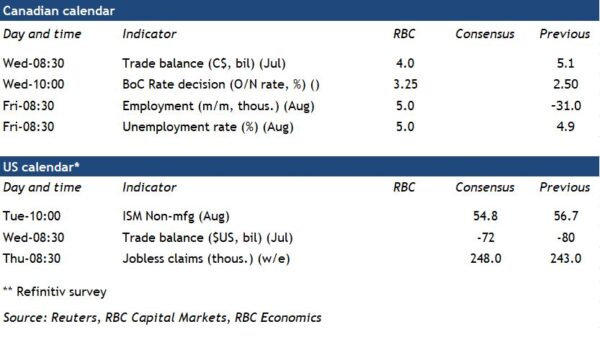

Another hefty 75 bps increase in the overnight rate is what we expect from the Bank of Canada next week. This would take the rate to a restrictive 3.25%, just above the 2% to 3% range the central bank deems “neutral” (the rate at which interest rates are neither adding to nor subtracting from longer-run economic growth trends). And the bank’s commitment to front loading rate hikes in the face of red-hot inflation means an even bigger 100 bps increase (matching July’s hike) can’t be ruled out.

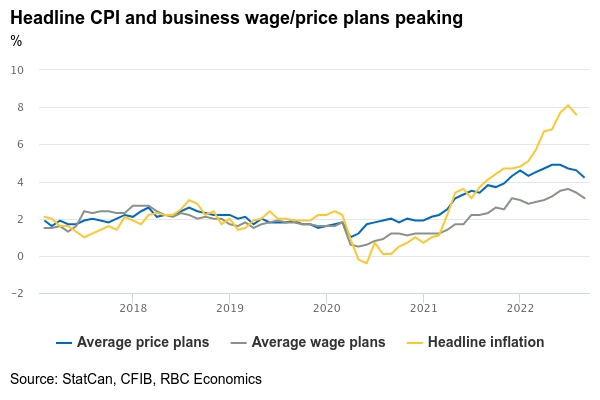

Data releases since the bank’s July meeting have shown marginal improvements. Headline inflation appears to have finally peaked, as have business average wage and price plans, according to Canadian Federation of Independent Business. Global commodity prices turned a corner and supply chain pressures have steadily eased, all of which signal more moderations in inflation trends in the months to come. Home resale markets have also cooled rapidly, following previous rate hikes and rising mortgage borrowing costs.

But at this point, a further softening in household demand is still required to bring inflation back to the bank’s 2% target rate. Labour market conditions are still exceptionally tight—even with softer employment readings in recent months and an expected uptick in the unemployment rate in next week’s August job market numbers. If household demand and inflation pressures wane as expected, the bank could be in a position to halt its tightening cycle soon. Still we expect policymakers to maintain a tightening bias beyond September, and follow up with an additional 25 basis point hike in October, bringing the overnight rate to 3.5%.

Week ahead data watch:

We expect Canadian employment rose by 5,000 jobs in August. This would follow two consecutive monthly declines. These recent sluggish developments stem almost entirely from a lack of available workers, not weakening demand. At over 1 million in June, job vacancies were still well above pre-pandemic levels. We look for an increase in the unemployment rate to 5.0% (which is still very low).

The Canadian merchandise trade surplus likely shrank in July after jumping to $5 billion in June. A 12% drop in oil prices will lower the energy trade surplus.