Dollar remains broadly firm today, unmoved by the cautious comments from Fed Chair Janet Yellen. Traders are eagerly awaiting the long-awaited tax reform from US President Donald Trump. Meanwhile, Euro and Kiwi continue to suffer post election weakness. It’s reported that German Chancellor Angela Merkel have begun the coalition talk between CDU, CSU, GDP and Greens. But the common currency could stay pressured until the picture becomes clearer. And, it’s consistent with the technical development that EUR/USD is in a medium term correction that would take some more time to complete.

Trump to deliver long awaited tax plan

Trump is expected to speak in Indiana on tax reform today. Yet, the details remained unclear with reports suggesting that Treasury secretary Mnuchin, Trump’s chief economic adviser Gary Cohn, House Speaker Paul Ryan, Senate majority leader Mitch McConnell, House Ways and Means committee Chairman Kevin Brady and Senator Orrin Hatch still can’t compromise of a number of issues. The biggest debate is on whether there should be any net tax cut on the wealthiest Americans, even if the top rate of income tax is lowered to 35% from 39.5% as proposed.

Fed Yellen still expects gradual tightening

Fed Chair Janet Yellen spoke at the National Association for Business Economics in Cleveland yesterday. Regarding the slowdown in inflation, Yellen noted that policy makers "may have misjudged the strength of the labor market, the degree to which longer-run inflation expectations are consistent with our inflation objective, or even the fundamental forces driving inflation." That highlights Fed’s difficulty in forecasting inflation and thus its own rate path. Currently, there is a 30% chance that inflation could range anywhere from 1% to 3%. Any outcome could change the rate path drastically.

For now, Fed "continues to anticipate that, with gradual adjustments in the stance of monetary policy, inflation will rise and stabilize at around 2 percent over the medium term." And, "without further modest increases in the federal funds rate over time, there is a risk that the labor market could eventually become overheated, potentially creating an inflationary problem down the road that might be difficult to overcome without triggering a recession." Hence, "we should be wary of moving too gradually."

EC Tusk: No sufficient progress on Brexit negotiation yet

After meeting with UK Prime Minister Theresa May, European Council President Donald Tusk said he’s "cautiously optimistic about the constructive and more realistic tone in the prime minister’s speech in Florence and of our discussion today." But he reiterated EU’s stance that discussion on future relations will start once there is "so called sufficient progress". And for now, "there is no sufficient progress yet".

May’s office said in a statement that her Florence speech last week "had been intended to create momentum in the ongoing talks." And she urged "EU negotiators to now respond in the same spirit." And, May also said earlier that "by being creative in the ways we approach these issues, we can find solutions that work both for the remaining (EU) 27 but also for the UK and maintain that cooperation and partnership between the UK and the EU."

French Macron laid out plans for EU transformation

French President Emmanuel Macron set out his plans for a "profound transformation" of the US in his speech yesterday. He warned time time was running out for the EU to reinvent itself to counter the rise of far-right nationalism and "give Europe back to its citizens". He acknowledged that the Europe is "too slow, too weak too ineffective" and that’s why isolationist attitude had resurfaced, with a far right party entering Bundestag for the first time in 70 years. In short, Macron called for a common finance minister for the Eurozone, budget and parliament. And he also proposed a common European defence force, a European intelligence agency to fight terrorism, a European-wide asylum office and stronger EU border force.

On the data front

Swiss will release UBS consumption indicator in European session. Eurozone will release M3 while UK will release CBI realized sales. But main focus will be on durable goods orders from US. Pending home sales will also be featured.

AUD/USD Daily Outlook

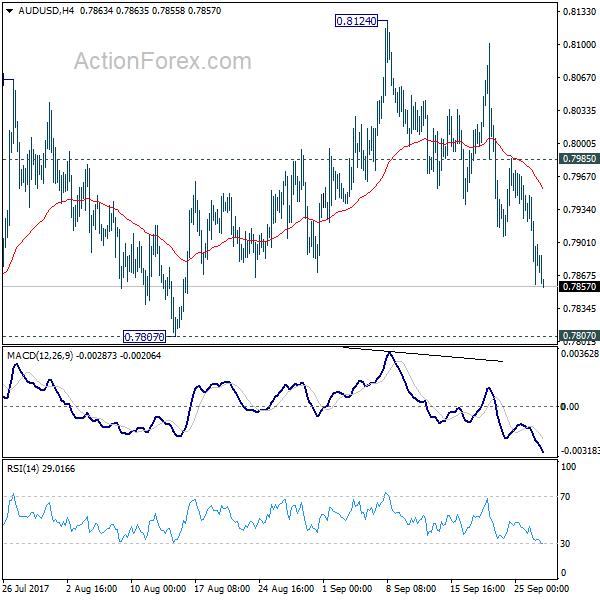

Daily Pivots: (S1) 0.7848; (P) 0.7898; (R1) 0.7937; More…

AUD/USD drops to as low as 0.7856 so far and correction from 0.8124 extends. Overall, with 0.7807 support intact, larger rally is still expected to resume later. Above 0.7985 minor resistance will turn bias to the upside for retesting 0.8124 high first. Break will target 00% projection of 0.6826 to 0.7833 from 0.7328 at 0.8335 next. However, considering bearish divergence condition in daily MACD, firm break of 0.7807 will indicate near term reversal and turn bias back to the downside for 55 week EMA (now at 0.7670).

In the bigger picture, rise from 0.6826 medium term bottom is still in progress. At this point, there is no confirmation of trend reversal yet and we’ll continue to treat such rebound as a corrective pattern. But in any case, break of 55 month EMA (now at 0.8090) will target 38.2% retracement of 1.1079 to 0.6826 at 0.8451. Break of 0.7807 support is needed to to be the first sign of completion of the rebound. Otherwise, further rise is now in favor.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 06:00 | CHF | UBS Consumption Indicator Aug | 1.38 | |||

| 08:00 | EUR | Eurozone M3 Y/Y Aug | 4.70% | 4.50% | ||

| 10:00 | GBP | CBI Realized Sales Sep | 8 | -10 | ||

| 12:30 | USD | Durable Goods Orders Aug P | 1.00% | -6.80% | ||

| 12:30 | USD | Durables Ex Transportation Aug P | 0.20% | 0.60% | ||

| 14:00 | USD | Pending Home Sales M/M Aug | -0.50% | -0.80% | ||

| 14:30 | USD | Crude Oil Inventories | 4.6M | |||

| 20:00 | NZD | RBNZ Rate Decision | 1.75% | 1.75% |