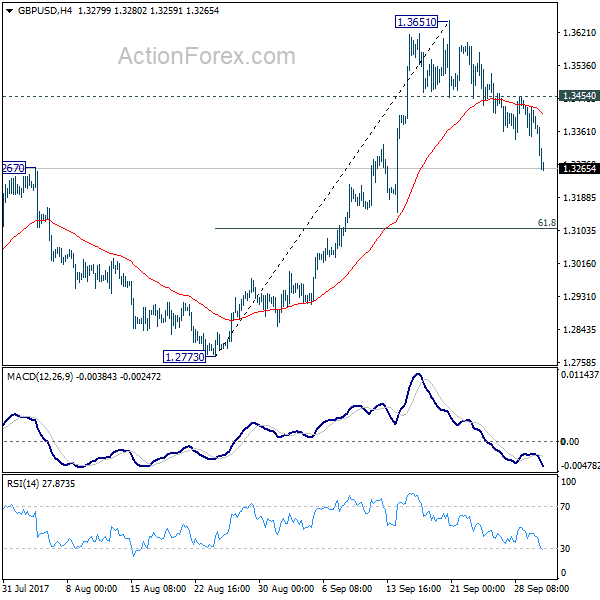

Daily Pivots: (S1) 1.3347; (P) 1.3395; (R1) 1.3441; More….

Intraday bias in GBP/USD remains on the downside for the moment as fall from. Deeper decline would be seen to 61.8% retracement of 1.2773 to 1.3651 at 1.3108. On the upside, break of 1.3454 minor resistance is needed to signal completion of the decline. Otherwise, near term outlook remains mildly bearish in case of recovery.

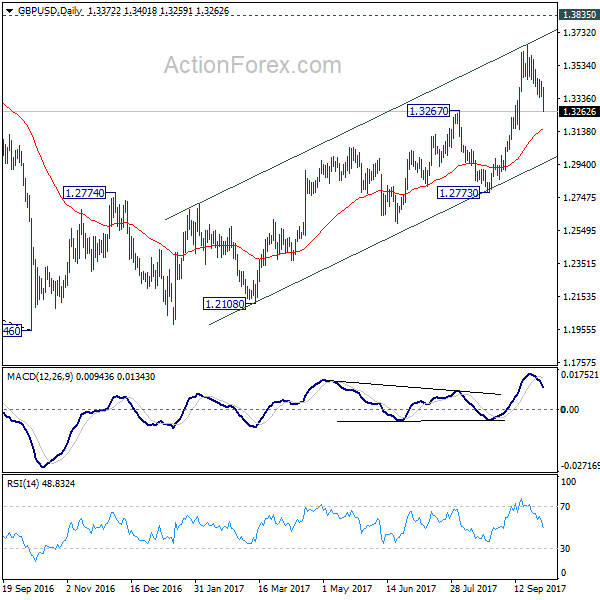

In the bigger picture, current development argues that the long term trend in GBP/USD has reversed. That is, a key bottom was formed back in 1.1946 on bullish convergence condition in monthly MACD. Current rise from 1.1946 will target 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466 next. In any case, medium term outlook will now stay bullish as long as 1.2773 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Tankan Large Manufacturers Index Q3 | 22 | 18 | 17 | |

| 23:50 | JPY | Tankan Large Manufacturers Outlook Q3 | 19 | 16 | 15 | |

| 23:50 | JPY | Tankan Non-Manufacturing Index Q3 | 23 | 24 | 23 | |

| 23:50 | JPY | Tankan Non-Manufacturing Outlook Q3 | 19 | 21 | 18 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q3 | 7.70% | 8.40% | 8.00% | |

| 23:50 | JPY | Tankan Small Mfg Index Q3 | 10 | 8 | 7 | |

| 23:50 | JPY | Tankan Small Mfg Outlook Q3 | 8 | 6 | 6 | |

| 23:50 | JPY | Tankan Small Non-Mfg Index Q3 | 8 | 7 | 7 | |

| 23:50 | JPY | Tankan Small Non-Mfg Outlook Q3 | 4 | 2 | 2 | |

| 00:00 | AUD | TD Securities Inflation M/M Sep | 0.30% | 0.10% | ||

| 00:30 | JPY | PMI Manufacturing Sep F | 52.9 | 52.6 | 52.6 | |

| 07:15 | CHF | Retail Sales (Real) Y/Y Aug | -0.20% | 0.50% | -0.70% | |

| 07:30 | CHF | SVME PMI Sep | 61.7 | 60.5 | 61.2 | |

| 07:45 | EUR | Italy Manufacturing PMI Sep | 56.3 | 56.8 | 56.3 | |

| 07:50 | EUR | France Manufacturing PMI Sep F | 56.1 | 56 | 56 | |

| 07:55 | EUR | Germany Manufacturing PMI Sep F | 60.6 | 60.6 | 60.6 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Sep F | 58.1 | 58.2 | 58.2 | |

| 08:30 | GBP | PMI Manufacturing Sep | 55.9 | 56.2 | 56.9 | 56.7 |

| 09:00 | EUR | Eurozone Unemployment Rate Aug | 9.10% | 9.00% | 9.10% | |

| 13:30 | CAD | Canada Manufacturing PMI Sep | 55 | 54.6 | ||

| 13:45 | USD | Manufacturing PMI Sep F | 53.1 | 53 | 53 | |

| 14:00 | USD | ISM Manufacturing Sep | 60.8 | 58 | 58.8 | |

| 14:00 | USD | ISM Prices Paid Sep | 71.5 | 64 | 62 | |

| 14:00 | USD | Construction Spending M/M Aug | 0.50% | 0.40% | -0.60% |