Key Highlights

- The Euro remains in an uptrend, but struggling to hold gains against the US Dollar above 1.1850.

- There is a contracting triangle forming with support near 1.1860 on the 4-hours chart of EUR/USD.

- The US Services PMI for Sep 2017 (Prelim) released this past week posted a decline from 56.0 to 55.1.

- The US Manufacturing PMI preliminary reading (Sep 2017) increased from 52.8 to 53.0.

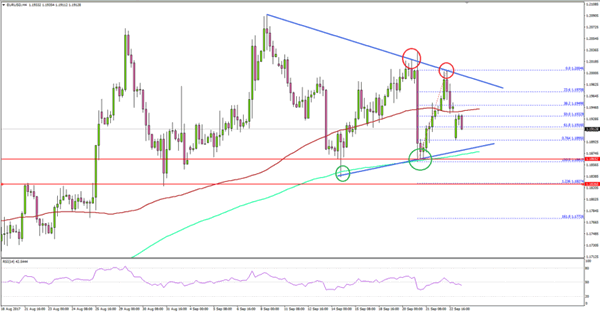

EURUSD Technical Analysis

The Euro remained in a broad range above 1.1850 against the US Dollar. However, the EUR/USD is under pressure and might attempt a downside break below 1.1850 in the near term.

Looking at the 4-hours chart of EUR/USD, there is a contracting triangle forming with support near 1.1860. The triangle support at 1.1860-50 is also near the 200 simple moving average.

On the upside, an initial resistance is around 1.1940 and the 100 simple moving average (H4). Above 1.1940, the triangle resistance is at 1.1970. A proper close above 1.1970 is needed for the Euro buyers to gain momentum.

On the downside, a break of the triangle support or 1.1850 might ignite further losses towards the 1.1820 level. Below 1.1820, the next important support is at 1.1780.

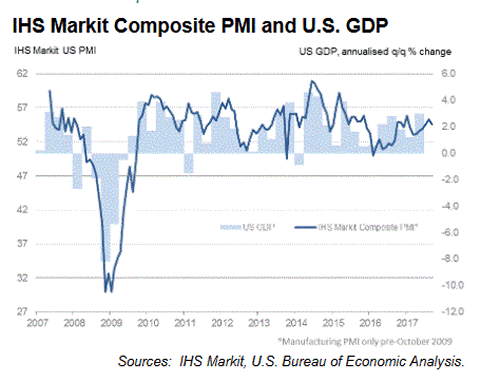

US Manufacturing PMI

Recently in the US, the Manufacturing Purchasing Managers Index (PMI) for Sep 2017 (Prelim) was released by the Markit Economics. The forecast was slated for a rise from the last reading of 52.8 to 53.0.

The actual result was in line with the forecast, as the PMI rose to 53.0. On the other hand, the US Services PMI was forecasted to decrease from 56.0 to 55.9, but it declined to 55.1.

Commenting on the Manufacturing PMI report, the Chief Business Economist at IHS Markit, Chris Williamson, stated:

The US economy showed encouraging resilience in a month of hurricane disruption. Although the September surveys indicated a moderation in growth of business activity, the overall rate of expansion remained robust.

Overall, it seems like the EUR/USD pair is struggling to remain above 1.1860 and remains at a risk of a breakdown in the near term. Today’s European Central Bank’s President Mario Draghi’s speech might impact EUR/USD and could ignite a break either above 1.1970 or below 1.1860.