The GBPUSD trades under the 1.3400 level, as Brexit negotiations with the EU remain deadlocked and the U.S dollar index continues to strengthen, after President Donald Trump proposed the biggest U.S. tax overhaul in three decades.

Sterling is expected to remain under further selling pressure while U.S fundamentals outweigh the United Kingdom’s, while trading sentiment surrounding the greenback support further U.S dollar gains.

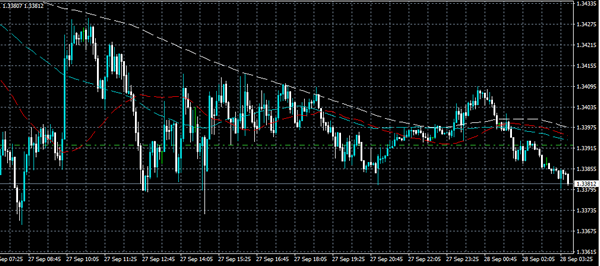

The GBPUSD pair has struggled to advance past the 1.3400 technical level during the Asian session, with price-action slipping further towards the currently weekly price-low.

Going forward, the GBPUSD pairs key 200-week moving average remains key, a move below the 200-week MA would signal further bearish losses for sterling

Key intraday support for the GBPUSD pair is found at 1.3360, 1.3340 and the key 1.3300 level. Below the 1.3300 level, the former yearly price high at 1.3268 acts as the foremost support.

To the upside, key GBPUSD technical resistance is found at the pairs daily pivot point, at 1.3400 and the 50-hour moving average at 1.3430. Above 1.3430, buying interest should accelerate towards 1.3444 and 1.3461.

.