Risk off sentiment appears to be intensifying today. Selloff in particularly serious in German DAX, while FTSE and CAC are also down. US futures are also pointing to a lower open while 10-year yield is pressing 3% handle. In the currency markets, Euro and Sterling are main losers for the day so far, but Yen is also weak. Dollar is clearly strong against most, with the exception of Aussie and Kiwi, which are showing some resilience.

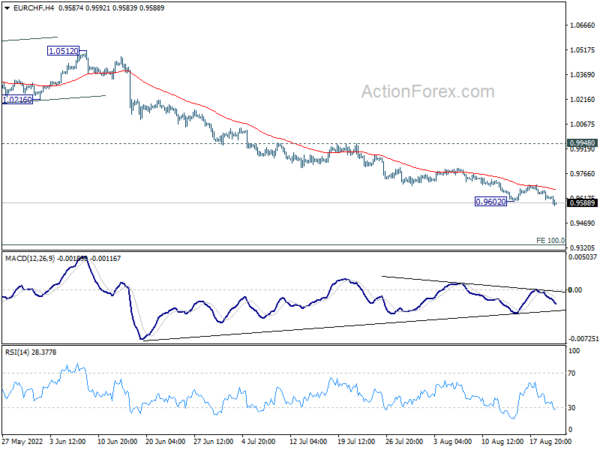

Technically, EUR/CHF is taking the lead in downside breakout, resuming down trend through 0.9602. Attention will be on when EUR/USD’s reaction below parity. As EUR/USD breaks through 0.9951 low, the selloff could spill over to other pairs, and push EUR/AUD through 1.4318 low, and EUR/CAD through 1.2970. Let’s see.

In Europe, at the time of writing, FTSE is down -0.46%. DAX is down -2.14%. CAC is down -1.62%. Germany 10-year yield is up 0.054 at 1.285. Earlier in Asia, Nikkei dropped -0.47%. Hong Kong HSI dropped -0.59%. China Shanghai SSE rose 0.61%. Singapore Strait Times rose 0.49%. Japan 10-year JGB yield rose 0.0302 to 0.231.

Bundesbank: Inflation could reach order of 10% in fall

Bundesbank said in its monthly report that the Germany will be adversely affected by the unfavorable developments on the gas market in the summer quarter and beyond. Also, the likelihood of GDP falling in the coming winter half-year has therefore increased “significantly”.

Inflation rate is expected to reach “new highs” in the Autumn, and could reach the “order of 10 percent”. Outlook for inflation remains extremely uncertain, primarily due to the unclear situation on the commodity markets.

RBNZ Hawkesby: Things will be evenly balanced once rates reach 4-4.25%

RBNZ Deputy Governor Christian Hawkesby said the strategy now is to get the cash rate “comfortably above neutral” to bring down core inflation. And, “that will afford us some breathing space to see how things are playing out.”

“Once we get the OCR up into that 4%-4.25% level we’re seeing things evenly balanced from there,” he added. “So we’d put equal weight on having to put the OCR up as we would putting it down.”

“The economy will evolve differently than our projections. There will be shocks that come along. There’ll be data that’s different than the forecast. And we’ll just keep coming back to what does it mean for our mandates,” Hawkesby said. “We certainly are projecting an environment where the economy cools.”

China PBoC cut loan prime rate to support housing

China’s PBoC lowered the one-year loan prime rate (LPR) by 5bps to 3.65% today. The five-year LPR rate, which is used to price mortgages, was slashed by 15bps to 4.30%.

The larger cut is the 5-year rate was seen as for addressing the problems in the housing markets. The asymmetry is also for giving additional boost to long-term financing demand.

