Dollar trades broadly higher today as markets are awaiting Fed Chair Janet Yellen’s speech on inflation, uncertainty and monetary policy at the National Association for Business and Economics in Cleveland. Yellen is likely to maintain the tone that Fed is on course for gradual stimulus removal. Her comments regarding slowdown in inflation will also be closely watched. With the job market maintaining solid growth momentum, inflation is the main obstacle to another hike by Fed this year. Comments from other Fed officials are mixed so far. For example, New York Fed President Dudley just reiterated his expectation for inflation to climb back to 2% target after "idiosyncractic" factors fade. But Chicago Fed President Charles Evans is a little bit concerned that the slowdown in inflation is structural.

The anticipation of the details of US President Donald Trump’s tax plan is also giving the greenback a lift. Republicans are set to unveil the plan tomorrow. It’s reported that Trump told dinner guests on Monday that House will approve the tax bill in October, followed by the Senate by year end. But that’s is an extremely aggressive scheduled considering that no details are being released yet. And comparing to the last time a tax overhaul was done back in 1986, it took roughly 10 months for the bill to move from introduction to then President Ronald Reagan’s desk.

Meanwhile, market concerns over tensions between US and North Korea have eased mildly. There have been busy verbal exchanges between Trump, North Korea leader Kim Jong-Un and his Foreign Minister Ri Yong Ho. After Trump tweeted in his private account that the latter two "won’t be around much longer", Ri criticized that was a declaration of war. And North Korea claimed every right on counter measures including shooting down US bombers "even when they are not inside the airspace border of our country". The White house’s official message was that "we’ve not declared war on North Korea. And frankly, the suggestion of that is absurd."

Released from US, S&P Case-Shiller 20 cities house price rose 5.8% yoy in July, meeting expectations.

