Dollar weakens pare gains as markets are heading to weekly close. In particular, Swiss Franc has overtaken Dollar’s place as the strongest one for the week. Economic data from US are providing little boost for the greenback. Instead, tamer than expected inflation is weighing mildly on Dollar. And traders should be taking profit at quarter end, and ahead of next week’s employment data. Meanwhile, some more time is needed to reassess the impact of US President Donald Trump’s tax plan, before traders take a more decisive stance. US personal income rose 0.2% in August, spending rose 0.1%, in line with consensus. Headline PCE was unchanged at 1.4% yoy while core CPI slowed to 1.3% yoy. Both were below expectations. From Canada, GDP rose 0.0% in July, below expectation of 0.1% mom. IPPI rose 0.3% while RMPI rose 1.0% mom in August.

BoE Carney affirms rate hike in "relatively near term"

BoE Governor Mark Carney said in a BBC radio interview that "if the economy continues on the track that it’s been on, and all indications are that it is, in the relatively near term we can expect that interest rates would increase somewhat." That is affirming to the view that BoE will hike in the next MPC meeting in November. Carney also noted that there is a "speed limit" for UK’s growth. Brexit will be as immigration slows and investment in capacity being held off, the economy will not be able to grow as fast as before, without pushing up inflation. And, "if the speed limit has slowed and we’re in a position where we’ve used up a lot of the capacity in this economy … it means that we should be thinking about, and we are open about this, we’re thinking about taking our foot a bit off the accelerator."

Released from UK, Q2 GDP growth was finalized at 0.3% qoq, 1.5% yoy. Current account deficit widened to GBP -16.9b in Q2. Mortgage approvals dropped to 67k in August. M4 money supply rose 0.9% mom in August. Index of services rose 0.5% 3mo3m in July. Gfk consumer sentiment improved to -9 in September.

Macron won Merkel backing on EU reforms

In Eurozone, German Chancellor Angel Merkel hailed French President Emmanuel Macron’s proposals on EU reforms. She said that Macron’s ideas could be the foundation for an "intense" Franco-German cooperation on the future of Europe. And, Merkel noted that "as far as the proposals were concerned, there was a high level of agreement between German and France. We must still discuss the details, but I am of the firm conviction that Europe can’t just stay still but must continue to develop." Meanwhile, Macron said after an EU summit dinner that "we’re all convinced Europe must move ahead faster and stronger, for more sovereignty, more unity and more democracy."

Released from Eurozone, CPI was unchanged at 1.5% yoy in September, below expectation. Core CPI dropped to 1.1% yoy in September, below expectation of 1.2%. German unemployment dropped -23k in September. German unemployment rate dropped to 5.6%, hitting the lowest level since the data series began in January 1992. German retail sales dropped -0.4% mom in August. Also from Europe, Swiss KOF leading indicate rose to 105.8 in September.

One BoJ member called for expanding stimulus

Summary of opinions in the September BoJ meeting showed that one policymaker called for expanding monetary stimulus. Meanwhile, all other nine-members were in consensus to maintain the current program. The dovish member was quoted saying that "it’s necessary to stimulate demand further with additional monetary easing to achieve and stabilize inflation at the BOJ’s target, given a scheduled sales tax hike in October 2019." The dissenting member was not named in the summary, but it’s rather clear that the meeting statement showed newcomer Goushi Kataoka dissented last time. And Kataoka is widely known as a dove that advocates aggressive easing. The summary also showed concerns over escalating tensions between US and North Korea. One member was quoted saying that "if geopolitical risks heighten further, the BOJ must be ready to consider taking necessary policy adjustments to prevent deflationary mindset from re-emerging."

Released from Japan, National CPI core accelerated to 0.7% yoy in August, up from 0.5% yoy. Tokyo CPI core rose to 0.5% yoy, up from 0.4% yoy. Unemployment rate was unchanged at 2.8%, household spending rose 0.6% yoy, retail sales rose 1.7% yoy, industrial production rose 2.1% mom. Housing starts dropped -20% yoy in August.

USD/CHF Mid-Day Outlook

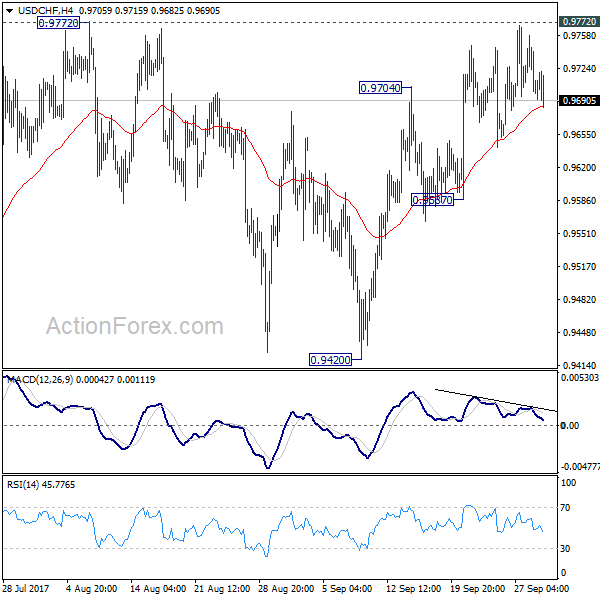

Daily Pivots: (S1) 0.9679; (P) 0.9718; (R1) 0.9740; More….

