Yen trades broadly higher today on resurgence of geopolitical risks. North Korea threatens to launch hydrogen bomb in Pacific Ocean, in response to US President Donald Trump’s "total destruction" provocation, and new sanctions. But overall, Yen is the weakest one for the week so far with risk appetite and global monetary stimulus exit in the background. This is also reflected in Swiss Franc, which is the second weakest for the week. On the other hand, Euro reversed the post FOMC selloff and is occupying the top spot among major currencies. The common currency is also getting support from solid data. Dollar is firm too but the uncertainty over the tension with North Korea is limiting its strength.

Eurozone PMIs indicates broad-based upswing

PMI data from Eurozone are generally better than market expectation. Eurozone PMI manufacturing rose to 58.2 in September, up from 57.4 and beat expectation of 57.2. Eurozone PMI services rose to 55.6, up from 54.7 and above expectation of 54.8. Germany PMI manufacturing rose to 60.6 in September, up from 59.3, and beat expectation of 59.0. Germany PMI services rose to 55.6, up from 53.5, beat expectation of 53.8. France PMI manufacturing rose to 56.0, up from 55.8, beat expectation of 55.5. France PMI services rose to 57.1, up from 54.9, beat expectation of 54.8. IHS Markit chief business economist Chris Williamson noted that "it was a super manufacturing performance. We are well-placed for a strong fourth quarter as well … in this broad-based upswing."

Japan PM Abe to announce snap election next Monday

In Japan, rumors continue to heat up, on Prime Minister Shinzo Abe to dissolve the parliament this month and call for a snap election on October 22. Abe would be holding a news conference on Monday afternoon Japan time to announce it. It’s reported that Abe would also make use the opportunity to delay the timing to achieve primary budget surplus, for a few years from fiscal 2020. IMF mission chief for Japan said that BOJ will likely lag behind Fed and ECB in normalization of monetary policy. But he noted that "his is appropriate, as monetary policy is focused on domestic conditions and domestic conditions are different among countries and regions." And, a gradual increase in sales tax, together with control social security spending would help the government to achieve medium term fiscal reform.

Loonie softer after mixed data

Canadian Dollar trades softer after mixed data. Headline CPI rose 0.1% mom, 1.4% yoy in August, below expectation of 0.2% mom, 1.5% yoy. But that was an uptick from July’s 0.0% mom, 1.2% yoy. CPI core common rose to 1.5% yoy, CPI core trim rose to 1.4% yoy, CPI core mean was unchanged at 1.7% yoy. Retail sales rose 0.4% mom in July, above expectation of 0.3% mom. But ex-auto sales rose 0.2%, well below expectation of 0.4% mom.

In the weekend – New Zealand and Germany elections

The upcoming New Zealand election would be a tight race between the incumbent National Party and Labor Party. Opinion polls suggest that supports for both parties are at around 40%. As such none of them would be able to a form government without entering coalition with smaller parties. This is such uncertainty that has increased the volatility of New Zealand dollar of late. Maintaining the status quo – a minority government led by Nationals- would be the most NZD-favorable while a Labor + Green+ NZ First trio would lead to an immediate, but short-term selloff in the currency. More in New Zealand Election: Change in Government is NZD-Negative in Near-Term

Although Chancellor Angela Merkel’s Christian Democratic Union (CDU) and its sister party, the Christian Socialist Union (CSU), have been comfortably leading in polls. There still are a number of uncertainties in the upcoming German election. While Merkel is on the way to be the Chancellor for a fourth, and the last, term, her party is unlikely to form a government without forming coalition with other party(ies). While the Grand Coalition (CDU/CSU+SPD as the junior partner), just like the one we have had since 2013 and between 2005-2009, is the most favorable to the economy and the financial markets, it cannot be seen as a done deal. Meanwhile, rising supports for the populist Alternative for Germany (AfD) signal that a far-right party would enter the parliament for the first time since WWII. AfD has pledged to promote its anti-EU and anti-immigrants rhetoric in the parliament as it might probably become the biggest opposition party in case of a Grand Coalition. Moreover, the parliament is prone to be more fragmented with six parties in 2017-term, compared with four previously. More in German Election: Not as Boring as You Think

