While Euro is staying soft, after post German election selloff, it’s still holding above near term support against Dollar and Yen. Weakness is mainly seen against Sterling as 0.8773 support is taken out. Also, the common currency has not yet shown any sign of a rebound. Meanwhile, Dollar is turning slightly softer against others while Yen is picking up some strength. Mixed comments from Fed officials provided little support the the greenback. While are still pricing in more than 70% chance of a December Fed hike, the decision will remain very much data dependent. Tensions between US and North Korea remain tight as verbal exchanges between leaders continued to escalate.

North Korea boosting defense in its east coast

South Korea news agency Yonhap reported that North Korean has been boosting defense in its east coast as tensions between US and the North escalated. North Korea Foreign Minister Ri Yong Ho complained yesterday that US President Donald Trump’s tweet that Ri and leader Kim Jong Un "won’t be around much longer" was a declaration of war. And, North Korea has every right on counter measures including shooting down US bombers "even when they are not inside the airspace border of our country". And Ri warned that "the whole world should clearly remember it was the U.S. who first declared war on our country." White House Press Secretary denied that and said "we’ve not declared war on North Korea. And frankly, the suggestion of that is absurd."

Chicago Fed Evans a little nervous that inflation weakness is structural

Chicago Fed President Charles Evans, a dove, repeated his call for cautious and gradual approach to rate hike. Even though he is "broadly comfortable" with Fed’s projections, his emphasized that "this path are not set in stone". And, "as the FOMC comes to decision points over the coming months, I think we need to see clear signs of building wage and price pressures before taking the next step in removing accommodation." Also, it would take "a couple more months of data" before confirming that the slow down in inflation was temporary. And he is " a little nervous that some of the recent weakness might be a little more structural."

On the other hand, New York Fed President William Dudley said that "With a firmer import price trend and the fading of effects from a number of temporary, idiosyncratic factors, I expect inflation will rise and stabilize around the 2 percent objective over the medium term". And, "in response, the Federal Reserve will likely continue to remove monetary policy accommodation gradually."

ECB Draghi: We can’t afford hasty moves

ECB President Mario Draghi spoke to the European Parliament’s comment on economic affairs in Brussels yesterday. Draghi emphasized the need to be "sensitive to the danger of not halting a recovery through hasty monetary-policy decision making." And he warned that "we can’t afford hasty moves." And any change, or so called re-calibration of monetary policies will maintain "the degree of monetary support that the euro-area economy still needs to complete its transition to a new balanced growth trajectory characterized by sustained conditions of price stability." Nonetheless, Draghi still sounded upbeat and noted that "economic expansion is now firm and broad-based across euro area countries and sectors." And, policymakers "are becoming more confident that inflation will eventually head to levels in line with our inflation aim".

Separately, ECB Executive Board member Yves Mersch said that the central bank will continue to "prudently adjust our toolbox of monetary policy instruments" once there is "a sufficiently sustained adjustment in the path of inflation." Regarding the stimulus program, Mersch noted that "while the temporary collateral framework has successfully eased potential collateral shortages, it could be argued that it should not become part of the regular framework". That is, collateral rules could now be tightened up as ECB can also start shifting back to "a more conventional environment for the conduct of monetary policy.

French Macron to deliver Euro reform speech

French President Emmanuel Macron will deliver a speech in Paris today, outlining his proposals on reforms in Europe. And it’s seen as an appropriate step to voice our his ideas before German Chancellor Angela Merkel has formed the coalition after Sunday’s election. The key elements of Macron’s reform include reinforcing the Euro against future shocks, a European agency for innovation and a system on start-up funding. However, the untested coalition of CDU, FDP and Greens in Germany could prove to be intrinsically unstable. And negations could take months that might delay Macron’s plan.

EU and UK still at odds over key Brexit issues

As the fourth round of Brexit negotiations started, the EU and UK are clearly staying at odds over the key issues. EU’s chief negotiator Michel Barnier emphasized that "we cannot discuss a transition period without reaching a preliminary agreement on an orderly withdrawal." And he reiterated that "real progress on the three main issues is essential to move to a discussion on the transition as well as the future, these are separate issues." Also, Barnier pointed out that a future trade agreement and so called transition or implementation period are not foregone conclusions. And "without exception", UK will remain subject to EU budge, jurisdiction if it choose to stay in the single market after Brexit.

UK’s Brexit Secretary David Davis, on the other hand, emphasized that "we do not want our EU partners to worry they will pay more or receive less over the remainder of the current budget plan as a result of our decision to leave." And, "the UK will honour commitments we’ve made during the period of our membership." However, Davis also emphasized that "it’s obvious that reaching a conclusion on this issue can only be done in the context of, and in accordance with, our new deep and special partnership with the EU."

While the talks of the Brexit teams carry on in Brussels, UK Prime Minister Theresa May will meet with European Council President Donald Tusk in London today.

New Zealand business confidence tumbled

New Zealand NBNZ business confidence sank to 0 in September, down sharply from 18.3. That’s the third straight month of decline and the lowest reading since September 2015. Nonetheless, ANZ chief economist Cameron Bagrie noted today that news economic drivers are emerging and growth would remain "respectable". The drivers are appearing in form of "higher commodity prices, rising household incomes and expansionary fiscal policy". Nonetheless, Bagrie also pointed out, after the election over the weekend, "policy uncertainty will rise over the coming months as political horse trading takes place" and that can be "unsettling". Also from New Zealand, trade deficit came in much higher than expected at NZD -1235m in August.

