The majority of Dollar bulls appear to be staying on the sideline today. Despite earlier rally attempt, the greenback starts to pare back some gains into US session. US futures are also trading flat in very tight range. Investors are holding their bet ahead of a wave of speeches of central bankers, and more importantly, US CPI data to be featured later in the week. Sterling is taking European majors higher after solid job data. Commodity currencies are digesting recent losses.

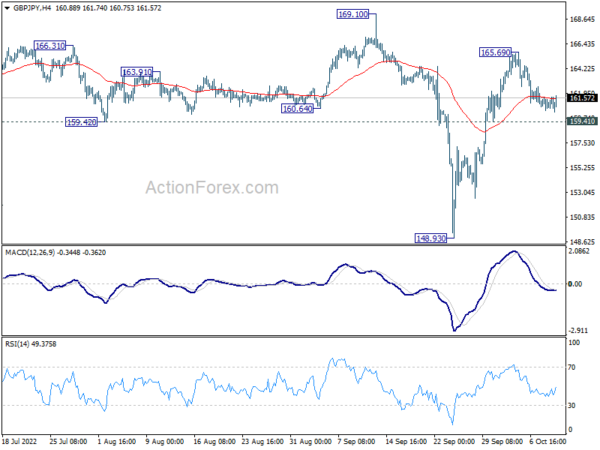

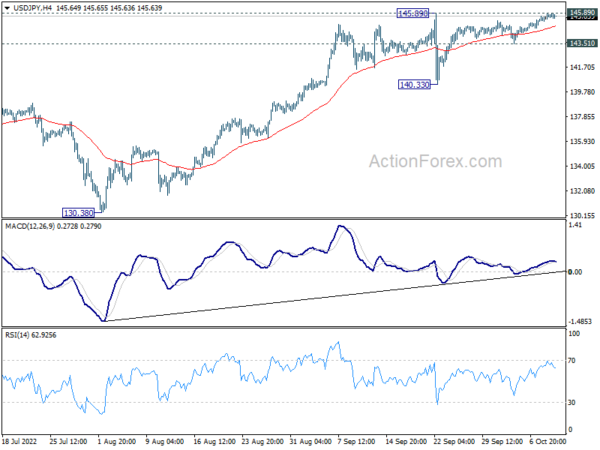

Technically, both EUR/JPY and GBP/JPY are holding above minor support levels of 140.77, 159.41 respectively, despite this week’s retreats. As long as these levels hold, further rise could be seen to retest recent highs at 145.62 and 169.10, before another fall. The interesting part is, if EUR/JPY and GBP/JPY do rebound, what would be the corresponding action in USD/JPY? A break through 145.89 high even with the risk of intervention by Japan?

In Europe, at the time of writing, FTSE is down -0.44%. DAX is down -0.30%. CAC is down -0.01%. Germany 10-year yield is down -0.0164 at 2.330. Earlier in Asia, Nikkei dropped -2.64%. Hong Kong HSI dropped -2.23%. China Shanghai SSE rose 0.19%. Singapore Strait Times dropped -0.08%. Japan 10-year JGB yield rose 0.0014 to 0.255.

UK payrolled employment rose 69k in Sep, unemployment rate dropped to 3.5% in Aug

UK payrolled employment rose 69k in September, or 0.2% mom, to 29.7m. Total growth over the 12-month period was 714k. Median monthly pay rose 6.3% yoy to GBP 2131.

In the three-month period to August, unemployment rate dropped to 3.5%, down -0.3% from the previous three-month period. Employment rate also dropped -0.3% to 75.5%. Economic inactivity rate rose 0.6% to 21.7%. Totally weekly hours dropped -0.4% to 1046m.

Average earnings excluding bonus rose 5.4% 3moy in August, up from 5.2%. Average earnings including bonus rose 6.0% 3moy, up from 5.5% 3moy.

Japan foreign currency deposits up 8.3% since start of the year

Accord to latest BoJ data, foreign currency deposits at domestic banks rose the JPY 26.58T at the end of August, up 8.3% since the start of 2022. The increase in deposits in the eight month period was also the highest since 2015.

The surge could partly be explained by Yen’s depreciation. Yet, the flow into foreign currencies could also be seen as a factor contributing to the persistent decline in Yen’s exchange rate.

Japan Suzuki: Will take appropriate action on excessive Yen moves

Japanese Finance Minister Shunichi Suzuki reiterated today, “we will take appropriate action if there are any excessive moves” in Yen’s exchange rate. The comment came as Yen threatens to decline further towards the lowest level since 1998 again.