Euro selloff accelerates, pointing lower

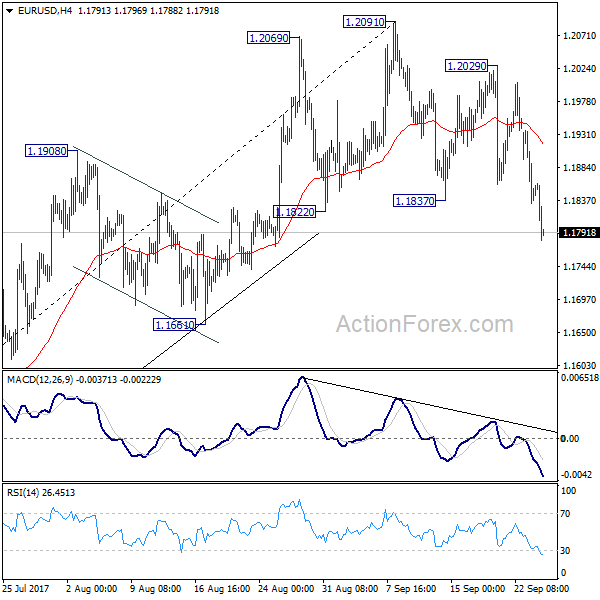

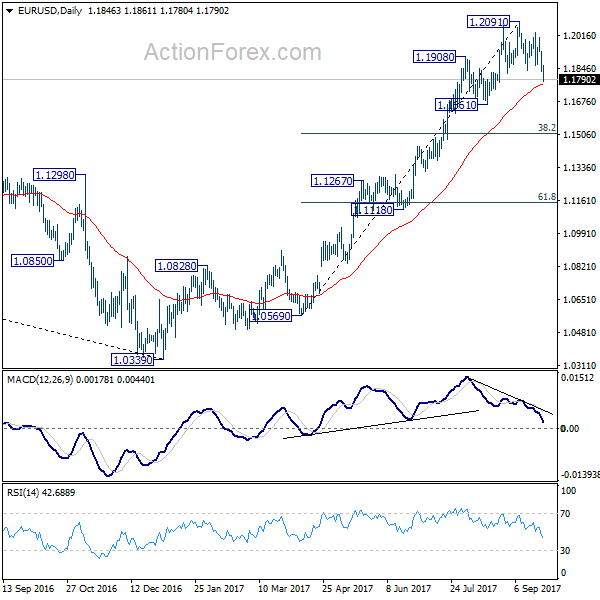

On the other hand Euro’s selloff started to accelerate today after EUR/GBP breaks 0.8773 support. EUR/USD’s break of 1.1822 support argues that it’s now in a medium term correction. Deeper fall could be seen through 1.1661 support in near term. Based on the hesitation in the decline, results of Germany election shouldn’t be a direct reason for the selloff. Instead, markets are looking through the temporary uncertainty over Chancellor’s difficulty in forming a coalition. The main problem is that a so called Jamaica coalition of CDU, pro-business FDP and Greens is intrinsically unstable. That raises some worries over the predictability of Germany’s economic policies. And as the main driver of Eurozone economy, the whole bloc will also be affected. In addition, with the presence of right wing Afd in the parliament, it would be tougher for Merkel to work with French President Emmanuel Macron on deeper integration of EU.

Released from Eurozone, German import price index rose 0.0% mom in August.

BoJ July minutes optimistic on inflation trend

Minutes of BoJ July meeting showed that policy makers generally agreed to stick with current policy framework. Meanwhile, the minutes noted that "most members shared the view that, although the recent developments in CPI had been relatively weak, the year-on-year rate of change was likely to continue on an uptrend and increase toward 2 percent, mainly on the back of the improvement in the output gap and the rise in medium- to long-term inflation expectations."

Also from Japan, corporate service price index rose 0.8% yoy in August.

New Zealand business confidence tumbled

New Zealand NBNZ business confidence sank to 0 in September, down sharply from 18.3. That’s the third straight month of decline and the lowest reading since September 2015. Nonetheless, ANZ chief economist Cameron Bagrie noted today that news economic drivers are emerging and growth would remain "respectable". The drivers are appearing in form of "higher commodity prices, rising household incomes and expansionary fiscal policy". Nonetheless, Bagrie also pointed out, after the election over the weekend, "policy uncertainty will rise over the coming months as political horse trading takes place" and that can be "unsettling".

Also from New Zealand, trade deficit came in much higher than expected at NZD -1235m in August.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1808; (P) 1.1872 (R1) 1.1913; More…

Intraday bias in EUR/USD remains on the downside for 1.1661 support. Fall from 1.2091 is corrective whole rise from 1.0569. Break of 1.1661 will target 38.2% retracement of 1.0569 to 1.2091 at 1.1510, where we’re expecting support to bring rebound. On the upside, break of 1.2029 resistance is needed to confirm completion of the pull back. Otherwise, deeper fall will remain in favor as the correction develops.

In the bigger picture, rise from medium term bottom at 1.0339 is still in progress for 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. However, it should be noted that there is no confirmation of trend reversal yet. That is, such rebound from 1.0399 could be a correction. And the long term fall from 1.6039 (2008 high) could resume. Hence, we’d be cautious on strong resistance from 1.2516 to limit upside. But after all, break of 1.1661 is needed to indicate medium term topping. Otherwise, outlook will remain bullish in case of pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Aug | -1235M | -825M | 85M | 98M |

| 23:50 | JPY | BOJ Minutes July 19-20 Meeting | ||||

| 23:50 | JPY | Corporate Service Price Y/Y Aug | 0.80% | 0.70% | 0.60% | |

| 00:00 | NZD | NBNZ Business Confidence Sep | 0 | 18.3 | ||

| 06:00 | EUR | German Import Price Index M/M Aug | 0.00% | 0.10% | -0.40% | |

| 13:00 | USD | S&P/Case-Shiller Composite-20 Y/Y Jul | 5.80% | 5.80% | 5.70% | 5.60% |

| 14:00 | USD | New Home Sales Aug | 591K | 571K | ||

| 14:00 | USD | Consumer Confidence Sep | 120 | 122.9 |