Bitcoin rose on Monday, ending the day at around $19,800. The recovery continues Tuesday morning, taking the exchange rate to 20,300 and adding 6.4% over the past 24 hours. Ethereum added 9.8% to $1160, while other top-ten altcoins gained between 2.7% (XRP) and 9.8% (Solana).

Total cryptocurrency market capitalisation, according to CoinMarketCap, rose 6% overnight to $917bn.

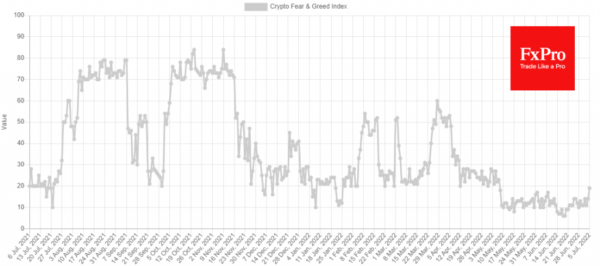

The cryptocurrency Fear & Greed Index rose 5 points to 19 by Tuesday, the highest level since May 7, near the upper edge of ‘extreme fear’ territory.

Traders took advantage of a US weekend when the stock market was not trading to buy. In addition, Asian trading is also moderately positive, adding to the optimism of retail participants.

According to CoinShares, capital inflows into crypto funds last week amounted to $64m, with the bulk coming from funds that allow shorts on bitcoin ($51m).

Cryptocurrency-related companies have had to fend off information attacks pointing to problems. Circle CEO Jeremy Allaire, for example, denied rumours of issues with the USDC stablecoin. KuCoin trading platform CEO Johny Lyu denied rumours of a possible exchange default and assured that the platform had nothing to do with LUNA or Three Arrows Capital.

Market veteran Peter Brandt said that USDT has no place in the financial system and that stablecoin will die soon.

Singapore-based cryptocurrency lending and trading platform Vauld, which targets the Indian market, announced that it is suspending withdrawals due to market volatility.

The developers of Solana blockchain-based decentralised finance (DeFi) project Crema Finance have suspended all operations due to a hack.

With such a background, the crypto market growth looks like the intention of retail to “buy when there is blood on the streets”. However, at this stage, when we see only timid attempts at growth, it would be too early to talk about confirmation of a broken downtrend.