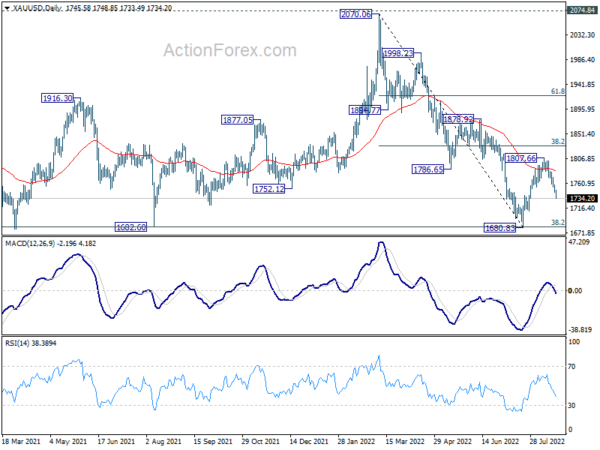

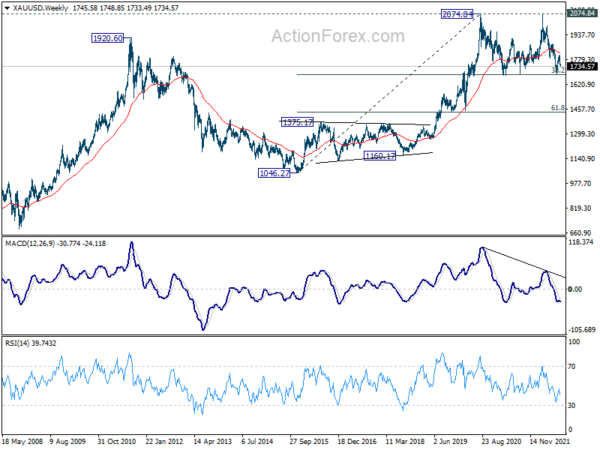

Gold’s accelerates down, 1700 vulnerable

Gold’s decline from 1807.66 extends further today, on the back on broad based strength in Dollar. The downside accelerations argue that rebound from 1680.83 has completed at 1806.66 already. Deeper fall is likely through 1700 handle.

Nevertheless, strong support is still mildly in favor at around 1680.83 low to contain downside. Above 1772.19 minor resistance should resume the rebound through 1807.66.

However, the rejections by 55 day EMA, and below 55 week EMA are both rather bearish signal. Firm break of 1680.83 cluster support will complete a medium term double top pattern (2074.84, 2070.06). That could prompt deeper selloff to 61.8% retracement of 1046.27 to 2074.84 at 1439.18.

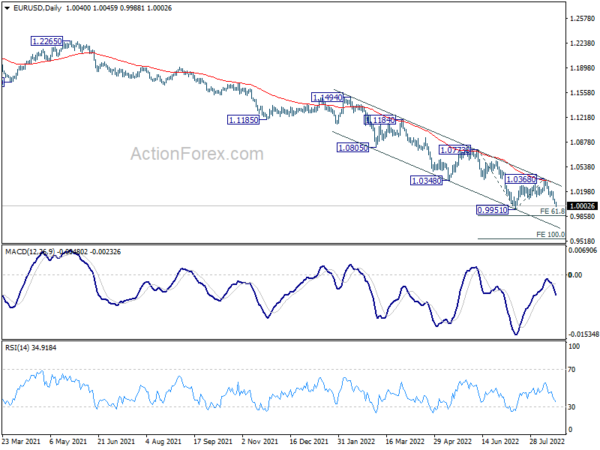

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0014; (P) 1.0058; (R1) 1.0083; More…

EUR/USD’s fall from 1.0368 is still in progress and intraday bias stays on the downside for retesting 0.9951 low. Firm break there will resume larger down trend to 61.8% projection of 1.0773 to 0.9951 from 1.0368 at 0.9860, and then 100% projection at 0.9546. On the upside, above 1.0121 minor resistance will turn intraday bias neutral first. But outlook will stay bearish as long as 1.0368 resistance holds.

In the bigger picture, down trend from 1.6039 (2008 high) is still in progress. Next target is 100% projection of 1.3993 to 1.0339 from 1.2348 at 0.8694. In any case, outlook will stay bearish as long as 1.0773 resistance holds, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 10:00 | EUR | German Buba Monthly Report | ||||

| 12:30 | CAD | New Housing Price Index M/M Jul | 0.10% | 0.40% | 0.20% |