Dollar is staying as the strongest one for the week as markets await FOMC rate hike. Yet, the greenback is still held below last week’s high against most counter parts except Loonie and Kiwi. Swiss Franc is also resilient while markets are speculation a larger than expected hike by SNB later on Thursday. Commodity currencies are generally weak on risk aversion while Yen is pressured by rising major yields. Euro and Sterling are mixed for now.

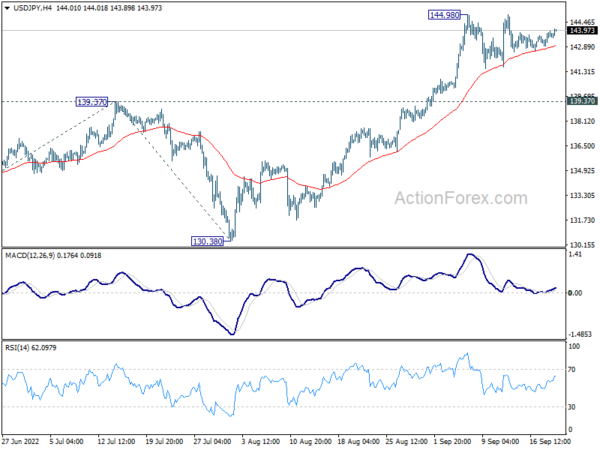

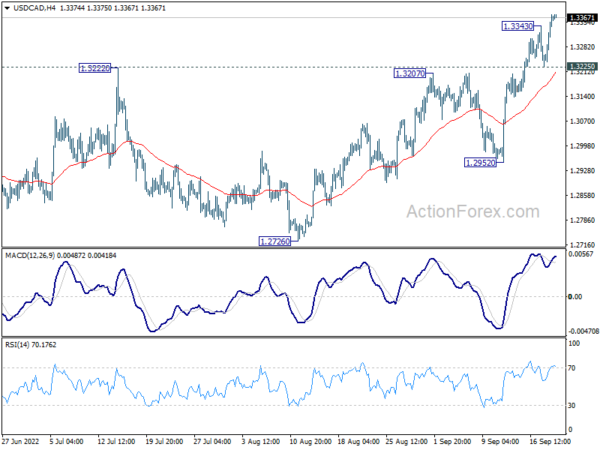

Technically, USD/CAD’s break of 1.3343 temporary top overnight was a sign of rally resumption in Dollar. But more breakouts are needed to confirm the greenback’s strength. The immediate levels to watch are 144.98 resistance in USD/JPY, and 1.1349 temporary low in GBP/USD, and 0.6680 support in AUD/USD. A more distant level is 0.9863 low in EUR/USD.

In Asia, at the time of writing, Nikkei is down -1.17%. Hong Kong HSI is down -1.24%. China Shanghai SSE is down -0.04%. Singapore Strait Times is up 0.06%. Japan 10-year JGB yield is down -0.0042 at 0.256. Overnight, DOW dropped -1.01%. S&P 500 dropped -1.13%. NASDAQ dropped -0.95%. 10-year yield rose 0.081 to 3.571.

ADB slashes developing Asia growth forecast to 4.3%, China to 3.3%

The Asian Development Bank slashed growth forecasts for developing Asia from 5.2% (April forecast) to 4.3% in 2022, and 5.3% to 4.9% in 2023. It said, “The revised outlook is shaped by a slowing global economy, the fallout from Russia’s protracted invasion of Ukraine, more aggressive monetary tightening in advanced economies, and lockdowns resulting from the People’s Republic of China’s zero-COVID policy.”

As for China, growth forecasts was downgraded sharply from 5.0% to 3.3% in 2022, and from 4.8% to 4.5% in 2023. India’s growth forecast was also cut from 7.5% to 7.0% in 2022, and from 8.0% to 7.2% in 2023.

On the other hand, inflation forecast was raised from 3.7% to 4.5% in 2022, and from 3.1% to 4.0% in 2023, “due to higher energy and food prices”.

ECB Lagarde: We will reassess whether a normalization strategy is sufficient

In a speech, ECB President Christine Lagarde said, discussed two considerations for monetary policy, the “destination” and the “pace” to get there.

As for the “destination”, she said, “as we move forward, we will reassess whether a normalization strategy is sufficient to bring us back to 2% inflation over the medium term,” hinting that interest rate could go into restrictive region.

Meanwhile, the “appropriate pace of future rate increases will be decided on a meeting-by-meeting basis.”

RBA Bullock: Interest rate not yet restrictive

RBA Deputy Governor Michele Bullock said interest rate at 2.35% is not yet restrictive. But the central was already looking for opportunities to slow the pace of tightening at some point. The monthly inflation data to be released next week would have a lot of statistical noises, and would unlikely be having much impact of the deliberations at the October meeting.

Regarding the asset purchased during the pandemic bond buying program, Bullock said RBA had taken a mark-to-market valuation loss of AUD 33.9B in 2021/22. That would let the central bank in a negative net equity position of AUD 12.4B. But she added, since it has the ability to create money, the Bank can continue to meet its obligations as they become due and so it is not insolvent… The negative equity position will, therefore, not affect the ability of the Reserve Bank to do its job.”

Fed to hike 75bps as 10-year yield resumed up trend

FOMC rate decision is the main focus of the day and another jumbo rate hike is expected. Based on current market pricing, there is 82% chance of a 75bps hike to 3.00-3.25%, and just 18% chance of a 100bps hike to 3.25-3.50%. Thus, there is little chance for Fed to upset the markets.

Overall rhetoric should be unchanged that tightening is set to continue while Fed is committed to bring inflation down to target. The bigger questions are on the new economic projections and the dot plot. Some hawkish surprise could be seen there, which indicates higher terminal rate for current cycle, and a longer period to stay there.

Here are some previews:

- FOMC Meeting Preview: 100bps Unlikely, But Longer Rate Hike Path in Play

- Another Fed Hike is Coming; Mind the Dots

- Is the Fed Preparing to Crash the Markets, Or Will it Give Them a Helping Hand?

- Fed Preview: Fast Pace Hiking Cycle Continues

- September Flashlight for the FOMC Blackout Period

US 10 year yields rose another 0.81 to close at 3.571 overnight, break through prior high at 3.483. The development confirmed resumption of up trend from 2020 low at 0.398. Next target will be 61.8% projection of 1.343 to 3.483 from 2.525 at 3.847. Hawkish surprise in today’s FOMC projections could accelerate TNX’s path to this target.

Elsewhere

UK will release public sector net borrowing. US will also release existing home sales.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3272; (P) 1.3324; (R1) 1.3419; More…

USD/CAD’s rally resumed after brief consolidations and intraday bias is back on the upside. Current up trend should target medium term fibonacci level at 1.3650. On the downside, break of 1.3225 minor support is needed to indicate short term topping. Otherwise, outlook will stay bullish in case of retreat.

In the bigger picture, down trend from 1.4667 (2020 high) should have completed at 1.2005, after defending 1.2061 long term cluster support. Rise from there should target 61.8% retracement of 1.4667 to 1.2005 (2021 low) at 1.3650. This will remain the favored case now as long as 1.2716 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Westpac Leading Index M/M Aug | -0.10% | -0.15% | ||

| 06:00 | GBP | Public Sector Net Borrowing (GBP) Aug | 7.5B | 4.2B | ||

| 14:00 | USD | Existing Home Sales Aug | 4.70M | 4.81M | ||

| 14:30 | USD | Crude Oil Inventories | 2.4M | |||

| 18:00 | USD | Fed Interest Rate Decision | 3.25% | 2.50% | ||

| 18:30 | USD | FOMC Press Conference |