On Wednesday, 27th of July, at 18:00 GMT, the Fed will release its monetary policy decision, including the interest rate and the QE programme. The news is expected to cause a surge of volatility in the USD and across the markets.

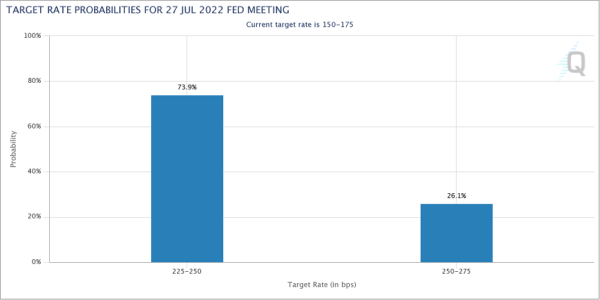

Analysts expect the FOMC to raise the rate by 75 basis points to 2.5%. This is an extraordinarily sharp and rare hike for the Fed. Moreover, interest rate futures price a 26% chance of a 100 bp hike. In addition to policy changes, market participants will also pay attention to sentiment regarding the economic outlook and the next Fed moves.

Signals that the Fed is now to slow the pace of policy tightening indicate concern about the rate of economic growth and less about inflation which could put pressure on the dollar and increase appetite for risks.

On the contrary, tolerance for slower economic growth and a determination to continue fighting inflation could breathe new life into the dollar rally and trigger a sell-off in risk-sensitive instruments.