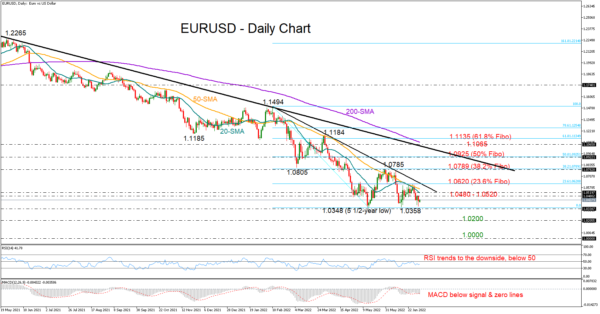

EURUSD managed to stay afloat above the downtrend’s bottom line of 1.0348 for the third time despite its bearish weekly close. Nevertheless, negative risks keep lingering in the background.

Particularly, the 20-day simple moving average (SMA) has resumed its negative slope after failing to cross above the 50-day SMA, while the RSI and the MACD are also pointing to the downside, with the former distancing itself below its 50 neutral level and the latter deviating beneath its red signal line.

In the event the price tumbles below the 1.0348 floor, breaching the 2017 low of 1.0339 too, the sell-off may intensify towards the crucial 1.0200 psychological level, where the pair changed direction twice during 2002. That might be the last opportunity for a rebound before the pair reach parity. Additional bearish actions from here may next test the 0.9900 number.

On the upside, the 1.0480 – 1.0520 territory and the 20-day SMA appeared as hurdles last week. Hence, a successful extension above that bar could provide direct access to the descending trendline and the 23.6% Fibonacci extension of the 1.1494 – 1.0348 downleg at 1.0620. Higher, the recovery is expected to pick up steam towards the 38.2% Fibonacci of 1.0789, where any violation would put the negative trend at risk.

In brief, although EURUSD maintains a neutral short-term trajectory above May’s 5½-year lows, technical signals remain bearish. Traders may wait for a move below 1.0348 or above 1.0620 before they act accordingly.