The currency markets continue to be relatively steady today, as traders are holding their bets ahead of Fed’s expected 75bps rate hike. Euro is recovering slightly but remains the worst performer for the week, followed by Yen. On the other hand, Canadian Dollar is leading Australian and Sterling higher. Dollar is mixed for now. The interplay between US stocks, benchmark yields, and Dollar will be the major focus for the retest of the session.

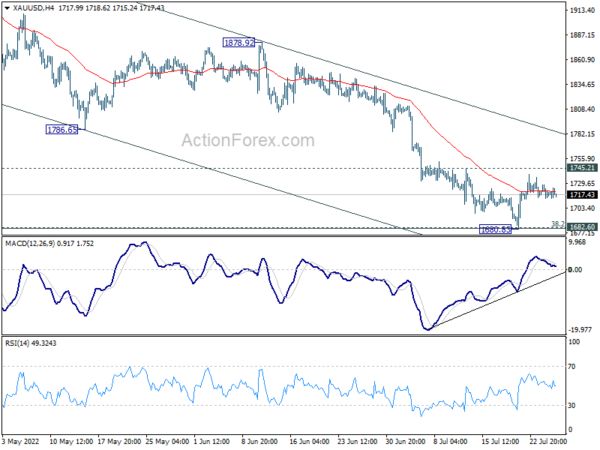

Technically, some attention will also be on Gold’s reaction to Fed hike. Recovery from 1680.83 is so far disappoinintg. But another rally is still envisaged. Firm break of 1745.21 minor resitasnce swhould confirm short term bottoming at 1680.83, on bullish convergence condition in 4 hour MACD. That would also be the first signal of near term bullish reversal , and turn focus to channel resitsance at around 1780.

In Europe, at the time of writing, FTSE is up 0.69%. DAX is up 0.64%. CAC is up 0.58%. Germany 10-year yield is up 0.014 at 0.942, staying below 1%. Earlier in Asia, Nikkei rose 0.22%. Hong Kong HSI dropped -1.13%. China Shanghai SSE dropped -0.05%. Singapore Strait Times rose 0.41%. Japan 10-year JGB yield dropped -0.0142 to 0.195, back below 0.2%.

Here are some previews for FOMC:

- What to Expect from FOMC Meeting on July 27th

- Trader Thoughts – Make or Break Time for US Equity Markets

- FOMC Preview – Assessing the Balance of Risk for Traders

- Fed to Likely Hike by 75 bps But May Still Weigh 100-bps Option

- FOMC Meeting Preview: Traders Looking for 75bps, Powell’s Presser Key

- All Eyes on Bond Yields ahead of FOMC

US durable goods orders rose 1.9% mom, ex-transport orders up 0.3% mom

US durable goods orders rose 1.9% mom to USD 272.6B in June, much better than expectation of -0.5% mom decline. Ex-transport orders rose 0.3% mom, below expectation of 0.4% mom. Ex-defense orders rose 0.4% mom. Transportation equipment rose 5.4% mom to USD 92.7B.

US goods exports rose 2.5% mom, imports dropped -0.5% mom

US exports of goods rose 2.5% mom or USD 4.4B to USD 181.5B in June. Imports of goods dropped -0.5% mom or USD -1.5B to to USD 279.7B. Good trade deficit came in at USD -98.2B, smaller than expectation of USD -103.2B.

Wholesale inventories rose 1.9% mom, 25.6% yoy to USD 896.0B. Retail inventories rose 2.0% mom, 19.9% yoy to USD 723.0B.

Germany Gfk consumer sentiment hit another rock bottom at -30.6

Germany Gfk consumer sentiment for August dropped from -27.7 to -30.6, below expectation of -28.2. That’s another record low since the start of the series in 1991. In July, economic expectations dropped from -11.7 to -18.2. Income expectations dropped from -33.5 to -45.7. Propensity to buy dropped from -13.7 to -14.5.

“In addition to concerns about disrupted supply chains, the war in Ukraine and soaring energy and food prices, there are now worries about sufficient gas supplies for businesses and households next winter. This is currently causing consumer sentiment to hit rock bottom,” explains Rolf Bürkl, GfK consumer expert. “Especially as a tight supply of natural gas is likely to add to the pressure on energy prices and thus inflation.”