Oil prices surged on supply disruption concern

Oil prices jumped on concerns over potential supply disruption after Turkey threatened to "close the valves" on Kurdistan’s oil exports. This was due to Turkey’s objections over an independence referendum held in the Kurdistan region of Iraq. While the Iraqi government has condemned the act, Turkish and Iranian worried that the controversial referendum would be contagious, causing the huge Kurdish population in their countries to do the same. Western powers, including US and UK have also warned that the referendum would exacerbate the instability in the MENA region. However, these powers have not considered their indifference towards the suppression on the people in Kurdish region. Indeed, their concerns probably only lie on the oil. Kurdistan is home to 40% of Iraq’s oil reserves. It is estimated that Kurdistan has oil reserve of at least 45B barrel with exports of around 600K bpd. Most of the oil leaves the region via a pipeline from Kirkuk to the Turkish city of Ceyhan, to export markets in Russia and Europe. Oil facilities in the regions were relatively undamaged despite US’ invasion in Iraq in 2003. It would create another conflict, in case of a Kurdistan independence, on the ownership of the region’s oil revenue and the lucrative oil reserve.

EUR/GBP Daily Outlook

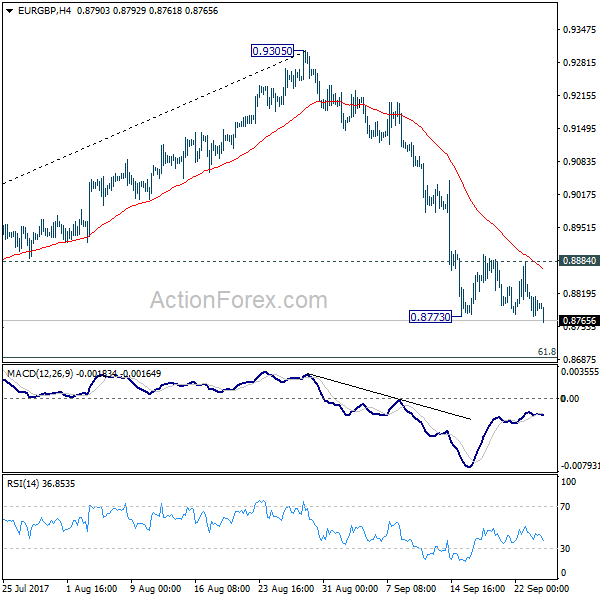

Daily Pivots: (S1) 0.8767; (P) 0.8803; (R1) 0.8830; More

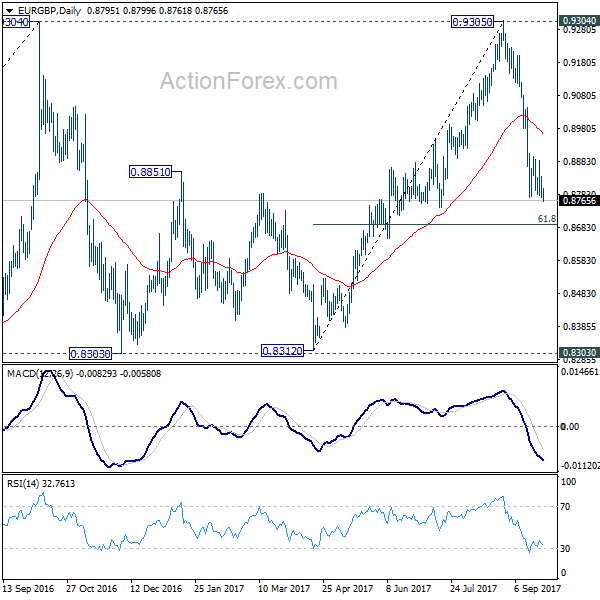

EUR/GBP’s break of 0.8773 suggests resumption of fall from 0.9305. Intraday bias is back on the downside for 61.8% retracement of 0.8312 to 0.9305 at 0.8691 and below. Such decline is seen as the third leg of consolidation pattern from 0.9304. We’ll look for bottoming signal again at it approaches 0.8303 support. However, break of 0.8884 minor resistance is needed to indicate short term bottoming. Otherwise, outlook will stay bearish in case of recovery.

In the bigger picture, price actions from 0.9304 are viewed as a medium term corrective pattern. It’s still in progress with fall from 0.9305 as the third leg. Break of 0.8303 could be seen. But we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside. Whole up trend from 0.6935 is expected to resume after consolidation from 0.9304 completes.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Aug | -1235M | -825M | 85M | 98M |

| 23:50 | JPY | BOJ Minutes July 19-20 Meeting | ||||

| 23:50 | JPY | Corporate Service Price Y/Y Aug | 0.80% | 0.70% | 0.60% | |

| 0:00 | NZD | NBNZ Business Confidence Sep | 0 | 18.3 | ||

| 6:00 | EUR | German Import Price Index M/M Aug | 0.00% | 0.10% | -0.40% | |

| 13:00 | USD | S&P/Case-Shiller Composite-20 Y/Y Jul | 5.80% | 5.70% | ||

| 14:00 | USD | New Home Sales Aug | 591K | 571K | ||

| 14:00 | USD | Consumer Confidence Sep | 120 | 122.9 |