Suzuki also said, Japan is closely watching current FX moves with a “strong sene of urgency”. He planned to explain the stance on intervention at G20 meeting. He said that Japan have gained “certain understanding” from the US regarding intervention.

Australia Westpac consumer sentiment dropped to 83.7, RBA averted a much bigger fall

Australia Westpac Consumer Sentiment Index dropped -0.9% mom to 83.7 in October. Westpac said the index remains in “deeply pessimistic territory”, at a level comparable to the lows “briefly reached during the pandemic”, and during the Global Financial Crisis.

It added RBA’s smaller than expected 25bps rate hike “averted a much bigger fall” in sentiment. Sentiment amongst those sampled before the RBA decision showed a “depressing” 77.4 index read. But the post RBA “relief rebound” is “unlikely to be repeated in future months”.

Westpac expects four more consecutive 25bps rate hikes at RBA’s November, December, February and March meetings.

Australia NAB business conditions rose to 25, confidence dropped to 5

Australia NAB Business Confidence dropped from 10 to 5 in September. Business Conditions rose from 22 to 25. Trading conditions rose from 29 to 38. Profitability conditions was unchanged at 19. Employment conditions dropped from 17 to 16.

“Conditions are now higher than their pre-COVID peak, which shows just how strong demand is at present,” said NAB Chief Economist Alan Oster. “The current level of conditions are only exceeded by the post-lockdown surge in early 2021. Clearly, consumers are still finding a way to keep spending, with the very strong labour market, savings buffers and a broader post-pandemic recovery all playing a role.”

“Confidence eased in the month but is still around the long-run average in the history of the survey,” said Oster. “The confidence index has been volatile recently but is clearly a little lower than it was early in the year when the passing of the Omicron wave was providing a strong reason for optimism. Still, businesses are far from pessimistic.”

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 145.30; (P) 145.55; (R1) 145.97; More…

Intraday bias in USD/JPY remains neutral for the moment. On the upside, firm break of 145.89 will resume larger up trend to 147.68 long term resistance. On the downside, break of 143.51 minor support will turn bias back to the downside to 140.33 support. But overall outlook will stay bullish as long as 139.37 resistance turned support holds.

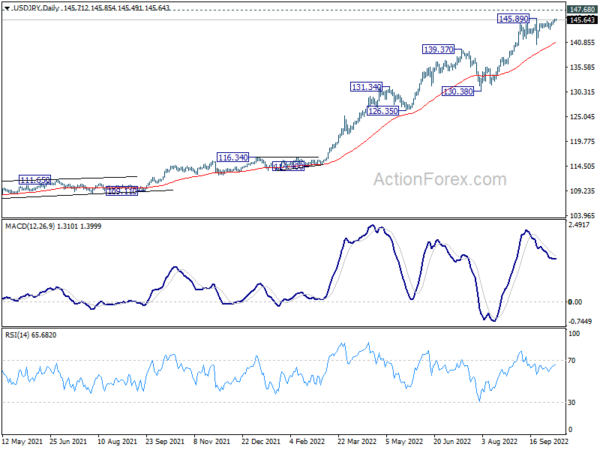

In the bigger picture, up trend from 101.18 is still in progress, as part of the whole up trend from 75.56 (2011 low). Further rise should be seen to 147.68 (1998 high). For now, break of 130.38 support is needed to be the first indication of medium term topping. Otherwise, outlook will stay bullish even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Like-For-Like Retail Sales Y/Y Sep | 1.80% | 0.50% | ||

| 23:30 | AUD | Westpac Consumer Confidence Oct | -0.90% | 3.90% | ||

| 23:50 | JPY | Current Account (JPY) Aug | -0.53T | -0.47T | -0.63T | |

| 00:30 | AUD | NAB Business Confidence Sep | 5 | 10 | ||

| 00:30 | AUD | NAB Business Conditions Sep | 25 | 20 | ||

| 06:00 | GBP | Claimant Count Change Sep | 25.5K | 4.2K | 6.3K | 1.1K |

| 06:00 | GBP | ILO Unemployment Rate (3M) Aug | 3.50% | 3.60% | 3.60% | |

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y Aug | 5.40% | 5.30% | 5.20% | |

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y Aug | 6% | 5.90% | 5.50% | |

| 08:00 | EUR | Italy Industrial Output M/M Aug | 2.30% | 0.20% | 0.40% | 0.50% |