The dollar index came under pressure on fresh risk mode and weighed by recession fears amid Fed’s aggressive rate hike path that threatens of further slowdown of the economy.

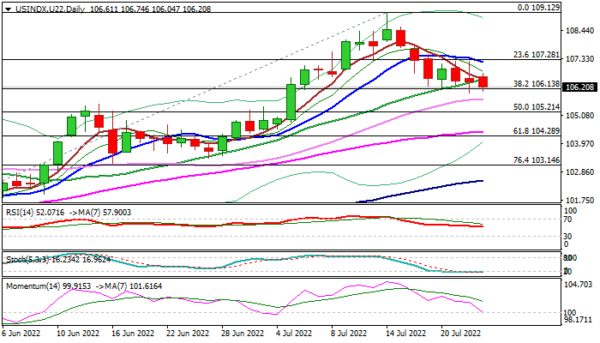

Fresh bears pressure last Friday’s two-week low (105.97) on renewed probe through pivotal Fibo support at 106.13 (38.2% retracement of 103.40/109.12 ascend) which repeatedly contained attacks last week.

Daily techs are weakening as 10/20DMA’s turned to bearish setup and south-heading 14-d momentum is at the border of the negative territory, while last week’s bearish close formed a reversal pattern on weekly chart.

Firm break of 106.13 pivot would generate fresh bearish signal for dip towards next significant supports at 105.21/104.97 (50% retracement/trendline support).

Conversely, repeated failure at 106.13 would keep the price action within existing congestion and await for stronger signals from Fed decision and US GDP data.

Res: 106.50; 106.74; 107.18; 107.92.

Sup: 105.97; 105.54; 105.21; 104.97.