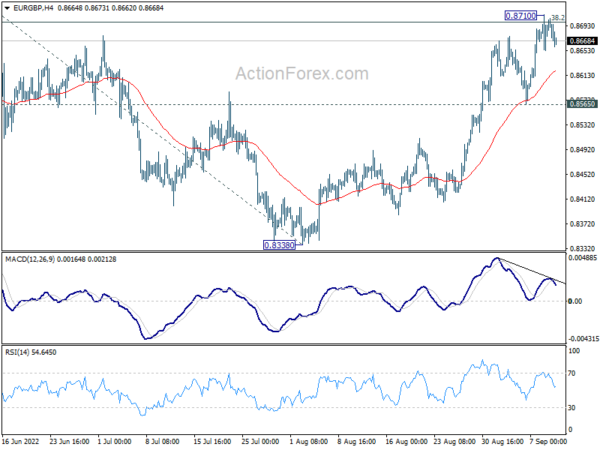

EUR/GBP edged higher to 0.8710 last week, but retreated ahead of 0.8720 resistance. Initial bias is turned neutral this week first. On the upside, decisive break of 0.8720 high will carry larger bullish implications. Next target is 100% projection of 0.8201 to 0.8720 from 0.8338 at 0.8857. However, break of 0.8565 will indicate rejection by 0.8270, and turn bias back to the downside for 55 day EMA (now at 0.8515) and below.

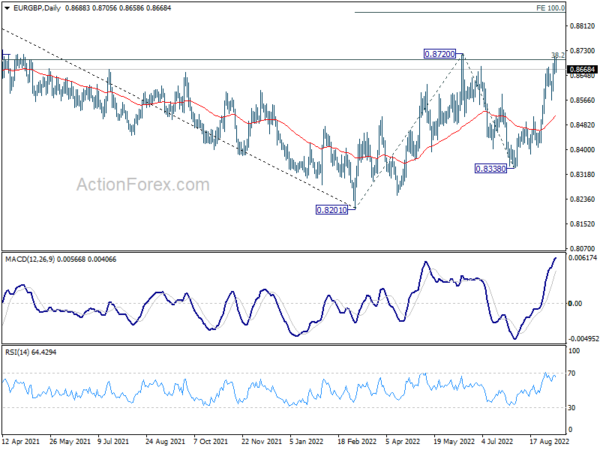

In the bigger picture, focus is back on 38.2% retracement of 0.9499 to 0.8201 at 0.8697. Sustained break there will argue that rise from 0.8201 is a medium term up trend, rather than a correction. Next target is 61.8% retracement at 0.9003. Rejection by 0.8697 again will maintain medium term bearishness, for extending the down trend from 0.9499 (2020 high) at a later stage.

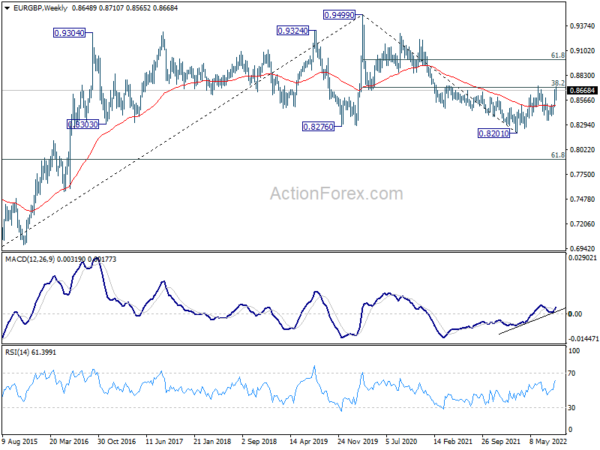

In the long term picture, the lack of medium term downside momentum suggests that fall from 0.9499 (2020 high) is merely a correction to rise from 0.6935 (2015 high). In case of another fall, downside should be contained by 61.8% retracement of 0.6935 to 0.9499 at 0.7917 to bring rebound. Sustained trading above 55 month EMA (now at 0.8601) will indicate that the correction has completed and bring retest of 0.9499.