Euro gaps lower against Dollar as another week starts. Markets seem to be dissatisfied with Germany election result even though Angela Merkel won her fourth term as Chancellor. Nonetheless, loss in the common currency is limited and it quickly recovers. Meanwhile, Kiwi also trades lower after indecisive election results. Yen is mildly weaker and risk sentiments are steady even though US President Donald Trump continued his verbal exchanges with North Korea officials. Yen traders’ are probably more on Japan Prime Minister Shinzo Abe’s press conference for snap election, rather than the words of the two sides that are on "suicide mission". Sterling is mildly firmer as the fourth round of Brexit negotiations starts.

Euro lower on plunge of support for CDU/CSU

Angela Merkel won a fourth term as German Chancellor after Sunday’s election. But vote for her CDU/CSU bloc suffered heavy decline to 32.7%, down 8.8% from 2013. That’s also the worst result since 1949. Main opposition Social Democrats scored 20.2%, the worst ever result. On the other hand, the anti-immigration Alternative for Germany won 13% of vote, up 8.7% from 2013. Free Democrats got 10.5% and Greens got 9.4%. The risk now is that Merkel will need to form a coalition with at least two other parties, and that is seen as some uncertainty for the near term. Also, the better than expected results for AfD and the plunge in CDU/CSU reminded people that populism remains a threat in European Union.

Kiwi dips mildly on indecisive election

New Zealand Dollar dips mildly today, in reaction to the indecisive election held on Saturday. The ruling centrist National party won 58 seats in a 120 seat parliament. Center-left Labour won 45 seats. New Zealand First won 9 while Greens got seven. Rightwing ACT got 1 seat. Without outright majority, the National could now take a few weeks for form a coalition. But the overall results are pretty much in line with pre-election polls. So, the impact to markets should be minimal.

Fourth round of Brexit negotiation to start

The fourth round of Brexit negotiation between UK and EU will start in Brussels today. Also, there will be another round of Brexit talks between Scottish and UK governments in London. Prime Minister Theresa May called for a two year "implementation period" on Brexit, and during the time, it’s almost like all status quo. UK will continue to have access to the single-market and pay into EU budgets. UK would even accept new EU regulations through to 2021. Such a proposal attracts criticism from May’s own MPs. The criticism mainly center around payment to EU an European Court of Justice jurisdiction.

Japan PMI manufacturing rose to 52.6

Japan PMI manufacturing rose to 52.6 in September, up from 52.2, but missed expectation of 53.4. Nonetheless, that’s the 13 straight month of expansionary reading, and the highest level since May. IHS Markit principal economist Annabel Fiddes noted that "firms signalled stronger expansions in both output and new orders amid reports of firmer demand both at home and abroad" And, "the strong end to Q3 bodes well for production in the coming months, with business confidence also perking up slightly since August." Japan Prime Minister Shinzo Abe is widely expected to announce a snap election for October today, to take advantage of the rebound in his popularity. Abe will hold a press conference at 0900GMT..

Looking ahead

German Ifo business climate in the main focus today. RBNZ rate decision is a main feature in the week and it’s widely expected to stand pat. Some important economic data will be featured including Eurozone CPI, Japan CPI, Canada GDP and US durable goods and PCE. But the highlight is likely on details of US President Donald Trump’s tax plan. Here are what are’s expecting for the week ahead:

- Tuesday: News Zealand trade balance, NBNZ business confidence; BoJ minutes, corporate service price; German import price; US S&P Case Shiller house price, new home sales, consumer confidence

- Wednesday: Swiss UBS consumption; Eurozone M3; US durable goods, pending home sales

- Thursday: RBNZ rate decision; German Gfk consumer sentiment; Eurozone confidence indicators; German CPI; US Q2 GDP final, jobless claims; trade balance

- Friday: Japan unemployment, CPI, retail sales, industrial production, BoJ summary of opinions; China PMI manufacturing; German retail sales, unemployment; Swiss KOF; UK Q2 GDP final, mortgage approvals, M4; Eurozone CPI flash; Canada GDP; US personal income and spending, Chicago PMI