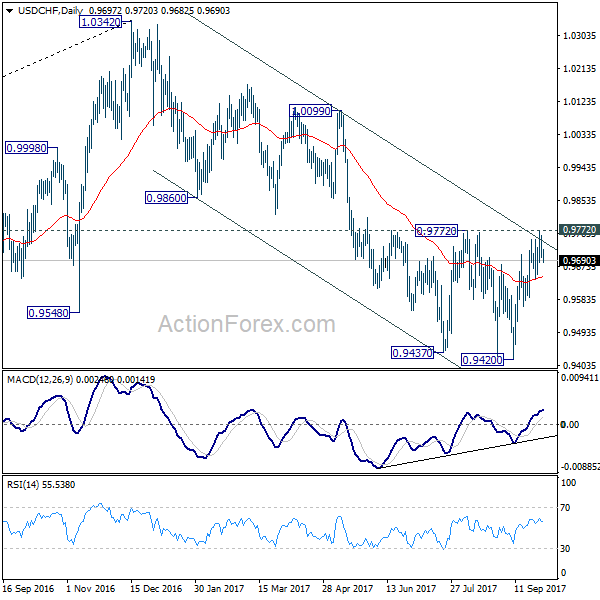

USD/CHF continues to gyrate lower today but overall outlook is unchanged. On the upside, decisive break of 0.9772 key resistance will suggest that whole down trend form 1.0342 has completed. In that case, near term outlook will be turned bullish for 0.9860/1.0099 resistance zone. Nonetheless, with 0.9772 resistance intact, outlook remains bearish. Below 0.9587 minor support will turn bias back to the downside for retesting 0.9420 low.

In the bigger picture, focus remains on whether 0.9443 key support (2016 low) could be taken out firmly as down trend from 1.0342 extends. There are various interpretation of the price actions. But in any case, medium term outlook will stay bearish as long as 0.9772 resistance holds. Current down trend could extend to 38.2% retracement of 0.7065 (2011 low) to 1.0342 (2016 high) at 0.9090. However, break of 0.9772 will indicate that USD/CHF has successfully defended 0.9443 again and turn outlook bullish for 1.0099 resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Aug | 10.20% | -0.70% | -1.70% | |

| 23:01 | GBP | GfK Consumer Confidence Sep | -9 | -11 | -10 | |

| 23:30 | JPY | Unemployment Rate Aug | 2.80% | 2.80% | 2.80% | |

| 23:30 | JPY | Household Spending Y/Y Aug | 0.60% | 0.90% | -0.20% | |

| 23:30 | JPY | National CPI Core Y/Y Aug | 0.70% | 0.70% | 0.50% | |

| 23:30 | JPY | Tokyo CPI Core Y/Y Sep | 0.50% | 0.50% | 0.40% | |

| 23:50 | JPY | BOJ Summary of Opinions Sept.20-21 Meeting | ||||

| 23:50 | JPY | Retail Trade Y/Y Aug | 1.70% | 2.40% | 1.90% | 1.80% |

| 23:50 | JPY | Industrial Production M/M Aug P | 2.10% | 1.80% | -0.80% | |

| 05:00 | JPY | Housing Starts Y/Y Aug | -2.00% | 0.60% | -2.30% | |

| 06:00 | EUR | German Retail Sales M/M Aug | -0.40% | 0.50% | -1.20% | -0.60% |

| 07:00 | CHF | KOF Leading Indicator Sep | 105.8 | 105.5 | 104.1 | 104.2 |

| 07:55 | EUR | German Unemployment Change Sep | -23K | -5K | -5K | -6K |

| 07:55 | EUR | German Unemployment Rate Sep | 5.60% | 5.70% | 5.70% | |

| 08:30 | GBP | Current Account (GBP) Q2 | -23.2B | -15.8B | -16.9B | |

| 08:30 | GBP | Mortgage Approvals Aug | 67K | 67K | 69K | |

| 08:30 | GBP | M4 Money Supply M/M Aug | 0.90% | 0.20% | 0.50% | |

| 08:30 | GBP | GDP Q/Q Q2 F | 0.30% | 0.30% | 0.30% | |

| 08:30 | GBP | GDP Y/Y Q2 F | 1.50% | 1.70% | 1.70% | |

| 08:30 | GBP | Index of Services 3M/3M Jul | 0.50% | 0.70% | 0.50% | |

| 09:00 | EUR | Eurozone CPI Estimate Y/Y Sep | 1.50% | 1.60% | 1.50% | |

| 09:00 | EUR | Eurozone CPI – Core Y/Y Sep A | 1.10% | 1.20% | 1.20% | |

| 12:30 | CAD | GDP M/M Jul | 0.00% | 0.10% | 0.30% | |

| 12:30 | CAD | Industrial Product Price M/M Aug | 0.30% | 0.50% | -1.50% | -1.60% |

| 12:30 | CAD | Raw Materials Price Index M/M Aug | 1.00% | 0.30% | -0.60% | -0.90% |

| 12:30 | USD | Personal Income Aug | 0.20% | 0.20% | 0.40% | 0.30% |

| 12:30 | USD | Personal Spending Aug | 0.10% | 0.10% | 0.30% | |

| 12:30 | USD | PCE Deflator M/M Aug | 0.20% | 0.30% | 0.10% | |

| 12:30 | USD | PCE Deflator Y/Y Aug | 1.40% | 1.50% | 1.40% | |

| 12:30 | USD | PCE Core M/M Aug | 0.10% | 0.20% | 0.10% | |

| 12:30 | USD | PCE Core Y/Y Aug | 1.30% | 1.40% | 1.40% | |

| 13:45 | USD | Chicago PMI Sep | 58.7 | 58.9 | ||

| 14:00 | USD | U. of Michigan Confidence Sep F | 95.3 | 95.3 |