EUR/USD Mid-Day Outlook

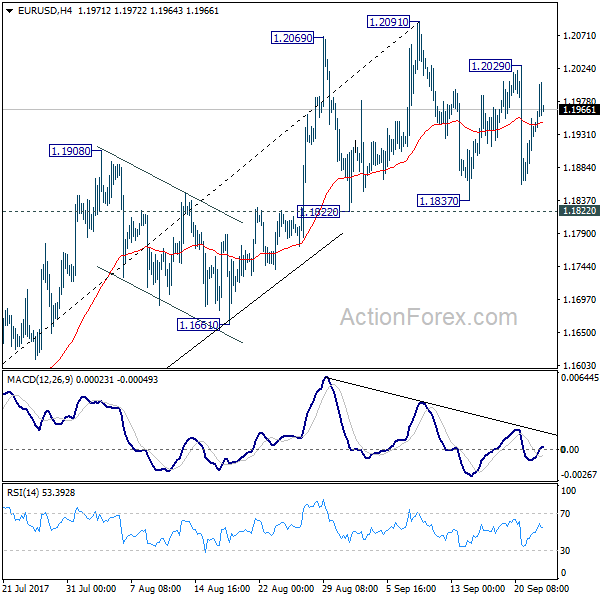

Daily Pivots: (S1) 1.1886; (P) 1.1919 (R1) 1.1974; More…

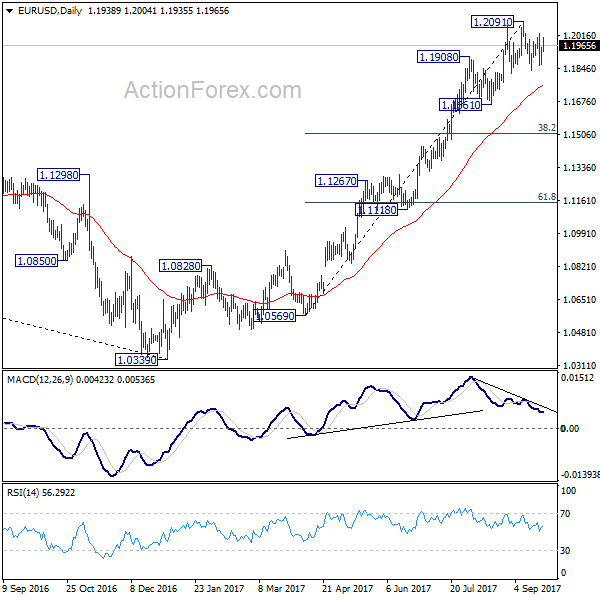

EUR/USD is bounded in range of 1.1822/2091 so far and intraday bias stays neutral. Considering bearish divergence condition in 4 hour and daily MACD, break of 1.1822 should confirm near term reversal. In the case, intraday bias will be turned back to the downside through 1.1661 support. EUR/USD should then correct whole rise from 1.0569 and target 38.2% retracement of 1.0569 to 1.2091 at 1.1510. However, rebound from 1.1822/1837 and break of 1.2029 will resume the larger up trend to next key fibonacci level at 1.2516.

In the bigger picture, rise from medium term bottom at 1.0339 is still in progress for 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. However, it should be noted that there is no confirmation of trend reversal yet. That is, such rebound from 1.0399 could be a correction. And the long term fall fro 1.6039 (2008 high) could resume. Hence, we’d be cautious on strong resistance from 1.2516 to limit upside. But after all, break of 1.1661 is needed to indicate medium term topping. Otherwise, outlook will remain bullish in case of pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 07:00 | EUR | France Manufacturing PMI Sep P | 56 | 55.5 | 55.8 | |

| 07:00 | EUR | France Services PMI Sep P | 57.1 | 54.8 | 54.9 | |

| 07:30 | EUR | Germany Manufacturing PMI Sep P | 60.6 | 59 | 59.3 | |

| 07:30 | EUR | Germany Services PMI Sep P | 55.6 | 53.8 | 53.5 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Sep P | 58.2 | 57.2 | 57.4 | |

| 08:00 | EUR | Eurozone Services PMI Sep P | 55.6 | 54.8 | 54.7 | |

| 10:00 | GBP | CBI Trends Total Orders Sep | 7 | 13 | 13 | |

| 12:30 | CAD | CPI M/M Aug | 0.10% | 0.20% | 0.00% | |

| 12:30 | CAD | CPI Y/Y Aug | 1.40% | 1.50% | 1.20% | |

| 12:30 | CAD | CPI Core – Common Y/Y Aug | 1.50% | 1.40% | ||

| 12:30 | CAD | CPI Core – Trim Y/Y Aug | 1.40% | 1.30% | ||

| 12:30 | CAD | CPI Core – Median Y/Y Aug | 1.70% | 1.70% | ||

| 12:30 | CAD | Retail Sales M/M Jul | 0.40% | 0.30% | 0.10% | |

| 12:30 | CAD | Retail Sales Less Autos M/M Jul | 0.20% | 0.50% | 0.70% | 0.40% |

| 13:45 | USD | US Manufacturing PMI Sep P | 53 | 52.8 | ||

| 13:45 | USD | US Services PMI Sep P | 55.9 | 56 |