EUR/USD Daily Outlook

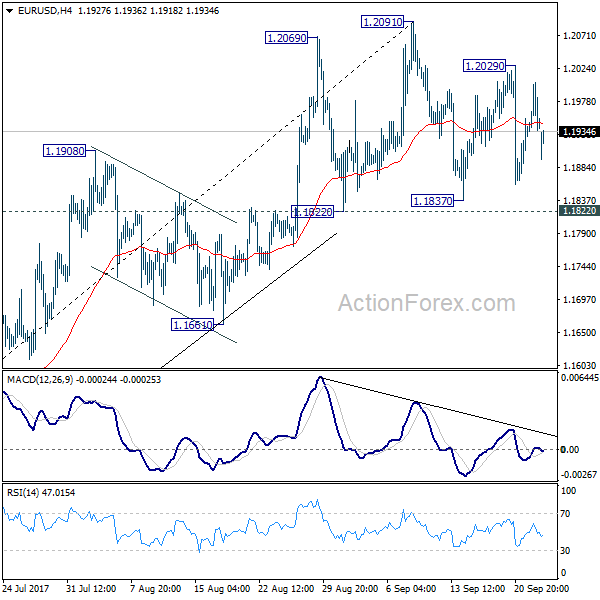

Daily Pivots: (S1) 1.1919; (P) 1.1961 (R1) 1.1990; More…

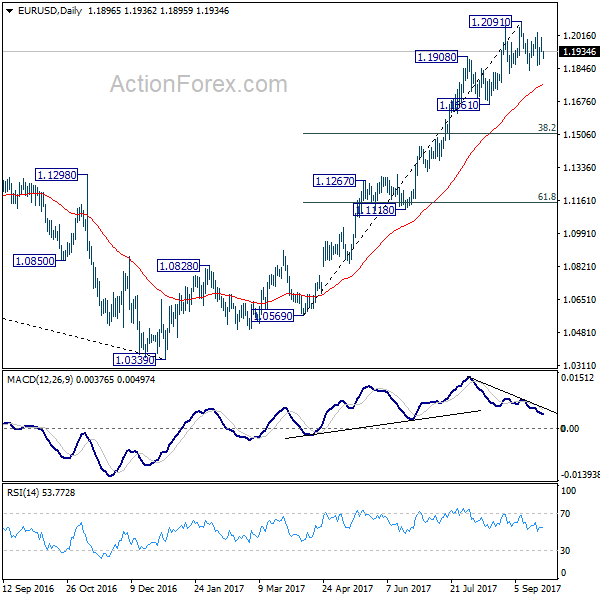

EUR/USD gaps lower today but it’s holding well in range of 1.1822/2091. Intraday bias remains neutral for the moment. With 1.1822 support intact, near term outlook remains bullish for further rally. Break of 1.2091 will extend larger rise from 1.0339 and target next key fibonacci level at 1.2516. But considering bearish divergence condition in 4 hour MACD, break of 1.1822 will confirm short term reversal. In the case, intraday bias will be turned back to the downside through 1.1661 support. EUR/USD should then correct whole rise from 1.0569 and target 38.2% retracement of 1.0569 to 1.2091 at 1.1510.

In the bigger picture, rise from medium term bottom at 1.0339 is still in progress for 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. However, it should be noted that there is no confirmation of trend reversal yet. That is, such rebound from 1.0399 could be a correction. And the long term fall from 1.6039 (2008 high) could resume. Hence, we’d be cautious on strong resistance from 1.2516 to limit upside. But after all, break of 1.1661 is needed to indicate medium term topping. Otherwise, outlook will remain bullish in case of pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:30 | JPY | PMI Manufacturing Sep P | 52.6 | 53.4 | 52.2 | |

| 8:00 | EUR | German IFO – Business Climate Sep | 116 | 115.9 | ||

| 8:00 | EUR | German IFO – Expectations Sep | 108 | 107.9 | ||

| 8:00 | EUR | German IFO – Current Assessment Sep | 124.7 | 124.6 | ||

| 13:00 | CNY | Conference Board Leading Index Aug | 0.90% |