Australia CPI surged to record 6.1% yoy, but below expectations

Australia CPI rose 1.8% qoq in Q2, blow expectation of 1.9% qoq. For the 12-month period, CPI accelerated from 5.1% yoy to 6.1% yoy, below expectation of 6.3% yoy. RBA trimmed mean CPI came in at 1.5% qoq, 4.9% yoy, versus expectation of 1.5% qoq, 4.7% yoy.

The quarterly increase was the second highest since the introduction of the Goods and Services Tax (GST), following on from a 2.1% increase in Q1. The annual rise was the highest since the introduction of GST.

“Annual trimmed mean inflation was the highest since the series commenced in 2003 and annual goods inflation was the highest since 1987, as the impacts of supply disruptions, rising shipping costs and other global and domestic inflationary factors flowed through the economy,” said Head of Prices Statistics at the ABS, Michelle Marquardt.

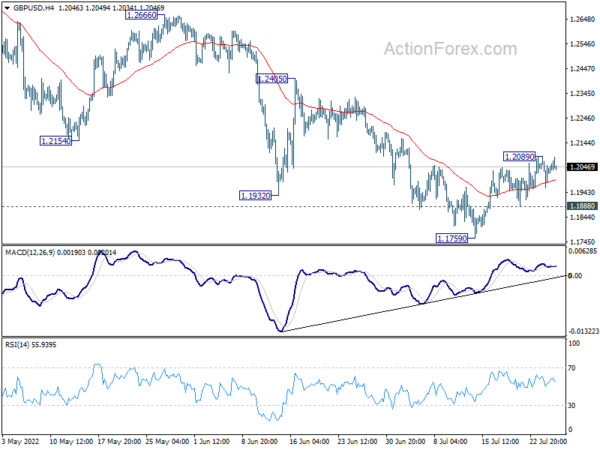

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1965; (P) 1.2027; (R1) 1.2091; More…

Intraday bias in GBP/USD remains neutral at this point. With 1.1888 minor support intact, further rise is mildly in favor. Above 1.2089 will target 55 day EMA (now at 1.2236). Sustained trading above there will pave the way to 1.2405 resistance and above. On the downside, below 1.1888 minor support will bring retest of 1.1759 low instead.

In the bigger picture, fall from 1.4248 (2018 high) could be a leg inside the pattern from 1.1409 (2020 low), or resuming the longer term down trend. Deeper decline is expected as long as 1.2666 resistance holds. Next target is 1.1409 low. However, firm break of 1.2666 will bring stronger rise back to 55 week EMA (now at 1.2986).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | CPI Q/Q Q2 | 1.80% | 1.90% | 2.10% | |

| 01:30 | AUD | CPI Y/Y Q2 | 6.10% | 6.30% | 5.10% | |

| 01:30 | AUD | RBA Trimmed Mean CPI Q/Q Q2 | 1.50% | 1.50% | 1.40% | |

| 01:30 | AUD | RBA Trimmed Mean CPI Y/Y Q2 | 4.90% | 4.70% | 3.70% | |

| 06:00 | EUR | Germany Gfk Consumer Confidence Aug | -30.6 | -28.2 | -27.4 | -27.7 |

| 08:00 | CHF | CHF ZEW Expectations Jul | -57.2 | -72.7 | ||

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Jun | 5.70% | 5.50% | 5.60% | 5.80% |

| 12:30 | USD | Goods Trade Balance (USD) Jun P | -98.2B | -103.2B | -104.3B | |

| 12:30 | USD | Wholesale Inventories Jun P | 1.90% | 2.00% | 1.80% | |

| 12:30 | USD | Durable Goods Orders Jun | 1.90% | -0.50% | 0.80% | |

| 12:30 | USD | Durable Goods Orders ex Transportation Jun | 0.30% | 0.40% | 0.70% | |

| 14:00 | USD | Pending Home Sales M/M Jun | 0.50% | 0.70% | ||

| 14:30 | USD | Crude Oil Inventories | -1.5M | -0.4M | ||

| 18:00 | USD | Fed Interest Rate Decision | 2.50% | 1.75% | ||

| 18:30 | USD | FOMC Press Conference |